Google Cost Cuts Spark Employee Concerns | BizBlog News Google Employees Pressure Costumed Execs at All-Hands Meeting for Clarity on Cost Cuts Cost-cutting measures often lead to tough conversations within large corporations, and Google is no exception. Recently, the tech giant held an all-hands meeting with a twist—some of the company’s senior executives appeared in Halloween costumes. But employees weren’t in a festive mood. The atmosphere quickly shifted as Googlers pressed for transparency on budget cuts, questioning how these changes might impact their roles, workplace culture, and the company’s long-standing values. The result? A compelling exchange that revealed a growing disconnect between Google’s workforce and its leadership during a period of heightened economic pressures. The All-Hands Meeting: Costumes, Questions, and Corporate Tensions The all-hands meeting at Google was supposed to be a light-hearted occasion with costumed executives leading the charge. But the event took a serious turn as employees began voicing their concerns. Although some may have expected updates on product innovations or growth strategies, the burning topic on everyone’s mind was cost management. Employees asked pointed questions on the motivation and strategy behind the recent budget reductions, including layoffs, reduced perks, and travel restrictions. From a corporate culture standpoint, Google has always prided itself on transparency and open communication. However, the tone of the questions indicated that many employees felt left in the dark about these cost-cutting decisions, particularly in terms of how the cuts would affect Google’s long-standing benefits, career development programs, and general work atmosphere. Why Are Google Employees Concerned About Cost Cuts? Google’s reputation as a workplace that prioritizes employee well-being is one of the pillars of its brand. In addition to high salaries, the tech giant is known for its perks, from gourmet food options to wellness benefits and substantial professional development resources. However, these perks come at a cost, and in recent months, the company has tightened its belt in ways that have raised concerns across its workforce. Cost-cutting measures at Google aren’t happening in a vacuum; they’re part of a larger trend within the tech industry. As rising operational expenses and global economic headwinds pressure profitability, tech companies are being forced to revisit their budgets, often focusing on non-essential expenses. For Google employees, this shift has been abrupt, and many are questioning what these changes mean for the future. Employee Concerns Surrounding Transparency At the all-hands meeting, Google employees repeatedly pressed for greater clarity around the motivations for these cuts. Questions centered on areas such as: Layoff decisions: Employees wanted to understand the criteria used to determine recent job reductions. Perk reductions: The rollback on certain employee perks, like free meals and fitness stipends, left many questioning how Google plans to maintain morale and engagement. Impact on innovation: With reduced budgets, employees expressed concern about how the cuts might impact Google’s ability to innovate and stay competitive. For employees who joined Google for its unique culture, the recent cost-cutting trend feels out of step with what the company stands for. The lack of clear answers has left many feeling uncertain about their roles and what they can expect from Google moving forward. The Disconnect Between Google’s Leadership and Workforce While Google’s executives have their reasons for enacting cost-cutting measures, the disconnect between leadership and employees is becoming increasingly apparent. The decision to appear in costumes at the all-hands meeting, intended as a morale booster, seemed to fall flat given the gravity of employee concerns. Some employees interpreted the costumes as a sign that leadership wasn’t taking their concerns seriously, underscoring the need for more direct communication. Employee responses indicated a desire for the company to return to its foundational principles of open, honest communication. Google, often celebrated for its emphasis on transparency and a supportive work culture, risks losing this reputation if employees continue to feel disconnected from high-level decisions. Google’s Response to Cost-Cutting Concerns: What’s Next? To address employee concerns and maintain trust, Google’s leadership has a challenging path ahead. Transparency is crucial, but so is providing a clear vision of how cost-cutting measures align with the company’s broader objectives. Without open channels for feedback, Google risks a morale decline that could hinder its ability to attract and retain top talent. For Google, moving forward with integrity and transparency in these decisions could reaffirm its status as an employer that values its workforce and is committed to balancing profitability with a positive employee experience. The Importance of Transparent Leadership at Google The tension at Google’s all-hands meeting speaks volumes about the importance of transparent communication during times of change. As Google and other tech giants continue to navigate economic pressures, employees will look to their leaders for clarity and direction. Google has an opportunity to demonstrate that, even amidst change, it remains a place that values and listens to its people. To sustain its reputation, Google must bridge the gap between executives and employees, ensuring its decisions are in line with the core values that have long set the company apart. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology Apple Working on AI-enabled HomePod with Touchscreen | Bizblog News September 28, 2024/No Comments Apple Working on AI-enabled HomePod with Touchscreen and Video Conferencing Features: Report In recent years, Apple has consistently pushed the… Read More Gen AI Industries: Insights from FLAME University VC – BizBlog

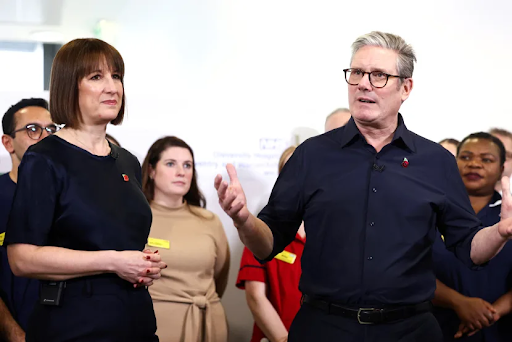

Why This Isn’t a Repeat of the Mini-Budget Crisis | BizBlog News

Why This Isn’t a Repeat of the Mini-Budget Crisis | BizBlog News Surge in UK Borrowing Costs: Why Economists Say This Isn’t Another ‘Mini-Budget’ Crisis The recent uptick in UK borrowing costs has led many to fear a repeat of the 2022 “mini-budget” crisis. While the sudden shift in government bond yields and interest rates raises some eyebrows, economists argue that today’s financial context is vastly different from last year’s fiscal turmoil. This analysis explores why economists believe that, despite the high borrowing costs, the current economic scenario should not spark panic or suggest a similar fallout to the crisis last year. Introduction: Understanding the UK’s Borrowing Cost Surge Borrowing costs in the UK have recently spiked, creating ripples of concern across financial markets and prompting discussions on whether the country is headed toward another economic crisis similar to the one caused by the controversial “mini-budget” in September 2022. However, economists assert that while the increase in borrowing costs is significant, it should not be seen as a prelude to another crisis. What Is Driving the Surge in UK Borrowing Costs? The rise in borrowing costs is largely due to global macroeconomic trends rather than domestic fiscal policy alone. Key factors contributing to this increase include: Higher inflation pressures globally: Central banks worldwide have been aggressively hiking interest rates to tackle inflation, which has inadvertently raised borrowing costs for governments as well. Global interest rate trends: With the US Federal Reserve and other major central banks continuing to increase rates, UK borrowing costs naturally follow suit, as UK government bond yields adjust to these trends. Domestic economic conditions: A slower economic recovery in the UK compared to other economies and a series of budgetary pressures have also pushed borrowing costs higher. How the Mini-Budget Crisis of 2022 Differed To understand why economists are not as concerned this time, it’s crucial to revisit what happened during the “mini-budget” crisis. The 2022 mini-budget, proposed by then-Chancellor Kwasi Kwarteng, unveiled unfunded tax cuts and aggressive fiscal policies without a clear plan for debt reduction. These policies sparked fear in bond markets, leading to a sharp drop in the value of UK government bonds (gilts) and a dramatic spike in borrowing costs as investors demanded higher returns due to perceived risks. By contrast, the current situation does not stem from similar policy errors or fiscal mismanagement. Instead, it is driven by broader market forces, which have a more systemic influence and are less likely to cause an isolated financial crisis. UK Government Bonds and Global Market Influence Bond markets are deeply interconnected, and UK gilts often reflect global financial trends. With central banks worldwide taking an aggressive stance on inflation, bond yields in the UK have risen alongside other countries. The result? Increased borrowing costs, but without the panic-inducing market shocks witnessed during the mini-budget era. Why Economists Don’t Foresee a Crisis Economists assert that the recent increase in UK borrowing costs is more a reflection of current global economic pressures than a signal of an impending financial collapse. Several reasons support this outlook: Steady fiscal policies: The current UK government has not introduced risky or unexpected fiscal policies akin to the 2022 mini-budget. Market expectations adjusted: Investors and markets have largely adjusted their expectations regarding inflation and interest rates, making the current situation less volatile than during the mini-budget. Bank of England’s active role: The Bank of England (BoE) has been vigilant about managing inflation and maintaining market stability, which was not the case when the mini-budget crisis unexpectedly disrupted the market. How UK Borrowing Costs Impact the Economy Rising borrowing costs inevitably influence various sectors, from government spending to consumer loans and mortgage rates. Here are some ways these increased rates might impact the UK economy in the near term: Public debt costs: Higher borrowing costs mean the government will pay more on its outstanding debt, which may put pressure on public spending. Mortgage rates and household finances: With higher borrowing costs, mortgage rates tend to rise, affecting homebuyers and homeowners with variable-rate mortgages. Business financing: Companies looking to finance expansion may face higher costs, potentially impacting growth and employment rates. How Can the UK Address Rising Borrowing Costs? The UK government and the Bank of England have several tools at their disposal to navigate these higher borrowing costs without falling into a crisis. Here are some measures that could help: Monetary policy adjustments: The BoE could consider modifying interest rate hikes if inflation shows signs of stabilizing, providing some relief to borrowing costs. Fiscal responsibility: A steady, clear fiscal policy without sudden changes or risky fiscal moves will reassure investors and help stabilize borrowing costs. Debt management strategies: The government may consider new strategies to manage its debt, such as issuing longer-term bonds to lock in borrowing at current rates. Lessons from the Mini-Budget Crisis for Future Policy The 2022 mini-budget crisis taught valuable lessons about the risks of uncalculated fiscal moves. Today, the government appears more cautious, focusing on maintaining fiscal responsibility and carefully planning any changes in tax or spending. Economists believe these lessons are contributing to a more stable, although challenging, economic environment. A Look Ahead: How Long Will Borrowing Costs Remain High? The duration of high borrowing costs depends on various factors, including the persistence of global inflation and the pace of rate adjustments by the Bank of England and other central banks. While economists predict that borrowing costs will remain elevated in the short term, they are hopeful for eventual stabilization as inflation pressures ease. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search

European Markets Gain 1% as Bank Stocks Lead | BizBlog News

European Markets Gain 1% as Bank Stocks Lead | BizBlog News European Markets Add 1% as Bank Stocks Lead Gains; UK Gilt Yields Fall After U.S. Jobs Report As the European stock markets see a 1% increase, led notably by bank stocks, investor sentiment appears buoyant across Europe. An added factor boosting optimism was a recent U.S. jobs report that exceeded expectations, which had a notable impact on UK gilt yields, pushing them downward. This convergence of factors has spurred excitement and renewed market confidence, especially as European financial institutions take the lead in sectoral gains. European Market Gains Highlight Economic Optimism European markets not only managed to rise by approximately 1% but also showed strong momentum, primarily attributed to rising bank stocks. This uptick signifies an optimistic response to the latest economic developments. The positive market movement aligns with broader investor expectations, which were favorably swayed by recent signs of U.S. economic resilience. These factors, coupled with stable European economic indicators, make for a solid foundation of renewed investor confidence across Europe. Bank Stocks Surge, Driving Market Momentum Bank stocks emerged as the primary contributors to the European market’s gains, reflecting the sector’s stable outlook and resilience against global economic pressures. With interest rates still relatively high, European banks have continued to benefit from favorable interest spreads, which boost profitability. This sectoral boost provides a noteworthy indicator for broader financial stability within European economies, hinting at sustained performance and investor trust in bank equities. Additionally, the boost in European banking shares reflects the sector’s recent developments, including improved earnings, rising dividends, and promising restructuring efforts in key institutions. These factors have bolstered bank stocks, contributing significantly to the overall gains observed across the continent’s major indices. UK Gilt Yields Drop Following Strong U.S. Jobs Report Another notable factor influencing European markets was the recent decline in UK gilt yields. The fall came after the U.S. jobs report highlighted a robust labor market, exceeding economic expectations and showcasing underlying strength within the American economy. This report impacted global markets, lowering bond yields across the board as investors recalibrate their portfolios in response to shifting expectations for U.S. monetary policy. In particular, lower gilt yields provide a promising scenario for UK investors, signaling both enhanced government borrowing conditions and potential interest rate adjustments. The jobs report has stirred speculation that the Federal Reserve might reconsider its stance on further rate hikes, an outcome that could reverberate positively through global bond markets, including in the UK. How Are European Market Gains Impacting Investor Strategies? The current 1% rise across European markets has renewed interest in the region’s equities, particularly in the financial and industrial sectors. Investors are increasingly pivoting toward European assets, drawn by both the potential for growth and the recent stability in Europe’s banking sector. This shift underscores how economic resilience and strong earnings from major corporations are reshaping portfolio strategies in favor of European equities. The UK gilt yield drop, coupled with an improved market outlook in the United States, strengthens the appeal of European assets, particularly for international investors seeking diversified, low-risk returns. Lower bond yields make stocks relatively more attractive, fueling further interest in equities. Broader Market Sentiment Following the U.S. Jobs Report The U.S. jobs report has not only impacted UK gilts but has also shaped a generally upbeat market sentiment across Europe. Investors appear reassured by the report’s strong employment numbers, which suggest a robust economic landscape. This optimism has contributed to stronger buying interest across multiple sectors, with bank stocks leading the charge. For European investors, the report alleviates concerns over global economic slowdown, a sentiment that has weighed heavily in recent months. Moreover, stable U.S. economic growth bodes well for Europe’s export-oriented sectors, hinting at potential boosts in demand that could further strengthen European equities. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology Apple Working on AI-enabled HomePod with Touchscreen | Bizblog News September 28, 2024/No Comments Apple Working on AI-enabled HomePod with Touchscreen and Video Conferencing Features: Report In recent years, Apple has consistently pushed the… Read More Gen AI Industries: Insights from FLAME University VC – BizBlog News September 27, 2024/No Comments Gen AI is Here to Stay, Students Should Be Skilled in AI to Stay Ahead: FLAME University VC Artificial Intelligence… Read More How to Pay Credit Card Bills Like a Pro – Biz Blogs News September 20, 2024/No Comments How to Pay Credit Card Bills? Navigate Online and Offline Options Like a Pro Managing credit card bills can sometimes… Read More Load More End of Content.

McDonald’s E. coli Outbreak Response | BizBlog News

McDonald’s E. coli Outbreak Response | BizBlog News McDonald’s Executives Say E. Coli Outbreak is ‘Behind Us’: What It Means for Customers and Food Safety McDonald’s, one of the world’s largest fast-food chains, has recently made headlines by announcing that a recent E. coli outbreak is now “behind us.” This declaration comes directly from McDonald’s executives, who are actively reassuring the public that all necessary safety measures have been taken to prevent future incidents. With the food safety of millions in question, customers everywhere are asking: How safe is McDonald’s food now? And what exactly does this announcement mean for fast food lovers? The E. coli Outbreak: A Brief Overview coli, a bacterium often found in contaminated food and water, can cause a range of health issues, from mild stomach discomfort to severe complications such as kidney failure. Foodborne outbreaks like these can spread quickly, particularly in high-volume fast-food establishments. As a result, news of the E. coli outbreak involving McDonald’s raised immediate concerns among both customers and food safety advocates. However, McDonald’s executives have stepped forward, assuring the public that they’ve conducted a thorough investigation and taken concrete steps to eliminate the risk, saying the outbreak is now “behind us.” What McDonald’s Executives are Saying In a recent statement, McDonald’s executives emphasized that the company acted swiftly and decisively to address the outbreak, partnering closely with food safety experts and regulators to ensure compliance with rigorous health standards. According to these executives, McDonald’s is committed to transparency and to keeping customers informed about steps taken to prevent any recurrence. Executives highlighted that new safety protocols are in place, and staff training has been enhanced to ensure that every part of the food preparation and delivery process meets strict hygiene standards. They also stressed that the outbreak was an isolated incident and, thanks to their prompt action, is now fully resolved. Enhanced Safety Protocols to Prevent Future Outbreaks McDonald’s has reportedly updated its food handling and preparation protocols, with special attention given to: Stricter Quality Control: Freshness and quality checks are now more frequent to reduce the risk of contaminated food reaching customers. Enhanced Staff Training: Employees have undergone additional training in hygiene, food safety practices, and handling procedures. Supplier Audits: McDonald’s has increased audits and checks for its suppliers to ensure that ingredients meet higher safety and quality standards. These changes are meant to reassure customers that McDonald’s is serious about food safety, aiming to prevent any potential risks from slipping through the cracks. The Impact on Customer Trust and Loyalty While it’s essential for fast-food chains to prioritize safety, the public response to outbreaks like this can have lasting effects. McDonald’s has always been a household name, known for its consistency and quality, yet incidents like an E. coli outbreak can shake customer confidence. By declaring the outbreak “behind us” and highlighting its proactive response, McDonald’s is working to rebuild trust with its customers. Many regular patrons will likely find reassurance in the company’s efforts, especially as these measures become more widely communicated. Additionally, McDonald’s move to go public with its safety improvements rather than remaining silent underscores its commitment to customer transparency and corporate responsibility. What Customers Can Expect Moving Forward For customers who are still concerned about food safety, McDonald’s announcement is likely a positive step. The enhanced safety protocols, increased staff training, and supplier audits are all part of a broader strategy to ensure food safety remains a top priority. Going forward, patrons can expect: Consistent Communication: McDonald’s has promised to maintain transparency with its customers, providing updates if new issues arise. Improved Hygiene Practices: Every part of the food preparation process, from kitchen to counter, is under new hygiene standards. Continued Partnership with Food Safety Experts: McDonald’s executives have assured the public of their close collaboration with food safety authorities to stay ahead of any potential risks. E. coli and Foodborne Illness: What to Know coli is a bacterium typically found in raw foods, unpasteurized milk, and undercooked meat. In severe cases, it can cause symptoms ranging from diarrhea and abdominal pain to more severe health complications, especially in vulnerable individuals like children and the elderly. For those concerned about E. coli contamination, a few simple steps can help reduce risk: Choose Well-Cooked Foods: Always opt for fully cooked menu items and avoid raw or undercooked options. Wash Your Hands: Before eating, especially in public spaces, wash your hands to minimize germ exposure. Stay Informed: Follow updates from reputable sources on food safety and outbreaks. By being aware of potential risks and taking simple safety steps, customers can help protect themselves and make informed choices about their meals. How McDonald’s Plans to Rebuild Trust After the Outbreak While McDonald’s executives have announced that the E. coli outbreak is “behind us,” rebuilding trust takes time and transparency. The company’s proactive approach is a step in the right direction, but ongoing communication and visible actions are key to re-establishing confidence among customers. To continue fostering trust, McDonald’s has hinted at several ongoing commitments: Regular Public Updates: Sharing regular safety and quality updates with the public. Continuous Improvement: Committing to revisiting and revising safety practices as needed. Customer Feedback: Encouraging customers to share their concerns so McDonald’s can address issues promptly. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Load More End of Content. UseFull Links Home About Stories Contact Technology Apple Working

New Mac Mini Redesign: Sleek, Smaller, and More Powerful | BizBlog News

New Mac Mini Redesign: Sleek, Smaller, and More Powerful | BizBlog News Apple’s New Mac Mini: First Redesign Since 2010 and Smaller Than Ever! Apple has officially announced its latest Mac Mini model, bringing excitement with a long-awaited redesign and a more compact form factor. This update, the first major change to the Mac Mini’s appearance since 2010, emphasizes Apple’s focus on delivering high performance in smaller, more efficient designs. The refreshed Mac Mini blends Apple’s renowned aesthetics with the latest hardware improvements, catching the eye of both tech enthusiasts and professionals who love this powerful, versatile desktop. What’s New with Apple’s Mac Mini? After more than a decade without significant design updates, the new Mac Mini breaks the mold with several key improvements. Apple has focused on reducing the device’s footprint without compromising its performance—a clear nod to its commitment to innovation and efficiency. Let’s dive into what sets this redesigned Mac Mini apart: Sleeker and Smaller Design Apple has redefined the Mac Mini’s compact form with a sleeker, even smaller design than previous models. The new Mac Mini is roughly 15% smaller than its predecessor, making it one of the smallest desktops available in the market today. This smaller size allows users to maximize desk space, making it a great choice for those with limited space or those who appreciate a minimalistic setup. The redesigned Mac Mini also sports Apple’s updated aesthetic with cleaner lines, rounded corners, and a lighter, matte finish. The updated design complements Apple’s ecosystem of devices, blending seamlessly with other Apple hardware, from the MacBook to the Studio Display. It’s a minimalist’s dream, reflecting Apple’s commitment to modern, uncluttered design. Power-Packed with Apple Silicon M3 Chip Inside, the new Mac Mini is powered by Apple’s latest M3 chip, promising groundbreaking performance and efficiency improvements. The M3 chip builds on the success of its M1 and M2 predecessors, delivering faster processing speeds, enhanced graphics capabilities, and improved machine learning performance. The M3’s architecture enables faster workflows, from editing high-definition videos to running multiple applications seamlessly. For creative professionals and tech enthusiasts, the Mac Mini now serves as a more viable alternative to larger, high-performance desktops while still providing the power needed for demanding tasks. Expanded Connectivity Options Apple has equipped the redesigned Mac Mini with more versatile connectivity options, making it even more compatible with a range of devices. It now features: Four Thunderbolt 4 ports for faster data transfer, supporting high-resolution displays and external drives. Two USB-A ports, maintaining compatibility with older devices. An upgraded HDMI 2.1 port, allowing for higher refresh rates and smoother visuals, ideal for gamers and those using large, high-definition displays. Wi-Fi 6E for faster, more reliable wireless connectivity, and Bluetooth 5.3 for seamless pairing with peripherals. These upgrades make the new Mac Mini an adaptable hub for both work and entertainment, giving users flexibility in connecting various devices to meet their needs. Energy Efficiency and Eco-Friendly Design With its M3 chip, Apple’s newest Mac Mini is also one of the most energy-efficient desktop computers on the market. The M3’s low power consumption means users can expect a quieter experience with less heat production, reducing the need for active cooling. This design not only enhances the device’s lifespan but also aligns with Apple’s sustainability goals. The Mac Mini’s casing is crafted from 100% recycled aluminum, and Apple has implemented eco-friendly production practices to reduce carbon emissions. From packaging to power efficiency, the Mac Mini demonstrates Apple’s commitment to minimizing its environmental footprint. Enhanced Software Experience Running macOS Sonoma, Apple’s latest operating system, the new Mac Mini delivers a rich software experience optimized for Apple Silicon. macOS Sonoma brings a host of new features designed to improve productivity, collaboration, and user experience. The latest OS supports features like widgets on the desktop, improved gaming with Game Mode, and powerful updates for productivity apps like Mail and Safari. For developers, Apple’s support for tools like Xcode and Swift on the M3 chip means faster builds and testing. It’s a software powerhouse that aligns perfectly with the hardware innovations in the Mac Mini, giving users a fully integrated Apple experience. Why the New Mac Mini Redesign Matters This redesign isn’t just about a smaller footprint. It marks a significant leap forward in Apple’s approach to desktops, pushing boundaries in size, power, and efficiency. Apple’s decision to overhaul the Mac Mini shows its dedication to refining the desktop experience, offering high performance without the bulk of traditional desktop setups. The new Mac Mini appeals to a wide audience, from home users to professionals and creatives who need a powerful, reliable desktop solution in a compact form. By making these bold design and performance improvements, Apple is redefining what a desktop computer can be. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Load More End of Content. UseFull Links Home About Stories Contact Technology Apple Working on AI-enabled HomePod with Touchscreen | Bizblog News September 28, 2024/No Comments Apple Working on AI-enabled HomePod with Touchscreen and Video Conferencing Features: Report In recent years, Apple has consistently pushed the… Read More Gen AI Industries: Insights from FLAME University VC – BizBlog News September 27, 2024/No Comments Gen AI is Here to Stay, Students Should Be Skilled in AI to Stay Ahead: FLAME University VC Artificial Intelligence… Read More How to Pay Credit Card Bills Like a Pro – Biz Blogs News September

European Markets Edge Up, Philips Shares Plunge 16% | BizBlog News

European Markets Edge Up, Philips Shares Plunge 16% | BizBlog News European Markets Inch Higher as Trading Week Begins; Philips Shares Tumble 16% As the new trading week kicks off, European markets showed modest gains, indicating cautious optimism among investors. While the general momentum is positive, there is notable turmoil within the healthcare sector, specifically with Philips shares, which took a sharp downturn, tumbling by 16% after a weak earnings report and a challenging forecast. This disparity in performance highlights the varied market sentiment, especially as Europe grapples with inflationary pressures, policy shifts, and earnings season dynamics. Let’s delve deeper into the factors contributing to the market’s incremental rise and the dramatic decline in Philips shares, exploring what it means for investors, the sectors to watch, and the broader economic landscape. European Markets Gain Despite Mixed Sector Performances European markets opened this week with moderate gains across several indexes. The FTSE 100, DAX, and CAC 40, three of the major European benchmarks, all saw slight increases as traders balanced their portfolios with a cautious approach to ongoing economic challenges and geopolitical factors. With inflation levels still elevated, central banks in Europe continue to wrestle with monetary policy adjustments. Investors are closely monitoring earnings reports, key economic indicators, and policy decisions to gauge future market movements. Philips Shares Fall 16% Amid Disappointing Earnings Report One of the most significant stories this week is Philips, whose shares plummeted by 16% following a disappointing earnings report. The Dutch health technology company cited continued supply chain disruptions, ongoing costs from product recalls, and weaker-than-expected demand as reasons for the profit slump. This led to the sharpest drop in Philips shares in recent months, raising questions about the company’s growth outlook and strategy. Philips’ decline was also spurred by a cautious guidance statement, which suggested that the headwinds impacting the company are unlikely to subside soon. This has led investors to recalibrate their expectations, and many analysts have revised their outlooks on Philips accordingly. What’s Behind the Mixed Market Sentiment in Europe? The mixed sentiment in Europe’s stock markets highlights the ongoing complexity of the economic environment. Factors such as high energy costs, supply chain bottlenecks, and geopolitical tensions, especially in Eastern Europe, are pressuring growth. However, some sectors, such as technology, renewable energy, and consumer goods, are showing resilience. Investors are increasingly selective, seeking stocks with strong fundamentals and proven adaptability in uncertain conditions. Meanwhile, companies like Philips, facing multiple headwinds and operational issues, are struggling to maintain investor confidence. Earnings Season: A Crucial Factor for European Markets The recent shift in the European stock market mood reflects the beginning of earnings season. For investors, this period is crucial as companies disclose their quarterly performance, providing a clearer picture of how they’re managing economic uncertainties. Robust earnings could bolster market confidence, while any weakness, as seen with Philips, could lead to significant individual stock selloffs. Sector Analysis: Healthcare and Tech on Divergent Paths The healthcare sector, traditionally seen as a safe haven, has encountered turbulence with the challenges faced by Philips. However, tech stocks in Europe have gained ground due to growing demand for digital transformation solutions across industries. Companies like SAP and ASML, leading players in software and semiconductor technology, are well-positioned to benefit from this trend and have seen stronger investor interest. Economic Indicators to Watch as European Markets Proceed As European markets progress through the week, several economic indicators and events could shape investor sentiment: Inflation Data: Rising inflation remains a core concern for policymakers, investors, and businesses alike. Energy Prices: With winter approaching, energy prices will be critical to watch, especially for sectors reliant on affordable energy. Central Bank Meetings: Policy announcements from the European Central Bank (ECB) could impact borrowing costs and investment decisions. Investor Takeaways: Navigating the European Market Landscape For investors, the European market offers both risks and opportunities in the current environment. While markets have shown resilience, caution is still advisable, especially with sector-specific challenges like those seen in healthcare. Balancing portfolios with a focus on defensive stocks, particularly those with low exposure to inflationary pressures and supply chain issues, might offer stability. In the case of Philips, the sharp decline emphasizes the importance of scrutinizing companies’ earnings reports and guidance. For long-term investors, there may be a buying opportunity if they believe in Philips’ recovery prospects, but it’s essential to be mindful of the ongoing risks in the healthcare sector. A Week of Cautious Optimism with Watchful Eyes on Earnings The European markets’ modest rise reflects a cautiously optimistic start to the trading week. Investors are treading carefully, especially with earnings season bringing both positive surprises and, as in Philips’ case, significant disappointments. Staying informed on economic indicators and sector trends will be key for investors looking to make the most of Europe’s evolving market landscape. By focusing on fundamentals, diversifying portfolios, and keeping a close eye on earnings, investors can better navigate the complexities of the European markets in these challenging yet opportunity-rich times. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs) are the future of… Read More HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Load More End of Content. UseFull Links Home About Stories Contact Technology Apple Working on AI-enabled HomePod with Touchscreen | Bizblog News September 28, 2024/No Comments Apple Working on AI-enabled HomePod with Touchscreen and Video Conferencing Features: Report In recent years, Apple has consistently pushed the… Read More Gen AI Industries: Insights from FLAME University VC – BizBlog

Autonomous Tech in Farming: Transforming Crops and Farm Labor | BizBlog News

Autonomous Tech in Farming: Transforming Crops and Farm Labor | BizBlog News Autonomous Tech Is Coming to Farming. What Will It Mean for Crops and Workers Who Harvest Them? In an era defined by rapid technological advancements, autonomous tech is transforming nearly every industry, and farming is no exception. From AI-driven tractors to robotic crop harvesters, autonomous technology has the potential to change how we grow, harvest, and distribute food worldwide. But as we consider the future of farming, we must ask, What does autonomous tech mean for the crops we rely on? And what will the impacts be on the workers who bring these crops from field to table? The adoption of autonomous tech in agriculture presents both opportunities and challenges, promising enhanced productivity, more sustainable farming practices, and even the possibility of addressing global food security. However, it also raises critical questions about the future role of human workers, skill requirements, and economic impacts within the agricultural sector. This article explores these implications, considering both the promise and complexity of autonomous tech in farming. The Rise of Autonomous Technology in Farming Autonomous technology in farming is reshaping traditional agricultural practices. From AI-powered machines that plant and water crops to robots capable of selective harvesting, autonomous innovations are enabling farms to become more efficient and productive. The rising demand for sustainable, high-yield farming methods has encouraged agritech companies to develop tools that streamline operations, cut labor costs, and ensure crop consistency. Innovations like John Deere’s autonomous tractors, drones for monitoring soil and crop health, and robotic weeders are just a few examples transforming farming. How Autonomous Tech Works in the Field Autonomous farming equipment operates with the help of sensors, GPS, AI algorithms, and data analytics. For instance, self-driving tractors use GPS to plow fields with precision, while AI-powered drones fly over vast acreage to gather insights on soil health and plant hydration. Robotics with high-resolution cameras are even able to identify ripe produce, reducing waste by ensuring only mature crops are harvested. This tech minimizes human error, optimizes resource use, and, importantly, reduces the need for physical labor. By leveraging AI and machine learning, farmers can also use data from these machines to predict crop yields, manage pests proactively, and analyze the best planting cycles for future seasons. These insights are transforming traditional agriculture into a data-driven enterprise, with implications for crop quality and yield consistency. The Impact of Autonomous Technology on Crop Production The promise of higher productivity and efficiency in crop production is one of the biggest advantages of autonomous tech in farming. Robotics and automation can operate longer hours, increasing the amount of land that can be cultivated and ultimately boosting food production. This may help address the global demand for food as the population grows, alleviating pressure on smaller farms and reducing the cost of food production. Improving Crop Health and Yield Autonomous tech is also helping farmers monitor crops with unmatched precision. Drones equipped with multispectral cameras can track plant health and alert farmers to pest infestations or nutritional deficiencies before they impact yields. By automating these processes, farms can take preventive actions rather than reacting to issues once they’re evident. Automated soil health monitoring systems ensure that crops receive optimal nutrients, directly impacting their quality and yield. Potential Risks and Concerns However, with new technology come risks. One concern with autonomous farming technology is the dependency on digital systems, which may be vulnerable to cyber-attacks or technical malfunctions. Moreover, maintaining these machines and systems may require substantial investment, which can be challenging for smaller farms with limited budgets. Autonomous tech could also lead to soil compaction, as heavier machinery can impact soil quality if not managed properly. The Human Element: Implications for Farm Workers While autonomous technology promises increased productivity, it also presents significant changes for the agricultural workforce. Agriculture has long been a labor-intensive industry, with millions of workers around the globe depending on seasonal and field labor for their livelihood. The automation of these tasks means that fewer people may be needed to plant, tend, and harvest crops, raising concerns about job displacement. The Changing Role of Farm Labor Farm jobs are changing, with traditional tasks like planting, weeding, and harvesting gradually being replaced by machine-operated systems. However, the need for skilled labor to operate, program, and maintain these advanced machines is increasing. Future farmworkers may find that their jobs require knowledge of technology, programming, and machinery maintenance—a shift that necessitates retraining and new skill development. Some labor-intensive tasks, such as harvesting delicate crops, still require a human touch. While robots are improving, the dexterity required for crops like strawberries or tomatoes is challenging to automate without damaging the product. This means that, for the foreseeable future, humans will still play an essential role in certain aspects of farming. Social and Economic Concerns The shift to autonomous farming could lead to economic disparity, as larger farms with the capital to invest in these technologies may outpace smaller farms that cannot afford to make such investments. Additionally, the social fabric of rural communities, many of which are built around farm labor, may face disruption as job opportunities shift away from traditional manual labor roles. This could lead to changes in rural demographics, impacting families, education, and community structures. Benefits of Autonomous Technology for Sustainable Farming Autonomous tech is not only increasing efficiency but also promoting sustainable farming practices. Precision agriculture—using data and technology to make farming as efficient and environmentally friendly as possible—is becoming increasingly feasible with automation. Robots, drones, and AI-driven machines are making it easier to use resources like water and pesticides responsibly, reducing environmental impact and promoting conservation. Reduced Resource Waste By precisely monitoring and managing resources, autonomous tech enables farms to use only the amount of water, fertilizer, or pesticide necessary. For example, robotic sprayers can target individual plants rather than entire fields, reducing the volume of chemicals used and minimizing their effect on surrounding ecosystems. Similarly, irrigation drones and sensors can help prevent water wastage

Aramco’s $100 Million AI Investment | BizBlog News

Aramco’s $100 Million AI Investment | BizBlog News Aramco’s Venture Arm Allocates $100 Million for AI Investments Artificial intelligence is increasingly becoming the backbone of modern industries, including energy and technology. Now, with its venture arm taking a bold leap into AI, Aramco—the world’s largest oil producer—is positioning itself at the forefront of AI-driven energy innovations. In a strategic move, Aramco Ventures has announced a massive $100 million investment focused on AI technologies. This initiative underscores a pivotal transition for Aramco, aimed at embracing and shaping digital advancements in energy, data analytics, and sustainability. Aramco’s Vision Behind AI Investments By setting aside $100 million for artificial intelligence, Aramco Ventures is creating a pathway to elevate efficiency, digital transformation, and automation within the oil and gas sector. This commitment highlights a forward-thinking approach toward operational excellence, cost-effectiveness, and sustainability. Aramco’s AI venture aligns with its goal to optimize complex processes, reduce carbon footprints, and support the global energy sector’s transformation through innovative technologies. Why AI is a Strategic Investment for Aramco The application of artificial intelligence in the energy sector is multifaceted, ranging from predictive maintenance to optimized energy usage and smart oil extraction methods. Aramco’s interest in AI arises from the potential of these technologies to revolutionize various elements of the oil and gas supply chain. With AI, Aramco can streamline complex calculations, predict equipment failures, and increase the lifespan of assets while reducing environmental impacts. Predictive Maintenance: One of the main applications of AI is predicting maintenance needs, allowing operators to anticipate and prevent machinery failures. This reduces downtime and enhances productivity. Smart Exploration: Advanced AI algorithms can improve exploration accuracy, optimizing resources and reducing wasted drilling efforts. Emission Control and Sustainability: Through AI-driven insights, Aramco aims to minimize its carbon footprint, aligning with global sustainability goals and enhancing its environmental stewardship. Focus Areas for General Atlantic’s Mideast Expansion Saudi Arabia is now home to multiple sectors primed for high-growth investments, many of which align with General Atlantic’s expertise. With this strategic Saudi office, the firm’s team will focus on industries with significant growth opportunities, including: Technology: Saudi Arabia is investing heavily in digital transformation, making technology one of the most promising sectors. Healthcare: As the population grows and urbanizes, the demand for healthcare services has surged. Consumer Goods: Shifts in consumer behavior have created unique opportunities in retail and lifestyle brands. Financial Services: Financial technology, or fintech, is gaining traction, offering new avenues for investment. Key Areas of AI Focus for Aramco Ventures The $100 million fund is expected to target several high-impact areas within AI, each geared toward optimizing Aramco’s operations and accelerating its growth trajectory. These areas include: Industrial Automation Automation remains a priority, and AI’s role is crucial in ensuring precise control and monitoring of complex industrial processes. With automated systems, Aramco can monitor performance metrics in real-time, increasing productivity and reducing waste. This AI application helps achieve operational excellence, which is critical for maximizing resource utilization. Data Analytics and Predictive Insights AI-backed data analytics offers powerful insights by collecting and analyzing vast amounts of data from different sources. This information helps Aramco anticipate market trends, optimize supply chain processes, and develop better strategies for energy production and distribution. Digital Twin Technology Digital twins—virtual representations of physical assets—are another area of significant interest. Through AI, these models simulate real-time conditions, allowing operators to test different scenarios without disrupting operations. Aramco plans to leverage digital twin technology to optimize plant operations, manage equipment, and improve safety protocols. How This Investment Strengthens Aramco’s Market Position Aramco’s decision to inject $100 million into AI serves multiple strategic purposes. Not only does it highlight the company’s commitment to technological evolution, but it also underscores its desire to strengthen its foothold in the global energy market. By proactively investing in AI, Aramco aims to stay ahead of the curve, bolstering its resilience in a market increasingly driven by technology. Enhancing Global Energy Security Aramco’s AI investment will improve operational efficiency and bolster the company’s role in ensuring global energy security. Through AI, Aramco can optimize energy production and distribution, ensuring a reliable supply to meet growing global demand. Driving Innovation in Energy and Technology By integrating AI, Aramco is set to foster innovation across its operations, from drilling to distribution. This progressive approach enhances its competitive edge and cements its reputation as a leader in technology-driven energy solutions. Benefits of AI-Driven Approaches in Oil and Gas The oil and gas industry has traditionally relied on heavy machinery and manual processes. However, AI-driven technologies present unique advantages that enable Aramco to operate more efficiently: Efficiency Gains: Automation and predictive maintenance reduce operational costs, while AI-enabled exploration improves resource allocation. Environmental Impact Reduction: AI can aid in monitoring emissions and optimizing energy consumption, helping the industry adhere to environmental standards. Enhanced Safety: AI’s predictive capabilities can identify potential risks, thereby enhancing workplace safety and minimizing accidents. Collaboration and Strategic Partnerships in AI Aramco Ventures’ $100 million allocation for AI investments opens doors for strategic collaborations with AI startups, tech firms, and research institutions. These partnerships will not only provide Aramco with cutting-edge technologies but also strengthen its ability to solve complex energy challenges. Fostering Partnerships with AI Startups By aligning with AI-focused startups, Aramco gains access to niche, innovative solutions that can be scaled for industrial use. Such partnerships allow Aramco to stay updated with emerging technologies, making it agile and adaptive to industry changes. Collaborations with Research Institutions Research institutions bring a wealth of theoretical knowledge, enhancing the practical application of AI. Aramco’s partnership with academia can catalyze research, focusing on AI solutions for energy, environmental monitoring, and operational improvements. Impact of Aramco’s AI Investments on the Broader Energy Landscape The ripple effects of Aramco’s venture into AI extend beyond its operations. As a leading industry player, Aramco’s AI strategies are likely to influence how other companies in the oil and gas sector approach technology investments. Promoting Sustainability in the Industry Aramco’s focus on AI can serve as a model

General Atlantic Saudi Office Launch | BizBlog News

General Atlantic Saudi Office Launch | BizBlog News General Atlantic Opens Saudi Office to Scout Mideast Deals As global venture capital flows adapt to the shifting dynamics of the Middle East, General Atlantic’s decision to open an office in Saudi Arabia signals a strategic focus on the burgeoning investment landscape in the region. This move by the U.S.-based growth equity firm reflects Saudi Arabia’s growing appeal as a hub for Middle Eastern deal-making. From a favorable business climate to long-term growth prospects across key industries, this new office in Riyadh aims to tap into investment opportunities in sectors like technology, healthcare, consumer goods, and financial services. General Atlantic’s Strategic Move: Why Saudi Arabia? As one of the world’s largest private equity firms, General Atlantic manages over $70 billion in assets and has developed a reputation for identifying high-growth potential across markets. The choice to open a Saudi office reflects a calculated move to harness the dynamic growth and rising diversification across Middle Eastern economies. Saudi Arabia, in particular, has taken steps toward economic diversification under Vision 2030, making it a strong destination for new investments. With its robust infrastructure and support for innovation, Saudi Arabia has increasingly attracted foreign investment, making it a primary hub in the Middle East for companies looking to expand. This trend has encouraged private equity and venture capital firms to see it as a prime location for tapping into regional opportunities. What General Atlantic’s Expansion Means for Mideast Investment For regional and global businesses alike, General Atlantic’s new presence in Saudi Arabia is an indicator of rising Mideast investment potential. The move is expected to encourage other firms to follow suit, boosting the region’s economic profile. Moreover, it signifies that General Atlantic, known for its expertise in high-growth industries, sees real potential in Middle Eastern markets and aims to help scale local businesses. The new Saudi office will be pivotal in evaluating emerging growth opportunities and establishing local partnerships that can serve as a gateway to more investment across the region. Focus Areas for General Atlantic’s Mideast Expansion Saudi Arabia is now home to multiple sectors primed for high-growth investments, many of which align with General Atlantic’s expertise. With this strategic Saudi office, the firm’s team will focus on industries with significant growth opportunities, including: Technology: Saudi Arabia is investing heavily in digital transformation, making technology one of the most promising sectors. Healthcare: As the population grows and urbanizes, the demand for healthcare services has surged. Consumer Goods: Shifts in consumer behavior have created unique opportunities in retail and lifestyle brands. Financial Services: Financial technology, or fintech, is gaining traction, offering new avenues for investment. The Competitive Edge of a Saudi Presence Saudi Arabia’s capital, Riyadh, is quickly becoming a central hub for business and investment in the Middle East, with government initiatives aimed at creating a more business-friendly environment. General Atlantic’s decision to establish a local office is also influenced by Saudi Arabia’s commitment to fostering a conducive environment for foreign direct investment (FDI). Over the past few years, Saudi Arabia has implemented regulatory changes to attract FDI, making it easier for foreign companies to enter the market and sustain operations. Having a physical office in Riyadh allows General Atlantic to establish closer relationships with regional partners, helping them remain agile in a highly competitive market. Challenges and Opportunities in Mideast Investment While the Middle Eastern markets hold vast potential, General Atlantic is also aware of the challenges involved. Economic instability in parts of the region and fluctuating oil prices could present hurdles. However, the firm’s strategic entry into Saudi Arabia demonstrates a focus on building resilient, diversified portfolios that can withstand these fluctuations. Moreover, Saudi Arabia’s Vision 2030 plan is encouraging economic diversification away from oil dependency. With this vision, General Atlantic is positioning itself to invest in sectors that will fuel the Saudi economy’s future. This long-term strategy could lead to sustained growth and offer General Atlantic a competitive edge within the region. How General Atlantic’s Presence Impacts Regional Businesses The firm’s new Riyadh office holds significant implications for regional businesses as well. With General Atlantic’s expertise in supporting growth-stage companies, local businesses can gain access to not just funding but also mentorship and global best practices. This can accelerate their growth and prepare them for larger international markets. General Atlantic’s presence also emphasizes the region’s potential to attract large-scale, institutional investors who can contribute to job creation, technological advancements, and economic diversification. Future Outlook: Mideast Deals and Market Dynamics The opening of General Atlantic’s Saudi office is an early step in what could be a broader wave of Middle East investments from Western firms. As more global investors observe Saudi Arabia’s evolving market, the region could see an influx of similar ventures. Local companies may also benefit from access to foreign capital and resources, accelerating their ability to scale in both the Middle Eastern and global markets. In terms of timing, General Atlantic’s expansion into Saudi Arabia aligns with a period of global venture capital reevaluation—with firms focusing on regions that offer stability and long-term growth potential. As Middle Eastern economies diversify, investments in sectors like technology and healthcare become not just viable but necessary, shaping the future of Mideast deal-making. A Pivotal Move for General Atlantic and Mideast Investment General Atlantic’s opening of a Saudi office represents more than just geographical expansion; it’s a strategic decision that aligns with both the firm’s global objectives and Saudi Arabia’s Vision 2030 goals. The move underscores the growing role of the Middle East in the global economic arena and presents exciting opportunities for investors looking to engage with one of the most rapidly transforming regions. With the right investments and partnerships, General Atlantic has the potential to contribute significantly to the Mideast market, supporting regional companies and strengthening economic ties between the Middle East and Western economies. This bold step could pave the way for more investment activity in the region and cement Saudi Arabia’s place as a primary destination for growth

Ex-Abercrombie & Fitch Head Faces Charges | BizBlog News

Ex-Abercrombie & Fitch Head Faces Charges | BizBlog News Ex-Abercrombie & Fitch Head to Be Arraigned on Sex Trafficking and Prostitution Charges: Unveiling the Allegations and Implications In a case that has shocked both the business and fashion worlds, former Abercrombie & Fitch CEO Mike Jeffries faces accusations that extend far beyond boardroom politics. Jeffries, who spearheaded Abercrombie & Fitch’s transformation into a global retail phenomenon, is now under scrutiny for serious charges involving sex trafficking and prostitution. The upcoming arraignment will shed light on allegations that could unveil an extensive pattern of exploitation tied to his position. This case raises critical questions about the accountability of influential figures in positions of power, the ethics surrounding the abuse of authority, and the broader implications for corporate culture. Below, we delve into the background of the case, the accusations facing Jeffries, and the potential impact on both the individuals involved and the broader business landscape. Who Is Mike Jeffries? A Look at the Former Abercrombie & Fitch Head Mike Jeffries is widely known for leading Abercrombie & Fitch during its meteoric rise in the 1990s and 2000s. Under his leadership, the brand became synonymous with a particular kind of “All-American” aesthetic, emphasizing exclusivity and beauty in its marketing campaigns. This branding came at a controversial cost, as Jeffries often stirred public backlash for his rigid standards of beauty and inclusion. Critics argued that Abercrombie & Fitch’s image promoted unrealistic beauty standards, while Jeffries defended the brand’s marketing as highly curated to target a specific demographic. While his aggressive marketing strategies helped Abercrombie achieve widespread success, they also sowed seeds of controversy that led to Jeffries’ eventual departure from the company in 2014. However, the allegations now surfacing in this legal case suggest that Jeffries may have been involved in activities that go far beyond mere controversy. The Accusations Unveiled: Understanding the Charges The charges against Jeffries are grave, including sex trafficking and prostitution—both serious violations with deep-rooted legal and ethical implications. According to preliminary reports, Jeffries allegedly engaged in, or enabled, a series of activities that exploited young men through coercive means. The charges claim that he abused his position of power, luring young models and influencers with promises of career advancement in exchange for engaging in explicit acts. These allegations echo broader concerns about power imbalances in industries like fashion, where vulnerable individuals seeking fame or success are often susceptible to manipulation. Prosecutors claim that Jeffries, along with his associates, may have been operating a highly orchestrated network of exploitation. The investigation is anticipated to bring forth witnesses who will provide insight into this alleged system, and their testimonies are expected to be crucial in painting a clear picture of the activities involved. Impact of the Case on Abercrombie & Fitch’s Legacy Although Jeffries left Abercrombie & Fitch almost a decade ago, his actions continue to cast a shadow over the brand’s legacy. As one of the most prominent figures associated with Abercrombie’s rise to fame, Jeffries’ legal troubles could impact the perception of the brand, even if indirectly. Abercrombie & Fitch has since sought to rebrand itself, pivoting toward inclusivity and diversity after distancing itself from Jeffries’ exclusive image standards. However, with these new allegations surfacing, Abercrombie may again find itself in the limelight for unfavorable reasons. The brand has yet to release an official statement regarding the charges against its former CEO, but industry experts speculate that this case could serve as a pivotal moment for Abercrombie & Fitch, further challenging its efforts to redefine its image. Implications for Corporate Accountability The case against Jeffries brings forth the question of corporate accountability and how companies can better safeguard against potential abuses of power by senior executives. In industries that often idolize high-profile figures, the boundaries between personal and professional conduct can blur, leading to situations where unethical behavior is overlooked due to an individual’s contribution to a brand’s success. If the charges against Jeffries hold, it could lead to broader changes within corporate governance structures, particularly in fashion and entertainment, where allegations of exploitation are unfortunately prevalent. Board members and investors may advocate for stricter oversight mechanisms to prevent such cases from occurring in the future. What Comes Next? The Path to Justice and the Legal Proceedings Ahead The upcoming arraignment will likely provide initial insights into the evidence collected against Jeffries and his associates. Legal experts suggest that the case may set a precedent in terms of accountability for those in power within the fashion industry. Prosecutors have reportedly gathered substantial evidence, and if the allegations are substantiated, it could lead to significant legal consequences for Jeffries. Beyond the legal ramifications, this case could act as a catalyst for much-needed conversations around power dynamics in the corporate world. By holding prominent figures accountable for their actions, society can hope to create safer environments for all individuals in industries where young talent often operates at a disadvantage. What This Means for the Fashion Industry’s Future The Jeffries case underscores the darker side of an industry that is often glamorized but rarely scrutinized at this level. A positive outcome of this high-profile case could be increased protections for individuals entering the fashion world, helping to ensure that opportunities are provided in a safe and ethical manner. Industry leaders might be motivated to adopt stricter guidelines and practices that prevent exploitation and abuse, fostering a healthier workplace culture in fashion and beyond. The implications of this case could reach far beyond one individual or one company. For an industry where image is everything, an increased focus on ethics and integrity could reshape how brands approach talent management and brand identity. By addressing these systemic issues, the fashion world can work towards a future where exploitation is eradicated and where transparency and respect define industry standards. UseFull Links Marketing Ford EV Sales Surge with New Benefits Program | BizBlog News October 1, 2024/No Comments Ford Aims to Boost EV Sales, Address Owner Concerns with New Benefits Program Electric vehicles (EVs)