Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

As the new trading week kicks off, European markets showed modest gains, indicating cautious optimism among investors. While the general momentum is positive, there is notable turmoil within the healthcare sector, specifically with Philips shares, which took a sharp downturn, tumbling by 16% after a weak earnings report and a challenging forecast. This disparity in performance highlights the varied market sentiment, especially as Europe grapples with inflationary pressures, policy shifts, and earnings season dynamics.

Let’s delve deeper into the factors contributing to the market’s incremental rise and the dramatic decline in Philips shares, exploring what it means for investors, the sectors to watch, and the broader economic landscape.

European markets opened this week with moderate gains across several indexes. The FTSE 100, DAX, and CAC 40, three of the major European benchmarks, all saw slight increases as traders balanced their portfolios with a cautious approach to ongoing economic challenges and geopolitical factors. With inflation levels still elevated, central banks in Europe continue to wrestle with monetary policy adjustments. Investors are closely monitoring earnings reports, key economic indicators, and policy decisions to gauge future market movements.

One of the most significant stories this week is Philips, whose shares plummeted by 16% following a disappointing earnings report. The Dutch health technology company cited continued supply chain disruptions, ongoing costs from product recalls, and weaker-than-expected demand as reasons for the profit slump. This led to the sharpest drop in Philips shares in recent months, raising questions about the company’s growth outlook and strategy.

Philips’ decline was also spurred by a cautious guidance statement, which suggested that the headwinds impacting the company are unlikely to subside soon. This has led investors to recalibrate their expectations, and many analysts have revised their outlooks on Philips accordingly.

The mixed sentiment in Europe’s stock markets highlights the ongoing complexity of the economic environment. Factors such as high energy costs, supply chain bottlenecks, and geopolitical tensions, especially in Eastern Europe, are pressuring growth. However, some sectors, such as technology, renewable energy, and consumer goods, are showing resilience.

Investors are increasingly selective, seeking stocks with strong fundamentals and proven adaptability in uncertain conditions. Meanwhile, companies like Philips, facing multiple headwinds and operational issues, are struggling to maintain investor confidence.

The recent shift in the European stock market mood reflects the beginning of earnings season. For investors, this period is crucial as companies disclose their quarterly performance, providing a clearer picture of how they’re managing economic uncertainties. Robust earnings could bolster market confidence, while any weakness, as seen with Philips, could lead to significant individual stock selloffs.

The healthcare sector, traditionally seen as a safe haven, has encountered turbulence with the challenges faced by Philips. However, tech stocks in Europe have gained ground due to growing demand for digital transformation solutions across industries. Companies like SAP and ASML, leading players in software and semiconductor technology, are well-positioned to benefit from this trend and have seen stronger investor interest.

As European markets progress through the week, several economic indicators and events could shape investor sentiment:

For investors, the European market offers both risks and opportunities in the current environment. While markets have shown resilience, caution is still advisable, especially with sector-specific challenges like those seen in healthcare. Balancing portfolios with a focus on defensive stocks, particularly those with low exposure to inflationary pressures and supply chain issues, might offer stability.

In the case of Philips, the sharp decline emphasizes the importance of scrutinizing companies’ earnings reports and guidance. For long-term investors, there may be a buying opportunity if they believe in Philips’ recovery prospects, but it’s essential to be mindful of the ongoing risks in the healthcare sector.

The European markets’ modest rise reflects a cautiously optimistic start to the trading week. Investors are treading carefully, especially with earnings season bringing both positive surprises and, as in Philips’ case, significant disappointments. Staying informed on economic indicators and sector trends will be key for investors looking to make the most of Europe’s evolving market landscape.

By focusing on fundamentals, diversifying portfolios, and keeping a close eye on earnings, investors can better navigate the complexities of the European markets in these challenging yet opportunity-rich times.

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

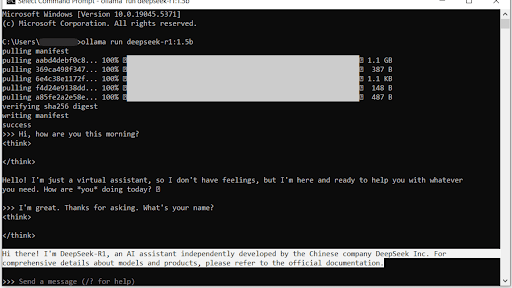

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...