In its June 2025 edition, the Reserve Bank of India (RBI) Bulletin highlighted the strength of the Indian economy amid a turbulent global backdrop. Despite rising global tensions and policy uncertainties, the Indian economy has demonstrated remarkable resilience, with multiple high-frequency indicators showcasing robust activity in both industrial and services sectors. Global Economic Challenges Persist The global economy continues to face severe headwinds. Trade policy disruptions, geopolitical tensions—particularly in key conflict zones—and inflationary pressures have created a challenging environment for nations worldwide. The RBI bulletin notes that these twin shocks have kept global markets volatile and investor sentiment cautious. These external shocks have had ripple effects across economies, slowing down trade, investment flows, and growth in several parts of the world. India’s Stable Growth Trajectory Amid this volatile global landscape, India stands out as a beacon of economic stability. The RBI report states that India’s macroeconomic fundamentals remain strong, supported by prudent fiscal and monetary policies, healthy domestic demand, and robust structural reforms. These factors have helped cushion the Indian economy from the full impact of global disruptions. High-Frequency Indicators Signal Positive Trends The bulletin emphasizes that several high-frequency indicators for May 2025 point toward sustained economic momentum. These include: Industrial production: Showing consistent year-on-year growth. GST collections: Remaining well above ₹1.5 lakh crore for the fifth consecutive month, signaling strong domestic consumption. Electricity consumption: A key proxy for industrial and residential activity, has seen an upward trend. Passenger vehicle sales and two-wheeler sales: Reflect growing consumer confidence and rural demand. E-way bills and FASTag collections: Indicate healthy freight movement and infrastructure usage. These indicators, taken together, underline the resilience and recovery strength of the Indian economy despite the global slowdown. Sector-Wise Economic Outlook 1. Industrial Sector The manufacturing sector has continued to expand, driven by government initiatives like Production Linked Incentive (PLI) schemes and a renewed push towards Make in India. Strong performances in core sectors such as steel, cement, and chemicals have further fueled industrial momentum. The Purchasing Managers’ Index (PMI) for manufacturing remained in the expansion zone, highlighting steady business optimism. 2. Services Sector The services sector, which contributes over 50% to the country’s GDP, has also been performing well. Strong demand in areas like financial services, travel and tourism, hospitality, and IT services has supported this growth. The Services PMI for May 2025 stood at a multi-month high, showcasing broad-based expansion and job creation in the sector. Consumer Confidence and Rural Economy India’s consumer confidence index has shown a positive uptick, supported by rising incomes, easing inflation, and better job prospects. The rural economy, which had shown signs of stress earlier, is now witnessing improvement due to a better-than-expected rabi harvest, increased government support through direct benefit transfers, and rural employment schemes.

Virgin Australia Makes Triumphant ASX Return with 7.9% Surge

A Resounding Comeback After Four Years Virgin Australia has made a strong return to the Australian Securities Exchange (ASX), with its shares surging by 7.9% on the first day of trading. The airline, which had been absent from public markets for more than four years following its voluntary administration in 2020, opened trading at midday and quickly attracted investor interest. At 12:20 PM AEST on Tuesday, shares were trading at $3.13, up significantly from the initial offering price. This strong debut marks a promising beginning for the reborn Virgin Australia, now under new management and operating with a more efficient and focused business model. The Road to Recovery: A Brief History Virgin Australia entered voluntary administration in April 2020 at the height of the COVID-19 pandemic, becoming one of the highest-profile corporate casualties of the crisis. Grounded flights, reduced passenger numbers, and rising debt pushed the company to the brink. In November 2020, the airline was rescued by US private equity firm Bain Capital, which took over ownership and immediately began a major restructuring process. The revival strategy involved cutting unprofitable routes, reducing staff, simplifying the fleet, and shifting the airline’s focus to being a mid-market, low-cost competitor to Qantas. Investors Flock to a Leaner, Stronger Airline Virgin Australia’s relisting on the ASX has drawn strong interest from institutional and retail investors alike. Much of the enthusiasm is credited to the company’s sharpened business strategy, leaner operations, and new leadership team. The IPO (initial public offering) valued the airline at approximately AUD 2.5 billion. With a restructured debt load and clearer financial outlook, investors are seeing renewed potential in a company that was once on the verge of collapse. “Virgin Australia has emerged as a more focused and resilient business,” said an analyst from a Sydney-based investment firm. “It’s well-positioned to capitalize on domestic travel demand and eventually international expansion.” New Management Inspires Confidence At the core of the airline’s resurgence is a fresh leadership team spearheaded by CEO Jayne Hrdlicka, who has been instrumental in reshaping Virgin Australia’s business approach. Hrdlicka’s focus on cost discipline, digital innovation, and improved customer service has helped restore public and investor confidence in the brand. Under her leadership, the airline has successfully targeted value-conscious travelers, bridging the gap between ultra-low-cost carriers and full-service airlines. “We’re entering a new chapter with confidence, stability, and a clear sense of purpose,” said Hrdlicka during Tuesday’s market relaunch. “Our focus is on profitable growth, operational excellence, and delivering a premium experience at an affordable price.” Strategic Shifts Paying Off Virgin Australia’s strategy to streamline its operations appears to be paying off. The airline now operates a simplified fleet made up entirely of Boeing 737 aircraft, allowing for greater efficiency in maintenance and training. Additionally, the airline has narrowed its focus to key domestic routes where demand remains high. Plans are also underway to gradually increase international operations, targeting markets such as New Zealand, Bali, and Fiji. This refined approach has already led to improvements in profitability, with the airline posting stronger earnings in recent quarters. Bain Capital’s support and investment in operational upgrades, IT systems, and staff training have also contributed to the turnaround. Strong Demand Fuels Optimism The resurgence in air travel demand, particularly for domestic flights, has provided a tailwind for Virgin Australia’s relaunch. Australians are once again traveling for both leisure and business, and Virgin aims to capture a significant share of this demand with its competitive pricing and elevated service standards. Travel analysts note that Virgin Australia is well-positioned to benefit from both rising fuel efficiency and consumer demand trends. As international travel continues to rebound, Virgin’s network expansion plans may further boost revenue. Competitive Positioning in a Tough Market While the ASX debut has been promising, Virgin Australia still faces tough competition. Qantas remains the dominant player in the Australian aviation market, and low-cost carrier Jetstar continues to attract price-sensitive flyers. However, Virgin has carved out a strong niche by offering a hybrid service model. With perks such as airport lounges, Velocity frequent flyer program, and optional upgrades, Virgin is appealing to both budget-conscious and premium travelers. Industry experts believe this positioning gives Virgin a sustainable competitive advantage, especially in a market still recovering from pandemic-related disruptions.

Digital Publishers Support Government’s Initiative to Review AI and Copyright Laws

A Crucial Move for Digital Content Protection In a significant development for the digital media landscape, the Digital News Publishers Association (DNPA) has extended its strong support to the Ministry of Commerce and Industry’s proposal to examine the complex intersection of artificial intelligence (AI) and copyright legislation. The move is seen as a timely and necessary step toward protecting the rights of content creators and ensuring ethical practices in the rapidly evolving digital ecosystem. The Rise of AI and Its Impact on Digital Publishing With the increasing use of AI technologies in recent years, particularly in areas like content generation, summarization, and language modeling, concerns have grown over the source of data used to train these intelligent systems. Many generative AI tools rely on massive datasets, which often include digital news articles, opinion pieces, and other original content published by media houses. This content, created through significant editorial effort and investment, is sometimes scraped or reused without proper authorization or attribution. Digital publishers argue that such practices not only infringe on their copyrighted material but also threaten their economic sustainability, especially as AI-generated content becomes more prevalent online. DNPA’s Response to the Government’s Initiative The DNPA has applauded the Ministry’s plan as a proactive measure in an era where content is increasingly vulnerable to misuse. In its official statement, the organization emphasized that examining how AI interacts with copyright law will be crucial in establishing clear legal boundaries and responsibilities for AI developers and content users. “The unauthorized use of digital publishers’ content to train AI models amounts to a clear violation of copyright protections,” the association stated. The DNPA further noted that AI platforms that ingest copyrighted content for training purposes—without permission or compensation—undermine the creative and financial value of journalism. Need for a Transparent Regulatory Framework Industry experts and legal analysts agree that India needs a comprehensive and transparent framework to manage how copyrighted materials are used in the development of AI technologies. As of now, there is limited clarity on whether current copyright laws are adequate to address the challenges posed by AI-generated outputs and training practices. The DNPA believes this policy review should lead to: Explicit guidelines for AI developers regarding the use of third-party content. Fair compensation mechanisms for publishers whose work is used in AI training. Technical safeguards to ensure AI models do not replicate or reproduce content verbatim from copyrighted sources. International Context: Global Moves Toward Copyright Reform India is not alone in addressing this issue. Countries like the United States, European Union, Canada, and Australia are actively reviewing or reforming their copyright laws to cope with the rise of AI. The European Union’s AI Act and the proposed Digital Services Act include clauses that mandate transparency from AI developers about training data sources. In the U.S., leading media outlets have already taken legal action against tech companies for using their content without permission. This global momentum adds weight to DNPA’s appeal for India to act swiftly and decisively. Protecting Journalistic Integrity and Revenue Models Digital news publishers operate in a competitive environment where generating high-quality, trustworthy content requires significant investment in human resources, technology, and infrastructure. When AI tools exploit this content without credit or compensation, it not only devalues journalistic effort but also disrupts business models that depend on subscriptions, ad revenue, and content licensing. DNPA has urged the government to consider: Mandatory licensing agreements between AI developers and content publishers. Monitoring systems to detect and report AI-generated content that mimics original journalistic work. Public awareness campaigns to educate users about the ethical use of AI tools. Collaboration Over Conflict: A Balanced Approach While highlighting the concerns, the DNPA also emphasized that it does not oppose the growth of AI. On the contrary, it acknowledged the immense potential of AI to transform the media industry, enhance reader engagement, and support editorial workflows. However, this transformation must occur within a structured legal framework that upholds content ownership and rewards original creators. The association has expressed its willingness to collaborate with government bodies, AI developers, and legal experts to create balanced policies that promote innovation without undermining creativity.

Why Income Investors Turn to EPD When the Market Sours

Finding Stability in Market Uncertainty In times of market volatility and economic downturns, investors often seek refuge in safe, income-generating assets. Among the many options available, Enterprise Products Partners L.P. (NYSE: EPD) has emerged as a top choice for income-focused investors. With a reliable dividend payout, strong operational fundamentals, and a strategic role in the energy infrastructure sector, EPD continues to attract investors even when broader markets falter. The Appeal of Dividend Stocks in a Bear Market When stock prices tumble and market sentiment turns bearish, dividend-paying companies provide much-needed financial comfort. These companies reward investors with regular income, reducing the pressure to sell at a loss. For this reason, income-generating equities like EPD become particularly attractive. Unlike growth stocks, which rely on capital appreciation, dividend stocks provide a consistent return through payouts. This is particularly beneficial during prolonged periods of uncertainty when capital gains are harder to achieve. Enterprise Products Partners L.P.: An Overview Enterprise Products Partners L.P., commonly referred to as EPD, is a major North American provider of midstream energy services. The company owns and operates a vast network of pipelines and storage facilities, transporting natural gas, natural gas liquids (NGLs), crude oil, and petrochemicals across the U.S. EPD has been in operation since 1968 and has steadily built a reputation for stability, scalability, and shareholder value. Its diversified operations and long-term contracts help insulate the company from sharp drops in commodity prices. Why EPD Stands Out for Income Investors 1. Reliable and High Dividend Yield One of EPD’s most attractive features is its consistently high dividend yield. As of recent data, the yield stands well above the S&P 500 average, often exceeding 7%. Importantly, the company has a long track record of not just maintaining but increasing its distribution to unitholders over time. This reliability provides a cushion against capital losses during a downturn. 2. Strong Cash Flows and Distribution Coverage Enterprise Products generates robust distributable cash flows (DCF), allowing it to comfortably cover its dividend payments. Even in challenging economic climates, the company’s cash flow stability ensures its ability to sustain its payout. Historically, EPD has maintained a distribution coverage ratio above 1.5x, meaning it earns significantly more than it pays out. 3. Defensive Business Model EPD operates primarily in the midstream segment of the energy industry, which is less sensitive to fluctuations in commodity prices compared to upstream (exploration and production) or downstream (refining and retail) operations. Its fee-based revenue model provides stability and predictability, making EPD a defensive stock in turbulent times. 4. Investment-Grade Credit and Low Debt Risk With a strong balance sheet and investment-grade credit ratings from major agencies, EPD stands on solid financial footing. The company has demonstrated prudent financial management by keeping debt levels manageable, which is crucial during times of rising interest rates and economic slowdown. Energy Demand: A Constant Through Market Cycles Regardless of market performance, energy demand remains relatively inelastic. Consumers, industries, and governments rely on energy for daily functioning, and this ongoing need supports companies involved in its production and distribution. While the broader energy sector can be cyclical, EPD’s infrastructure is essential for moving energy resources to where they’re needed. Its assets serve as critical arteries of the U.S. economy, providing resilience during downturns. Long-Term Outlook and Growth Prospects Even though income is a key focus for investors turning to EPD, growth shouldn’t be overlooked. The company continues to invest in expanding its infrastructure, including new pipelines, storage facilities, and export terminals. These strategic investments not only secure future revenues but also position EPD to benefit from growing global demand for liquefied natural gas (LNG) and petrochemical exports. Additionally, as the world transitions to cleaner energy sources, natural gas—considered a bridge fuel—will play a central role. EPD’s existing network is well-positioned to support this energy evolution.

Trump’s Trade War Begins to Impact China’s Economy

A New Economic Battlefront The ongoing trade conflict initiated by former U.S. President Donald Trump has begun to leave visible marks on the Chinese economy. While initial signs suggested resilience from Beijing, deeper analysis reveals early cracks beneath the surface. The first wave of tariffs and retaliations has not yet derailed China’s economic engine, but there are growing indications of strain, particularly in investment and industrial sectors. As tensions persist, the sustainability of China’s economic strength is under question. Retail Sector Shows Surprising Strength Despite mounting pressure from trade tariffs and global uncertainty, China’s retail sector has emerged as a surprising pillar of support. Recent government data for May suggests that consumer confidence remains intact, fueling solid domestic consumption. Retail sales showed strong growth year-over-year, indicating that internal demand is helping counterbalance the effects of declining foreign trade in certain sectors. Chinese consumers are continuing to spend on electronics, apparel, and luxury goods. This shift toward domestic consumption reflects a long-term strategy of transitioning from an export-driven economy to one that relies more heavily on internal demand. However, analysts caution that retail alone cannot carry the weight of the broader economy if other sectors falter. Investment Slumps Amid Uncertainty While the retail sector is experiencing growth, fixed asset investment—a key driver of economic development—is showing signs of weakness. Businesses, facing uncertainty due to escalating tariffs and global supply chain disruptions, are holding back on new projects. Real estate investment has plateaued, and industrial investment is lagging behind. The lack of robust investment signals diminishing confidence among Chinese businesses. Many firms are reluctant to commit capital in an environment where geopolitical tensions could significantly alter production and trade flows overnight. Industrial Deflation Raises Red Flags A deeper concern emerging from the recent data is factory-gate deflation. China’s producer price index (PPI), which tracks the prices of goods as they leave factories, has continued to decline. This deflation points to lower demand for manufactured goods and shrinking profit margins for manufacturers. This trend is especially alarming given China’s significant reliance on manufacturing as a backbone of its economy. Prolonged deflation could lead to reduced wages, layoffs, and further economic slowdowns in related sectors. Export Growth Masks Deeper Issues Interestingly, China’s export sector has shown surprising growth despite the trade war. In May, exports to several countries—including those outside the United States—saw a notable increase. This unexpected boom can partly be attributed to front-loading, where companies rush to ship goods before additional tariffs take effect. Moreover, China has been diversifying its trade partnerships, increasing exports to countries in Southeast Asia, Europe, and Latin America. However, this may only provide temporary relief. Experts warn that export growth in the current climate is unlikely to be sustainable, especially if the trade war escalates further or global demand softens. Imports Decline: A Sign of Weakening Domestic Demand? While exports have risen, imports have seen a sharp decline. This drop suggests that domestic businesses are buying fewer foreign goods, which may indicate slowing economic activity and reduced demand for raw materials and components used in manufacturing. This contraction in imports may also reflect a deliberate shift by China to rely more on domestic supply chains and reduce dependence on foreign inputs. While this could bolster self-sufficiency, it also hints at an undercurrent of economic caution and retrenchment. Trade Balance Under Transformation China’s trade balance is undergoing a significant transformation. The combination of strong exports and weakening imports has widened the trade surplus. While this may appear beneficial in the short term, it underscores an imbalance that could backfire if domestic consumption and investment continue to weaken. A prolonged period of export reliance without robust internal demand and investment could leave China vulnerable to further shocks—whether from escalating tariffs, global economic slowdown, or internal structural weaknesses.

Billionaire Lederer Family Expands into Private Credit with $200 Million Loan Portfolio

From Smallgoods to Big Finance: The Lederers’ Strategic Shift The billionaire Lederer family, known for founding and growing the Primo Smallgoods empire in Australia, has transitioned from processed meats to high-stakes finance. Following the 2014 sale of Primo to Brazil’s meat-processing giant JBS for a massive $1.45 billion, the family has quietly laid the groundwork for a new venture in the booming world of private credit. Their new investment vehicle, 3 Capital, launched just two years ago, has already made significant waves in the Australian financial ecosystem. According to recent reports, 3 Capital has extended over $200 million in loans, largely to real estate developers—a clear sign of the Lederers’ growing footprint in the alternative lending sector. The Rise of Private Credit in Australia Private credit, or non-bank lending, has emerged as a major trend in global finance. As traditional banks tighten lending policies in response to regulatory pressure and risk mitigation, private credit funds have filled the gap. These funds offer developers and businesses quicker access to capital, albeit at slightly higher interest rates. In Australia, this shift has been particularly evident in the property sector. Developers facing hurdles from banks are increasingly turning to private lenders like 3 Capital to fund their residential, commercial, and mixed-use projects. 3 Capital: A Quiet Powerhouse Founded by the Lederer family in 2022, 3 Capital was created to deploy family wealth into strategic investments that promise long-term yield and capital appreciation. Rather than go the traditional route of stock markets or passive holdings, the family chose to actively participate in one of the fastest-growing segments of the finance world—private lending. While 3 Capital maintains a low public profile, its impact is already being felt across the property development community. The firm is known to provide flexible loan structures, short approval cycles, and a willingness to back projects that mainstream banks might avoid due to rigid risk frameworks. A Closer Look at the Lederer Legacy The Lederer family’s financial might stems from the meteoric success of Primo Smallgoods, Australia’s largest producer of bacon, ham, and other smallgoods. Under the leadership of Paul Lederer, the company grew into a national powerhouse before its acquisition by JBS in 2014. Post-sale, the family diversified their holdings across property, sports (Paul Lederer is part-owner of the Western Sydney Wanderers football club), and now, finance. With the formation of 3 Capital, the family seems to be betting big on private credit as their next major growth area. Property Development: The Primary Loan Target So far, 3 Capital’s lending activities have been centered around property development loans. These loans are typically used by developers to fund construction, land acquisition, or refinancing of existing debts. The company’s $200 million loan book is believed to include a mix of mid-size residential and commercial projects across New South Wales and Victoria. Developers reportedly favor 3 Capital for its agility, with the firm able to assess and issue funds within weeks—a stark contrast to the months-long process often associated with major banks. Why Private Credit Appeals to Wealthy Families The Lederers’ move is part of a wider global trend where ultra-high-net-worth families are deploying capital through family offices into private credit markets. The appeal is twofold: Higher Returns: Compared to traditional fixed-income instruments like government bonds or term deposits, private credit offers significantly higher yields. Control and Flexibility: Lending directly to businesses or property developers gives these families more control over terms and risk exposure. For the Lederers, private credit represents not just a lucrative opportunity but also a platform to reinvest capital in sectors with high growth potential, while preserving the wealth they’ve built over decades. Market Outlook and Future Plans With Australia’s private credit market estimated to grow significantly in the coming years, 3 Capital is well-positioned to be a key player. Rising interest rates, ongoing housing demand, and tightening banking regulations are likely to sustain demand for alternative lenders. Industry insiders suggest that the firm may eventually expand into other sectors like agriculture, logistics, or even corporate lending, depending on the risk appetite and broader economic conditions. There is also speculation that 3 Capital might consider raising external capital or establishing a formal fund structure, especially if the Lederers seek to scale their operations further.

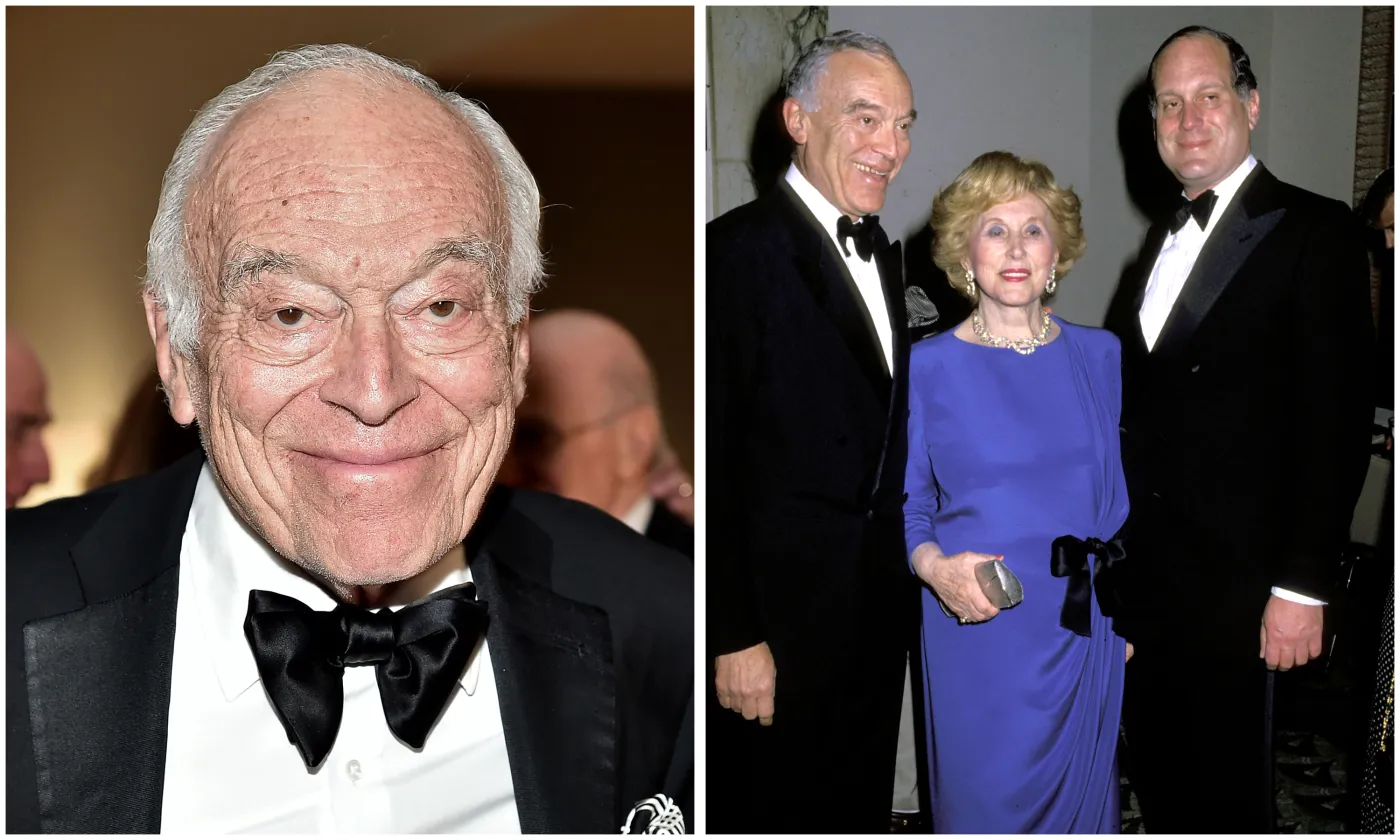

Leonard Lauder, Estée Lauder Beauty Empire Icon, Passes Away at 92

A Legacy Remembered Leonard Lauder, the visionary who transformed a small family-run cosmetics brand into one of the world’s leading beauty empires, has passed away at the age of 92. The Estée Lauder Companies Inc. announced his death with “deep sadness,” stating that he died peacefully at home, surrounded by loved ones. Lauder leaves behind a lasting legacy of innovation, leadership, and global expansion. Early Life and Education Born in New York City, Leonard Lauder was the eldest son of Estée and Joseph Lauder, the co-founders of the now-iconic beauty brand. Raised in a household immersed in entrepreneurship and product development, he was exposed to the inner workings of business from an early age. Lauder was a graduate of the prestigious Bronx High School of Science. He continued his studies at the Wharton School at the University of Pennsylvania and later earned an MBA from Columbia University. These formative years prepared him for a life dedicated to advancing his family’s business on the world stage. Joining the Family Business Leonard formally joined the Estée Lauder Companies in 1958. At the time, the company had just one brand and a limited product lineup. But Leonard had a broader vision—one of global reach and brand diversification. He brought business acumen, strategic foresight, and an instinct for branding that would redefine the company’s trajectory over the next six decades. Leadership Roles and Expansion Lauder’s influence grew steadily as he took on greater responsibilities within the company. He served as President from 1972 to 1995, CEO from 1982 to 1999, and Chairman from 1995 until June 2009. Even after stepping down from these formal roles, he remained active in the company’s acquisition and innovation strategy until his final days. Under his leadership, the Estée Lauder Companies evolved from a family-run business into a global beauty powerhouse with a portfolio of more than 20 brands. He oversaw the launches or acquisitions of well-known names including: Clinique MAC Bobbi Brown Aveda Jo Malone London These strategic expansions helped transform the company into a multi-billion-dollar enterprise with a global footprint in over 150 countries. Strategic Vision and Market Pioneering Lauder was among the first in the industry to recognize the potential of brand diversification and high-end beauty retailing. He insisted on maintaining the integrity and exclusivity of each brand while expanding its availability worldwide. He championed the concept of “prestige beauty” and positioned Estée Lauder products in top-tier department stores and high-end retailers, effectively setting industry standards. He also guided the company through its initial public offering (IPO) in 1995, further solidifying its position as a leader in the global cosmetics industry. Philanthropy and Cultural Contributions Outside of the boardroom, Leonard Lauder was a prominent philanthropist and patron of the arts. He made significant contributions to health care, education, and the arts, donating millions to institutions such as: The Whitney Museum of American Art (where he served as chairman emeritus) The University of Pennsylvania Columbia Business School Various Alzheimer’s disease research initiatives, in honor of his late wife Evelyn In 2013, he donated a world-class collection of Cubist art to The Metropolitan Museum of Art in New York—considered one of the most significant gifts in the museum’s history. Mentorship and Industry Impact Leonard Lauder was widely known for his mentorship and encouragement of emerging leaders in the beauty industry. He often emphasized the importance of customer experience, product quality, and storytelling in brand building. His leadership style was marked by warmth, wit, and wisdom. Many of today’s most influential beauty executives consider Lauder a mentor or inspiration. He was a firm believer in evolving with the times, encouraging innovation while preserving the core values established by his mother, Estée. Personal Life and Final Years Lauder remained closely connected to the Estée Lauder Companies even after stepping down from day-to-day leadership. He continued to play a key role in strategic planning and brand development well into his 90s. He passed away at his home, surrounded by his family, leaving behind sons William and Gary, both of whom have held leadership roles in the company. His life’s work was not just about building a business but nurturing a global brand rooted in elegance, trust, and excellence.

Roisin Rodgers: Leading Donegal With a Passion for Peak Performance

Balancing Leadership and Learning At just 23 years old, Roisin Rodgers exemplifies what it means to live and breathe elite athleticism. As the captain of the Donegal ladies football team, she doesn’t just wear the armband—she embodies the spirit, strength, and strategy of top-tier sport. Alongside her demanding athletic commitments, Roisin is also preparing to graduate this November with a degree in Health Science and Physical Activity from ATU Sligo. Her dual roles—as a student deeply immersed in the science of health and fitness, and a team leader competing at the highest levels of Gaelic football—give her a unique perspective on what it takes to excel. A Personal Trainer with Firsthand Experience Rodgers isn’t just applying what she learns from textbooks—she lives it daily. As a certified personal trainer, she understands the principles of training, recovery, and nutrition on a professional level. She also practices what she preaches, designing tailored workouts, focusing on injury prevention, and incorporating the latest research into her routines. Her academic journey has been instrumental in helping her better understand how to optimize her performance and that of her teammates. “I’ve always wanted to know the why behind everything we do in sport,” she explains. “Studying health science has helped me see the bigger picture—from biomechanics to mental wellbeing.” Early Passion for Sport and Science Growing up in Donegal, sport was always central to Roisin’s life. She showed early promise on the football pitch and quickly became known for her work ethic and leadership qualities. But even as a teenager, she was curious about what separated good athletes from great ones. That curiosity led her to pursue further education at Atlantic Technological University (ATU) Sligo, where she could dive deep into the science of movement, health, and performance. “I didn’t just want to play sport,” she says. “I wanted to understand it. I wanted to know how to train better, recover smarter, and lead more effectively.” Leading by Example on the Pitch Being the captain of a county team is no small responsibility, especially when juggling academic deadlines and personal training clients. But Rodgers thrives under pressure. Her teammates admire her not just for her skill on the field, but also for her discipline, empathy, and strategic mind. “She always shows up,” says one of her teammates. “Whether it’s training at 6am, rehab after a tough match, or leading team talks, Roisin is the one we look to.” Roisin admits that balancing everything can be a challenge, but she’s learned to stay focused on her priorities. “Time management and mindset are everything. I use what I’ve learned in my course to plan my days, manage stress, and stay consistent.” Academic Insights Applied to Athletics Rodgers credits her course at ATU Sligo with enhancing her approach to sport. From studying sports psychology to exercise physiology, every module has provided her with actionable insights. “Understanding how the body responds to stress, how nutrition affects recovery, or how sleep impacts performance—it’s all made me a smarter athlete and a better leader.” Her coursework also includes practical experience, such as performance testing, lab work, and community health initiatives. She’s particularly interested in how sports science can be applied to female athletes, an area she feels still needs more attention. “There’s still a lot of catching up to do when it comes to understanding how women’s bodies respond to training cycles, injury prevention, and performance tracking. I want to be part of that conversation.” Inspiring the Next Generation As someone who’s deeply committed to both playing and coaching, Roisin has started mentoring younger athletes in her local community. Through personal training sessions and guest workshops, she shares her knowledge with aspiring players who hope to follow in her footsteps. Her advice to them? “Never stop asking questions. Whether you want to be the best on the pitch or the best version of yourself off it, understanding why things work gives you an edge.” She also advocates for mental health awareness in sport. “There’s a lot of pressure on young athletes today. I try to remind them that performance isn’t just about physical ability—it’s also about emotional resilience and support.” Future Plans: More Than a Player Looking ahead, Roisin Rodgers has big plans. Once she graduates, she hopes to pursue a Master’s degree in sports performance or physiotherapy, and eventually work with elite teams in a coaching or rehab capacity. But she’s in no rush. “Right now, I’m enjoying the process. I’m learning every day—from my teammates, my clients, and my professors. I still have so much to give as a player, but I also know there’s a career waiting for me in the world of sports science.” A Role Model for Modern Athletes Roisin Rodgers is not just a captain or a college student—she’s a trailblazer in how we think about performance, leadership, and lifelong learning. By blending her on-field experience with academic knowledge and a passion for helping others, she represents the next generation of athletes: informed, inspired, and unstoppable. As she prepares to lead Donegal through another season and finish her degree at ATU Sligo, one thing is clear—Roisin isn’t just playing the game; she’s changing how it’s played.

Making Transactions Smarter – For Businesses and Customers

Embracing a More Efficient Payment System In today’s digital age, most businesses rely heavily on online transactions to streamline their operations and improve customer experience. One such company, Dymocks Tutoring, has taken a proactive step in enhancing its payment process. Recognizing the inefficiencies and complexities often associated with traditional payment systems, Dymocks Tutoring is currently trialling an innovative solution: a new payment collection platform designed to make transactions simpler, faster, and smarter—for both businesses and their clients. The Need for Innovation in Payment Processing Payment systems have evolved significantly over the years, but many still come with limitations. Credit card fees, delayed settlements, failed transactions, and complex reconciliation processes often hinder seamless business operations. For service providers like Dymocks Tutoring, these challenges can affect cash flow and customer satisfaction. That’s why Dymocks Tutoring decided to explore a smarter way of handling transactions. By offering customers the ability to make account-to-account (A2A) payments, both for one-time and recurring payments, the company aims to reduce friction and improve the overall experience. What Are Account-to-Account Payments? Account-to-account payments, often referred to as A2A payments, involve transferring funds directly from a customer’s bank account to a business account without the need for intermediaries like card networks. These types of transactions are typically more secure, faster, and less expensive than traditional credit card payments. With the increasing adoption of open banking and advancements in real-time payment infrastructure, A2A payments are emerging as a powerful alternative for businesses looking to modernize their financial operations. Dymocks Tutoring’s Approach to Smarter Payments As part of its initiative, Dymocks Tutoring is currently trialling an A2A payment system integrated into its platform. This system allows customers to choose between traditional payment options and the new direct account-to-account feature. For recurring payments—such as weekly or monthly tuition fees—this method simplifies the process by automating the payment cycle. Customers no longer need to worry about entering card details or remembering payment due dates, while the business gains better visibility and control over its revenue stream. Benefits for Businesses Implementing A2A payments offers several strategic advantages to businesses like Dymocks Tutoring: Lower Costs: By bypassing traditional card networks, businesses can save on transaction fees. Faster Settlements: Funds are transferred directly between accounts, reducing the delay in receiving payments. Improved Cash Flow Management: Predictable and timely payments make financial planning easier. Enhanced Security: Direct bank transfers reduce the risk of fraud and data breaches associated with card transactions. Benefits for Customers The new payment system also enhances the customer experience: Convenience: Easy setup for recurring payments eliminates the need to remember due dates. Transparency: Customers can clearly see the payment details within their banking apps. Security: Fewer intermediaries mean reduced risk of card fraud or information leaks. Speed: Real-time or near real-time processing ensures quicker confirmations. Aligning with the Future of Payments The shift toward smarter transactions isn’t unique to Dymocks Tutoring. Across industries, there is a growing movement toward more intelligent, automated, and secure payment systems. Innovations such as A2A, digital wallets, and embedded finance are transforming how businesses interact with their customers. This shift is also driven by customer expectations. As consumers become more digitally savvy, they seek seamless, instant, and safe payment experiences—qualities that A2A payments inherently offer. Regulatory and Technological Support The growing adoption of A2A payments is further supported by favorable regulatory environments and technological advancements. In countries like Australia, the introduction of NPP (New Payments Platform) and PayTo—a real-time payment initiation service—has laid the groundwork for businesses to adopt direct payment solutions. By participating in these trials, companies like Dymocks Tutoring are not only improving their operations but also helping shape the future of Australia’s digital economy. Looking Ahead: Scaling Smart Payments As the trial progresses, Dymocks Tutoring plans to gather customer feedback, analyze performance metrics, and refine the system based on usage patterns. If successful, this approach could be scaled across other parts of the business or even adopted by similar service-oriented organizations. The ultimate goal is to create a payment experience that is frictionless, efficient, and future-ready—a win-win for businesses and customers alike. Conclusion The move by Dymocks Tutoring to trial a smarter, account-to-account payment system is a forward-thinking step that reflects broader trends in the digital payment landscape. By embracing innovation, the company is positioning itself at the forefront of financial transformation—enhancing operational efficiency while meeting the evolving needs of its customers.

Petrol, Diesel Prices Updated for June 12: Latest City-Wise Fuel Rates Across India

Fuel prices in India are closely watched by millions of citizens as they directly impact household expenses, transportation costs, and inflation. On June 12, 2025, state-run oil companies released the latest retail prices for petrol and diesel across the country. While the global crude oil market remains relatively stable, retail prices in India vary based on local taxes, transportation charges, and VAT imposed by state governments. Here’s a detailed overview of today’s fuel prices and factors influencing these fluctuations. No Major Fluctuations in National Average As of June 12, there have been no significant nationwide price changes in petrol and diesel. However, state-wise variations continue due to differing VAT rates and state levies. In metro cities such as Delhi, Mumbai, Chennai, and Kolkata, prices remain mostly unchanged from previous trends. Consumers in Bengaluru, Hyderabad, and Lucknow also noticed stable fuel costs compared to earlier weeks. Why Fuel Prices Vary Across Indian States Fuel pricing in India operates under a dynamic pricing mechanism introduced in 2017. This means petrol and diesel rates are revised daily, taking into account: International crude oil prices Exchange rate fluctuations (INR vs USD) Base price set by OMCs (Oil Marketing Companies) Central excise duty State VAT and other levies For example, Maharashtra and Rajasthan tend to have higher fuel prices due to elevated VAT rates, while states like Goa and Uttar Pradesh enjoy relatively lower prices due to minimal tax structures. Role of OMCs and Global Markets India’s major fuel providers—Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL), and Hindustan Petroleum Corporation Ltd (HPCL)—review and adjust retail prices daily. These adjustments reflect the global crude oil market, where prices of Brent Crude and West Texas Intermediate (WTI) significantly influence domestic pricing. As of this week, Brent crude hovers around $81 per barrel, reflecting relative stability despite geopolitical concerns in oil-producing regions. How Citizens Are Coping with Fuel Price Pressure Despite no major hike today, many consumers remain cautious. Fluctuating fuel prices continue to impact transportation costs, cab fares, and commodity prices, indirectly affecting household budgets. In response, many urban dwellers are turning toward: Electric Vehicles (EVs) Carpooling and ridesharing Public transport Fuel-efficient driving practices Government Measures and Tax Outlook So far, the government has not made any fresh announcements regarding fuel tax reduction. Earlier, there were discussions about rationalizing excise duty and VAT structures, but no final policy has been implemented. Any future intervention will likely depend on global oil trends and inflationary pressures. With general elections on the horizon, fuel prices may become a political talking point, especially in states with high urban vehicle dependency.