Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

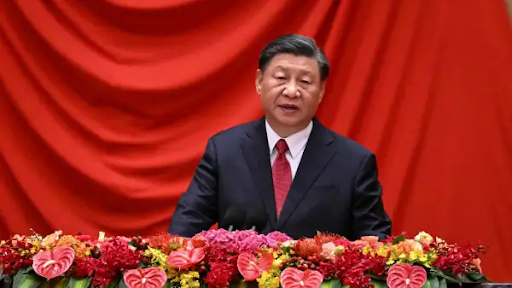

China’s recent decision to deepen fiscal stimulus efforts and have a more accommodative monetary policy is an indication that it is keen on consolidating economic stability and sustained growth . In the face of global economic uncertainties and its domestic challenges , these are efforts to strengthen the economy’s resilience and boost the confidence of the market .

With the slowdown in the global economy , geopolitical tensions, and lingering effects of the pandemic , China’s economy is under stress and needs focused interventions . Policymakers have identified the need to balance growth oriented policies with structural reforms to mitigate risks and achieve sustainable development .

The promise for an active fiscal policy is from the need to boost demand, improve industrial production, and relieve pressure off major sectors such as property and manufacturing . At the same time, easy monetary policies seek to lower borrowing costs and spur investment and liquidity in the financial markets .

China’s moderately eased monetary policy mainly includes lowering interest rates and reserve requirement ratios of banks to improve access of credit from banks to enterprises and residents , thus encouraging expenditure and investment .

The People’s Bank of China , the central bank, would adopt a calibrated policy response. It would avoid overly easing monetary policy so as not to fuel inflation or asset bubbles . This balance between both factors ensures long term financial stability while immediately resolving current economic challenges .

It would tend to fund infrastructure , which in fact was going to be one of the major fiscal stimuli; such projects were going to stimulate urbanization , both because of employment and setting long-run economic growth through improvements in connectivity and reductions in cost related logistical activities .

China’s investment in technological innovation is in line with its overall self-reliance agenda on key industrial sectors . Research and development , along with easy monetary policy , creates an ecosystem for tech-induced growth .

The real estate sector , China’s other key economic pillar , has also come under severe tests of late. Stimulatory measures targeted at developers and households , comprising support to developers and homebuyers , aim to stabilize the sector without reigniting speculative activity .

All the above measures are important but also raise the question about how sustainable the debt is going to be . Chinese policymakers, in particular , have underscored disciplined fiscal management for generations by being vigilant towards the need for short run gains and long run financial strength . This cautious optimism hinges upon fiscal and monetary tools deployed amid this complexity of economic dynamics .

Despite the optimistic forecast , several challenges are ahead. The geopolitical tensions, trade restrictions , and structural reforms needed are all obstacles to China’s economic agenda . There is also a risk of inflation, financial market volatility , or regional development imbalances, which policymakers must watch out for .

The commitment of China to a dual strategy of fiscal and monetary interventions underlines its adaptive governance model . It is not only addressing short term economic pressures but also aligning with long term strategic goals , such as reducing carbon emissions and fostering innovation .

Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...