Foxconn Lines Up $1 Billion Investment for Smartphone Display Modules: A Major Boost for India’s Value Chain India’s manufacturing landscape has just received a powerful endorsement. Foxconn, a global leader in electronics manufacturing, has announced a whopping $1 billion investment in India, specifically in the smartphone display module sector. This move is not only a monumental step for Foxconn’s expansion but also marks a significant leap forward for India’s ambition to become a global manufacturing hub, particularly in the smartphone industry. As the world’s fifth-largest economy, India’s manufacturing potential is on the rise, and Foxconn’s decision is a testimony to this growth. Foxconn’s Investment: Why It Matters Foxconn’s $1 billion investment is a clear signal of India’s growing relevance in the global value chain. Foxconn, known for assembling some of the most popular smartphones in the world, including Apple’s iPhones, is now setting its sights on expanding its footprint in India. By focusing on smartphone display modules, a critical component in modern mobile devices, Foxconn is betting big on India’s ability to support high-tech manufacturing. This investment is expected to bolster India’s local supply chain, bringing in advanced manufacturing techniques and creating thousands of new jobs in the process. Foxconn’s decision aligns with the Indian government’s push for the “Make in India” initiative, which aims to increase domestic production and reduce reliance on imports. This investment will not only enhance India’s capabilities but also make the country a key player in the global smartphone manufacturing market. Strengthening India’s Position in the Global Value Chain India has long been regarded as a promising market for electronics manufacturing. However, it’s only in recent years that the country has begun to capitalize on its potential. With favorable government policies, such as Production Linked Incentives (PLI) for electronics manufacturers, India is becoming an attractive destination for companies like Foxconn to set up large-scale manufacturing operations. Foxconn’s investment in display modules specifically targets a critical part of the smartphone value chain. The display is one of the most complex and expensive components in a smartphone, and localizing the production of such high-value parts in India will reduce costs for manufacturers and make India more competitive in the global market. India’s large, skilled workforce is another key factor that makes it an attractive destination for such an investment. The presence of top engineering talent, along with the government’s continued focus on upskilling and education in technology fields, ensures that India can not only meet the manufacturing demand but also innovate in this sector. Employment and Economic Impact of Foxconn’s Move Foxconn’s billion-dollar investment will undoubtedly create a massive wave of employment opportunities in India. The company is expected to generate thousands of direct jobs in its manufacturing units and support even more through its supply chain. Moreover, the local production of display modules will create a ripple effect across industries, benefiting local suppliers, logistics providers, and even small businesses that service these large facilities. For India, this investment is not just about jobs. It’s about becoming a hub for high-tech manufacturing. By focusing on the production of key components like smartphone display modules, India is positioning itself as a critical node in the global electronics supply chain. This is expected to attract other multinational companies to invest in the country, creating an ecosystem of innovation and development. “Make in India” and the Road Ahead Foxconn’s investment is closely aligned with India’s “Make in India” initiative, which seeks to transform the country into a global manufacturing powerhouse. By bringing in state-of-the-art technology and processes, Foxconn is helping to elevate India’s capabilities in producing high-quality, tech-driven products. This move not only adds credibility to the “Make in India” mission but also sends a strong signal to other global companies about the opportunities available in the Indian market. In recent years, India has been making strides to build its domestic manufacturing base, especially in the electronics and smartphone sectors. This includes setting up Special Economic Zones (SEZs), improving infrastructure, and introducing favorable trade policies. Foxconn’s commitment is proof that these efforts are beginning to bear fruit. India’s rising smartphone consumption, coupled with its young, tech-savvy population, presents a ripe opportunity for companies looking to capitalize on the demand for high-tech products. The Indian market, with its growing middle class and increasing disposable income, has become a key area of focus for smartphone manufacturers worldwide. Foxconn’s investment will help meet this demand by producing critical components locally, reducing costs, and speeding up production timelines. Foxconn’s Long-term Vision for India Foxconn’s decision to invest in India is not just about short-term gains. The company clearly sees India as a strategic location for its long-term growth. With geopolitical tensions pushing companies to diversify their supply chains, India offers a stable and scalable alternative to traditional manufacturing hubs like China. Foxconn’s investment in display modules is just the beginning. As India continues to invest in its infrastructure and human capital, Foxconn is likely to deepen its presence in the country. The company has already expressed interest in expanding into other areas of electronics manufacturing, including components for electric vehicles and cloud computing hardware. India’s push for renewable energy and sustainable manufacturing practices also aligns well with Foxconn’s goals of building environmentally friendly production processes. By investing in India, Foxconn is not only tapping into a growing market but also contributing to a greener, more sustainable future for electronics manufacturing. A Bright Future for India’s Manufacturing Sector Foxconn’s $1 billion investment in smartphone display modules marks a major milestone for India’s manufacturing sector. It reflects the country’s growing importance in the global value chain and signals a new era of high-tech manufacturing in India. As Foxconn expands its operations and brings in advanced technologies, India will not only benefit from job creation and economic growth but also from becoming a crucial part of the global electronics industry. India’s journey to becoming a global manufacturing hub is well underway, and Foxconn’s investment is a key stepping stone on that path. With the right policies,

Swiggy Secures SEBI Approval for IPO | Bizblog News

Swiggy Secures SEBI Approval for IPO, Launch Expected in November: Report Swiggy, one of India’s largest food delivery giants, has officially received approval from the Securities and Exchange Board of India (SEBI) to launch its long-awaited Initial Public Offering (IPO). According to various reports, this significant step is expected to materialize in November, marking a monumental moment in the company’s journey. But what does this mean for Swiggy, its investors, and the broader Indian tech ecosystem? The Significance of Swiggy’s IPO Swiggy’s IPO marks a key milestone not only for the company but also for India’s burgeoning startup landscape. As one of the largest players in the food delivery and online grocery sectors, Swiggy’s public listing is anticipated to raise substantial capital and fuel further growth in the hyper-competitive online services industry. Swiggy’s IPO launch is likely to be one of the most anticipated events in India’s startup scene this year. It follows a surge of Indian tech companies that have successfully made the transition from private to public entities, including Zomato, Paytm, and Policybazaar. However, unlike many of its peers, Swiggy’s IPO comes at a time when investors have become more cautious after witnessing some underwhelming performances post-IPO from other tech unicorns. SEBI Approval: A Critical Milestone Gaining SEBI approval is a crucial step in any IPO process. It not only confirms that the company meets the regulatory and financial requirements for listing but also gives a nod of approval to investors about the company’s overall financial health. For Swiggy, this approval is particularly timely as the company has been striving for profitability while expanding aggressively in new business areas like Instamart, its quick-commerce grocery delivery service. Swiggy’s IPO plans had been rumored for some time, with speculation mounting around its valuation, which is expected to be in the range of $10-12 billion. SEBI’s approval puts an official seal on these plans, setting the stage for Swiggy to go public and allowing early investors a chance to cash in on their investments. Why November Is the Ideal Launch Window Swiggy’s choice of November for its IPO is not arbitrary. Historically, the November-December period has been favorable for IPOs in India, as investors tend to have more liquidity due to bonuses and year-end financial planning. Additionally, a November IPO allows Swiggy to capitalize on the post-festive season high when consumer spending is traditionally robust in India. Timing the IPO just before the year-end could also give Swiggy the opportunity to tap into holiday season demand, driving further investor interest. This window is also ideal as it provides some distance from the volatility typically seen in the global markets in the second half of the year. The Impact on India’s Food Delivery Sector Swiggy’s IPO will have a ripple effect on India’s food delivery landscape, which is currently dominated by Swiggy and its primary competitor, Zomato. Zomato, which went public in 2021, has since faced its own challenges in maintaining investor confidence despite being a market leader. Swiggy’s listing will not only increase competition between these two giants but could also set the tone for how investors view the broader online services sector in India. If Swiggy’s IPO performs well, it could reignite investor interest in the food delivery and tech sectors, which have seen a dip in enthusiasm following a series of post-IPO struggles by other Indian tech companies. On the flip side, if Swiggy fails to meet market expectations, it could deepen concerns about the viability of high-growth, low-profitability tech companies going public. What Investors Should Know Before Swiggy’s IPO Before investing in Swiggy’s IPO, there are several key factors potential investors should consider. The company has made significant strides toward profitability but is still heavily reliant on venture capital funding to fuel its growth. Investors will need to assess whether Swiggy’s business model is sustainable in the long run, particularly as competition in both food delivery and quick commerce intensifies. Additionally, the broader macroeconomic environment, including inflation and shifts in consumer spending, will play a significant role in determining Swiggy’s post-IPO performance. With the cost of living rising, discretionary spending on food delivery services could take a hit, impacting Swiggy’s bottom line. However, Swiggy has shown a knack for innovation and adaptation. From its rapid expansion into grocery delivery with Instamart to introducing subscription-based models like Swiggy One, the company has consistently stayed ahead of the curve. For long-term investors, these innovations could be signs of a company that’s well-positioned to navigate future challenges. Swiggy’s Journey to IPO: A Decade of Growth Swiggy’s journey from a small startup founded in 2014 to one of India’s most valuable tech companies has been nothing short of remarkable. The company, which started as a food delivery platform, quickly scaled up to become the market leader, competing head-to-head with global giants like UberEats (which it later acquired in India) and homegrown rival Zomato. Swiggy’s success can be attributed to its customer-first approach, a vast delivery network, and a willingness to diversify its business model. In recent years, the company has expanded into grocery delivery, alcohol delivery, and even introduced a “genie” service, allowing users to send packages within cities. Swiggy’s ability to pivot and expand into new verticals will be a key selling point for its IPO. Investors will be keen to see how the company plans to sustain its growth while maintaining profitability in an increasingly competitive market. The Road Ahead for Swiggy As Swiggy gears up for its public debut, the company faces a mix of opportunities and challenges. On one hand, the IPO will provide the company with much-needed capital to expand its operations and strengthen its position in new markets like grocery delivery. On the other hand, it will also subject Swiggy to the scrutiny of public markets, where profitability and growth must be balanced more carefully. For consumers, Swiggy’s IPO could mean continued innovation and improvement in its services. As the company seeks to impress shareholders, we can expect it to roll out new features and

F&O Traders Face Massive Losses in 3 Years: SEBI Report | BizBlog News

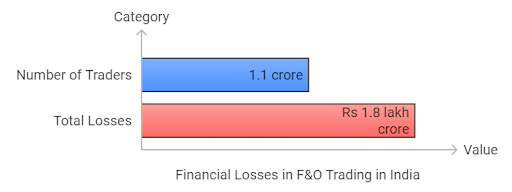

F&O Addiction: The Shocking Reality Behind Rs 1.8 Lakh Crore Loss in 3 Years Futures and Options (F&O) trading has become synonymous with high risks, fast profits, and unfortunately, devastating losses. A recent study by the Securities and Exchange Board of India (SEBI) has brought to light a staggering statistic—1.1 crore traders have lost a collective Rs 1.8 lakh crore over the last three years. This revelation has sparked concern across the financial community, as F&O addiction continues to lure retail investors into a high-stakes game they often cannot win. The findings highlight the darker side of trading, where dreams of quick money can lead to crushing financial losses. What Is F&O Trading, and Why Does It Attract So Many Traders? Futures and Options (F&O) trading allows investors to trade contracts on the future value of assets like stocks, indices, or commodities. The allure lies in the potential for massive gains with relatively small investments, thanks to the leverage involved. Many retail investors, lured by the promise of quick returns, dive headfirst into this market, often without a solid understanding of the risks. However, F&O trading is not for the faint of heart—it requires precision, market knowledge, and the ability to withstand financial shocks. Despite these requirements, SEBI’s study shows that a significant portion of F&O traders are retail investors who may not fully grasp the risks. With platforms making trading more accessible, the ease of entry has created a perfect storm for addiction, and this trend is rapidly growing. SEBI’s Alarming Study: 1.1 Crore Traders in Deep Losses SEBI’s extensive study covered three years of F&O trading data and revealed some shocking facts. It is not just the high volume of losses, but the sheer number of traders affected that stands out. Over 1.1 crore participants entered F&O trading during the period under review, and collectively, they lost Rs 1.8 lakh crore. While F&O might be marketed as an advanced financial instrument for seasoned traders, the reality is that a large portion of these losses came from retail investors, often with limited knowledge of the market dynamics. The study exposed a troubling pattern—retail investors were drawn to F&O because of aggressive marketing and an optimistic view of the stock market, which frequently downplayed the significant risks involved. These traders, hoping for outsized gains, often found themselves on the wrong side of the market, losing significant capital in a short time. The Psychology Behind F&O Addiction: Why Do Traders Keep Coming Back? Trading addiction is a growing concern, and F&O addiction is particularly perilous due to the high stakes involved. The psychological element of trading is often under-discussed. Traders experience a euphoric rush when they win, which leads to a dopamine hit similar to what one might feel with gambling. The high volatility of F&O trading, with its massive swings, adds to this sense of exhilaration. On the other side, the emotional pain of a loss pushes many to chase their losses, hoping for a lucky break. This cycle of highs and lows keeps traders coming back for more, often with detrimental financial consequences. SEBI’s study suggests that many retail investors in India are caught in this vicious cycle, where small wins are overshadowed by much larger losses, leading to devastating outcomes over time. The Role of Technology and Trading Platforms in Fueling F&O Addiction One of the most significant factors contributing to F&O addiction is the ease of access. Modern trading platforms offer user-friendly interfaces, making it incredibly simple for individuals to start trading F&O contracts. The convenience of apps and websites means that people can execute trades from their smartphones at any time, further feeding the addiction. While these platforms provide useful tools, they also remove the friction that might give someone pause before placing risky trades. In some cases, traders don’t even need substantial capital to get started, as F&O trading allows leverage—essentially borrowing money to increase the size of the trade. This means that traders can bet big without putting down an equivalent amount of money upfront, which, while enticing, also magnifies potential losses. Understanding the Heavy Financial Impact: Rs 1.8 Lakh Crore Loss The figure Rs 1.8 lakh crore is enormous—equivalent to the GDP of some small countries. The financial impact of these losses has ripple effects, not just on the individual traders but on the economy at large. Many of these losses are borne by retail investors, who often have smaller portfolios and fewer safety nets than institutional players. For those affected, these losses can mean more than just financial setbacks—they can derail life plans, drain savings, and lead to significant psychological stress. SEBI’s study highlights that a large majority of these losses were concentrated among retail investors, indicating a widespread problem that needs urgent attention. Risk Mitigation Strategies for F&O Traders While F&O trading inherently carries risk, there are strategies traders can adopt to mitigate their exposure. First and foremost, education is key. Traders need to fully understand the instruments they are dealing with, including the complex factors that influence price movements. Additionally, risk management strategies like stop-loss orders can help prevent significant losses. Diversification is another essential strategy. Rather than putting all their capital into F&O contracts, traders should consider spreading their investments across different asset classes to reduce risk. Finally, traders should only invest money they can afford to lose. Treating F&O trading as a speculative endeavor rather than a surefire way to make money is crucial to maintaining financial stability. SEBI’s Recommendations to Curb F&O Addiction In light of the findings from the study, SEBI has proposed several measures to curb F&O addiction and protect retail investors. These include stricter regulations on leverage, more robust disclosures regarding the risks involved, and enhanced educational initiatives to improve financial literacy among retail traders. Additionally, SEBI is considering limiting access to F&O trading for inexperienced investors. Such measures could include higher margin requirements or restrictions on the types of F&O contracts that retail investors can trade. These recommendations aim to reduce the

Avoid Double Tax on Kisan Vikas Patra Interest | Expert Tips – Bizblog News

Avoid Double Tax on Kisan Vikas Patra Interest | Expert Tips – Bizblog News Avoiding Double Tax on Kisan Vikas Patra Interest: ITR Filing Tips Kisan Vikas Patra (KVP) is a popular small savings scheme in India that offers guaranteed returns over a fixed period. While it’s a reliable investment tool, one crucial aspect that investors often overlook is the tax treatment of the interest earned. Failing to report the interest properly can lead to double taxation, which can erode your hard-earned returns. This article provides detailed insights and tips on how to avoid double tax on Kisan Vikas Patra interest while filing your Income Tax Return (ITR). Understanding Kisan Vikas Patra and its Interest Structure Kisan Vikas Patra (KVP) is a savings certificate scheme initiated by the Government of India. It allows individuals to double their investments over a fixed period—usually around 10 years and 4 months, depending on the prevailing interest rates. The certificate can be purchased from post offices, making it easily accessible to the masses. One of the significant advantages of KVP is that the interest accumulates annually, but you only receive the payout when the certificate matures. This creates a situation where the interest earned each year needs to be declared in your ITR, even though you haven’t received the actual payout. If you fail to declare the interest annually, you might end up paying taxes twice—once when the interest accrues and again when the certificate matures. Taxation on Kisan Vikas Patra Interest The interest earned on KVP is taxable under the head of “Income from Other Sources.” Unlike other small savings schemes like the Public Provident Fund (PPF), which is tax-exempt, the interest from KVP does not enjoy any tax exemptions. Thus, it is crucial to report it correctly in your ITR each year. If you neglect to do so, you may face the risk of double taxation. Here’s how: Interest Accrual Every Year: The interest on KVP accrues annually, even though you receive it upon maturity. Under the Income Tax Act, this annual interest accrual is taxable. Tax at Maturity: If you do not declare the interest income annually, the entire amount received at maturity (principal + interest) could be considered taxable income, leading to a hefty tax burden. Tips to Avoid Double Tax on Kisan Vikas Patra Interest 1. Opt for Accrual Method of Accounting One of the best ways to avoid double taxation on your KVP interest is by opting for the accrual method of accounting. This method ensures that you report the interest earned every year, even though you haven’t actually received it. By doing this, you pay taxes on the interest each year, rather than paying it in a lump sum at the time of maturity. When using the accrual method, make sure to: Keep track of the interest accumulated annually. Declare the interest in the “Income from Other Sources” section of your ITR. Pay taxes on this interest based on your applicable income tax slab. 2. Calculate Interest Accurately To avoid double taxation, it’s essential to calculate your interest accurately each year. KVP follows a compounding interest structure, which means the interest earned each year is added to the principal, and the next year’s interest is calculated on this new total. The formula for calculating KVP interest is simple:FV = P × (1 + r/n) ^ (nt) Where: FV = Final Value (Maturity Amount) P = Initial Principal r = Annual interest rate (divided by 100) n = Number of times interest is compounded annually t = Time the money is invested for, in years Using this formula, you can figure out the exact amount of interest earned annually and ensure it is properly declared in your tax returns. 3. Declare Interest in the Correct ITR Form Choosing the correct ITR form is vital for avoiding errors and potential penalties. The interest earned on KVP must be declared under “Income from Other Sources.” For individuals with a salary or pension income, ITR-1 is the appropriate form. However, if you have multiple sources of income, including capital gains or business income, you may need to file ITR-2 or ITR-3. Ensure that you input the interest accrued under the appropriate section to avoid any confusion or discrepancies during tax assessment. 4. Use the Form 26AS to Cross-Verify Income Form 26AS is a tax credit statement that the Income Tax Department provides to taxpayers. This form contains details about taxes deducted at source (TDS), advance tax paid, and other relevant information. Before you file your ITR, use Form 26AS to cross-verify the income reported by your bank or post office regarding your KVP. If there is any mismatch between your declared income and the details in Form 26AS, it could trigger a tax notice. Correct reporting is crucial to prevent any unnecessary complications. 5. Claim Deductions if Eligible While KVP interest is fully taxable, you may be eligible for deductions under other sections of the Income Tax Act. For instance, if you’ve invested in other tax-saving instruments like PPF, NSC, or ELSS, you can claim deductions under Section 80C to reduce your overall tax liability. Additionally, deductions under Section 80TTA can be claimed if you’ve earned savings bank interest. Although KVP interest is taxable, these deductions can offset some of your tax liability, providing significant savings. Common Mistakes to Avoid in KVP Interest Taxation 1. Not Reporting Interest Annually One of the most common mistakes is failing to report the KVP interest annually. Many taxpayers think that since they haven’t received the payout yet, they can defer the tax reporting until maturity. This can lead to hefty tax implications at maturity and possibly double taxation. 2. Misunderstanding Tax-Free Limits Some taxpayers mistakenly believe that KVP interest is tax-exempt, similar to PPF or Sukanya Samriddhi Yojana. Unfortunately, there is no such exemption, and the entire interest amount is subject to tax. Ensure you don’t fall into this trap, as it can lead to penalties or even legal issues. 3. Ignoring Changes

SEBI’s New Rule: Mutual Fund Houses Allowed to Trade Credit Default Swaps – BizBlog

SEBI’s New Rule: Mutual Fund Houses Can Now Trade Credit Default Swaps The Securities and Exchange Board of India (SEBI) has introduced a game-changing regulation that allows mutual fund houses to trade in credit default swaps (CDS). This move marks a significant development for the Indian financial markets, as it opens new doors for fund houses to manage risk, boost returns, and diversify their portfolios. SEBI’s decision reflects a broader effort to strengthen India’s financial ecosystem, aligning with global standards and offering mutual fund investors enhanced flexibility. Understanding SEBI’s New Rule on Credit Default Swaps SEBI, as the regulatory body for securities markets in India, continuously works to enhance the investment landscape. The decision to allow mutual fund houses to trade credit default swaps is a strategic step to provide greater opportunities for fund managers. But what does this rule mean for the industry, and more importantly, for the average investor? Previously, mutual funds in India were not permitted to trade in CDS directly. However, this new rule changes the game, allowing them to use CDS as a risk management tool. Credit default swaps, essentially a form of insurance against the default of a borrower, can now be bought and sold by mutual funds to hedge against potential credit risk in their portfolios. The move provides an additional layer of protection for investors while giving fund managers more leeway to craft sophisticated strategies to enhance returns. CDS can help mutual fund managers mitigate risks in case the issuer of a debt security defaults. What Are Credit Default Swaps (CDS)? Before delving deeper into how SEBI’s new rule will impact mutual fund houses, it’s essential to understand the basics of credit default swaps. A credit default swap is a financial derivative that allows an investor to “swap” or offset their credit risk with that of another investor. In simple terms, it functions like insurance. Here’s how it works: Suppose a mutual fund holds bonds issued by a company. If the fund manager believes that there is a risk the company might default on its obligations, they can enter into a CDS agreement. The fund manager pays a regular premium to another party (often a bank or financial institution) in exchange for protection. If the company defaults, the seller of the CDS compensates the buyer (the fund manager) for the loss, much like an insurance payout. Credit default swaps offer an essential tool for managing credit risk, allowing investors to protect themselves against adverse market conditions. However, CDS can also be used to speculate on the creditworthiness of companies and entities, adding an element of risk. The Impact of SEBI’s Decision on Mutual Fund Houses Mutual fund houses stand to benefit significantly from SEBI’s decision. The ability to trade in CDS gives fund managers a powerful risk management tool that can help them safeguard their portfolios against credit defaults. Here are a few ways this new rule will impact the industry: Risk Management: CDS can help mutual fund managers hedge against potential losses arising from defaults. With SEBI’s new rule, mutual funds can now insure themselves against the risk of non-payment from the companies or entities whose debt they hold. For instance, if a mutual fund has invested heavily in corporate bonds, and the creditworthiness of those companies becomes questionable, the fund can purchase CDS to protect itself. In the event of a default, the CDS seller will compensate the fund for the loss, thus reducing the overall impact on investors. Enhanced Returns Through Diversification: The ability to trade in CDS also allows mutual funds to diversify their investment strategies. By incorporating credit derivatives into their portfolios, fund managers can take on calculated risks to potentially boost returns. This added flexibility could make certain mutual funds more attractive to risk-tolerant investors looking for higher returns. While diversification typically lowers overall risk, using CDS can provide more creative avenues for generating income, especially in an environment where interest rates are low, and traditional fixed-income securities may not offer attractive yields. Alignment with Global Practices: SEBI’s decision also brings Indian mutual funds closer in line with global financial practices. In more developed markets, such as the United States and Europe, credit derivatives like CDS are commonly used by institutional investors. By allowing mutual funds to trade in CDS, SEBI is encouraging the Indian mutual fund industry to adopt more advanced risk management strategies, improving its competitiveness on the global stage. More Sophisticated Investment Products: Mutual funds trading in CDS can create more sophisticated products for investors. Fund houses can now craft offerings that combine traditional debt securities with CDS strategies, providing an enhanced balance of risk and return. This could result in the introduction of new funds aimed at more seasoned investors who are comfortable with the nuances of credit derivatives. For investors who seek exposure to higher-yielding debt instruments but wish to mitigate the risk of default, funds employing CDS strategies could provide an attractive solution. The Potential Risks of CDS in Mutual Fund Portfolios While the introduction of credit default swaps offers significant benefits, it is important to note that CDS are not without risks. SEBI’s new rule, while empowering mutual funds, also requires fund managers to navigate potential pitfalls carefully. Increased Complexity: Credit default swaps are complex financial instruments. They require a deep understanding of credit markets and the entities involved. While fund managers will undoubtedly have the expertise to handle CDS, the added complexity may not be fully understood by all investors. It is crucial for investors to read fund disclosures carefully and understand the risks before investing in funds that use CDS. Counterparty Risk: Another key risk associated with CDS is counterparty risk. In a CDS agreement, the protection buyer relies on the protection seller to compensate them in the event of a default. If the seller is unable to fulfill this obligation, the buyer may not receive the payout. This introduces a new layer of risk into the equation, especially in volatile market conditions where financial institutions

NPS Vatsalya vs Long-term Equity Funds vs Children MFs – Which Offers Maximum Returns? | Biz Blogs News

NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? Financial planning for the future, especially for your children’s well-being, involves making key decisions about where to invest. As a parent or guardian, you may be considering three major options: NPS Vatsalya, Long-term Equity Funds, and Children’s Mutual Funds (MFs). Each of these options offers unique benefits, but the ultimate question is: where will you get the maximum returns? In this comparison, we’ll dive into each of these investment vehicles, their benefits, risks, and overall potential for growth. By the end of this blog, you should have a clearer understanding of which option could be the most profitable for your financial goals. What is NPS Vatsalya? NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits. This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation. What is NPS Vatsalya? NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits. This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation. Key Features of NPS Vatsalya: Low Risk: Compared to equity-based investments, NPS Vatsalya is a low-risk option, since it largely focuses on debt instruments like government bonds. Tax Benefits: You can claim deductions of up to ₹1.5 lakh under Section 80C, along with an additional ₹50,000 under Section 80CCD(1B). Steady Returns: While the returns are stable, they tend to be lower compared to equity-based investments due to their conservative nature. However, NPS Vatsalya is not known for rapid growth. It’s an option more suited for conservative investors looking for steady income post-retirement, rather than parents aiming for high returns for their children’s future education or other financial needs. What Are Long-term Equity Funds? Long-term equity funds, often referred to as ELSS (Equity-Linked Savings Schemes), focus on investing in equity markets for wealth creation over an extended period. These funds come with a higher degree of risk due to the inherent volatility of stock markets but offer the potential for much higher returns. These funds are generally suitable for investors with a long-term horizon (5 years or more), allowing them to benefit from compounding returns and market growth. Key Features of Long-term Equity Funds: High Returns: Equity markets have historically provided returns in the range of 10%-15% over the long term, depending on market performance. Tax Benefits: Like NPS Vatsalya, investments in ELSS are eligible for tax deductions of up to ₹1.5 lakh under Section 80C. Liquidity: ELSS has a lock-in period of three years, which is the shortest among tax-saving investment options. After this period, you can withdraw or continue holding the investment, depending on market conditions. For parents or guardians with a higher risk appetite and longer investment horizon, long-term equity funds can offer substantial returns, especially for long-term goals like higher education or weddings. However, the volatility of equity markets means there’s no guaranteed return, and the capital can fluctuate over time. Understanding Children’s Mutual Funds (MFs) Children’s Mutual Funds are specifically designed to help parents build a corpus for their child’s future, focusing on long-term goals like education, marriage, or other significant expenses. These funds are typically hybrid in nature, blending equity and debt instruments to balance both risk and growth potential. While equity-driven children’s MFs have higher risk, the inclusion of debt components tempers this risk, making them a balanced choice for many investors. Key Features of Children’s MFs: Balanced Risk: These funds usually have a mix of equity and debt, providing a blend of high-return potential with some stability. Lock-in Period: Similar to ELSS, children’s MFs often come with a lock-in period, ensuring that funds are preserved for the intended purpose. Goal-based Investment: These funds are structured around specific future goals for your child, such as education, helping you stay focused on long-term planning. Children’s MFs are an excellent option for parents seeking a middle ground between safety and return potential. They are more flexible than NPS Vatsalya but less risky than pure equity funds, providing a solid option for moderate risk-takers. Conclusion: Where Will You Get Maximum Returns? Choosing between NPS Vatsalya, Long-term Equity Funds, and Children’s MFs depends on your financial goals, risk tolerance, and investment horizon. NPS Vatsalya is ideal for conservative investors focused on long-term stability and retirement planning. Its returns are steady but not suited for those looking to grow wealth rapidly for their children’s future. Long-term Equity Funds are best for those with a high-risk tolerance and a long investment horizon. They offer the highest potential returns but come with market risks. Children’s MFs provide a balanced approach, offering both safety and growth potential, making them a good option for parents who want moderate returns without extreme volatility. Ultimately, if your goal is maximum returns, long-term equity funds will likely outperform the other two options. However, if you prioritize safety and a guaranteed corpus, then NPS Vatsalya or Children’s MFs may be more suitable. Diversifying your investments across these segments could also offer a good balance between growth and security. Education NPS Vatsalya vs Long-term Equity

Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News

Truecaller Fraud Insurance Policy: What should you know about this new safety measure? In an age where online fraud and phone scams are increasing exponentially, Truecaller has stepped up its efforts to protect users with an innovative safety net: the Truecaller Fraud Insurance Policy. As people rely more on mobile communication, fraudsters have become adept at deceiving individuals through fake calls and messages. But this new insurance policy promises to be a significant layer of defense, helping users reclaim their financial security if they fall victim to fraud. What is Truecaller Fraud Insurance? Truecaller is widely known as an app that helps identify unknown numbers, block spam calls, and improve communication safety. However, its latest offering, Truecaller Fraud Insurance, adds an extra layer of security for users. Partnering with reputable insurance companies, Truecaller now provides a safeguard that covers financial losses resulting from fraudulent activities, such as phishing or scam calls. This insurance is designed to help individuals recover from potential monetary losses that occur due to deception from fraudsters. By offering this service, Truecaller aims to provide users with peace of mind, knowing that they have a safety net in place if they ever become victims of such schemes. How Does the Fraud Insurance Policy Work? The Truecaller Fraud Insurance Policy is straightforward. When a user falls prey to a scam that results in a financial loss, they can file a claim with Truecaller’s insurance partners. After submitting relevant evidence, including the nature of the fraud and the financial impact, the user may receive compensation as per the terms of the insurance plan. To be eligible, users must first ensure they have opted into the insurance program through the Truecaller app. There may be different tiers or levels of coverage, depending on the user’s country of residence, as the policy is not yet available globally. Once a fraudulent event occurs, the victim can file a report with Truecaller’s support team, who will guide them through the process of claim submission. The protection extends to a variety of scams, including: Phishing scams: where fraudsters pose as legitimate companies or banks to steal sensitive information. Vishing (Voice phishing): where criminals use phone calls to trick users into revealing financial or personal details. SMiShing (SMS phishing): a deceptive practice using text messages to lure users into providing confidential data or making fraudulent payments. Who Should Consider Opting for Truecaller Fraud Insurance? Anyone who uses a smartphone and is concerned about the rise in online fraud should consider opting for this policy. Mobile scams have become more sophisticated, and even vigilant users can fall prey to well-executed schemes. This is especially true for individuals who frequently use online banking or make transactions via mobile platforms. The fraud insurance policy can be an effective back-up in case something goes wrong. Additionally, businesses that handle sensitive customer information and communication via phone calls may also benefit from enrolling in Truecaller Fraud Insurance for added protection. Key Features of the Truecaller Fraud Insurance Policy Truecaller’s fraud insurance offers several important features that make it a viable option for those looking to secure their digital interactions: Wide coverage: The policy covers a range of fraud types, from vishing and phishing to deceptive SMS frauds. Efficient claims process: Truecaller promises a smooth and timely process for claim submissions. Users can track their claim progress through the app, ensuring transparency. Affordable premiums: Early indications suggest that the premiums will be reasonably priced, making it accessible to the average user. Trusted partners: Truecaller has collaborated with leading insurance firms to ensure that users get reliable and swift support when dealing with fraud. Multi-tiered plans: Users may have the option to select from different coverage levels, tailoring the policy to their needs and usage habits. Is Truecaller Fraud Insurance the Answer to the Rising Threat of Phone Scams? While no system is foolproof, Truecaller’s Fraud Insurance Policy certainly marks a significant step in the fight against phone-based fraud. The increasing sophistication of scams—often involving impersonations, fake government or banking alerts, and urgent payment requests—makes it difficult to rely on just caller identification apps or personal vigilance. Having an insurance policy that specifically covers financial fraud provides an added layer of security that could prove invaluable. Given that mobile scams are projected to increase in the coming years, the availability of such a service could act as a critical deterrent. By offering users financial coverage, Truecaller is not only enhancing its brand as a protector of safe communication but also addressing a real and growing concern for digital users. How to Activate Truecaller Fraud Insurance? Activating the Truecaller Fraud Insurance Policy is a straightforward process. First, users need to ensure that they are using the latest version of the Truecaller app. Once logged in, they can navigate to the “Safety & Protection” section within the app’s settings. From there, users will find an option to activate the fraud insurance. This feature might initially be available in select countries, so users should check for its availability based on their region. After signing up, users will be required to choose a plan that suits their needs and confirm their subscription. Depending on the chosen policy, Truecaller’s insurance partners will provide the necessary coverage. The Growing Need for Fraud Protection in the Digital Age We live in an era where digital communication is vital. Whether for work, social interaction, or financial transactions, the reliance on mobile phones has reached unprecedented levels. Unfortunately, this heavy dependence has also made individuals more vulnerable to fraudsters who exploit weaknesses in communication systems. Scammers have grown bolder and more creative, using technologies like spoofing and social engineering tactics to mislead even the most careful users. Often, a single deceptive phone call or SMS can result in significant financial damage. Truecaller’s fraud insurance aims to mitigate this risk by ensuring that users are not left financially devastated after falling victim to such malicious acts. Education Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News September 20, 2024/No

How to Pay Credit Card Bills Like a Pro – Biz Blogs News

How to Pay Credit Card Bills? Navigate Online and Offline Options Like a Pro Managing credit card bills can sometimes feel overwhelming, but with the right approach, it becomes a smooth process. Whether you’re new to credit cards or simply looking for easier ways to manage your payments, knowing your options will help you stay on top of your finances. In this guide, we’ll walk you through the most effective ways to pay credit card bills, both online and offline. With these methods, you’ll be able to navigate the payment process like a seasoned pro. Paying off your credit card bill on time is crucial to maintaining a healthy financial profile. Late payments can lead to penalties, higher interest rates, and a negative impact on your credit score. But don’t worry! Whether you prefer paying your bills digitally or in person, there’s a solution that fits your lifestyle. Online Payment Options In today’s fast-paced digital world, online payments offer convenience, speed, and security. Let’s dive into some of the most popular ways to pay your credit card bills online. Internet Banking One of the most straightforward ways to pay credit card bills is through internet banking. This method allows you to transfer money directly from your bank account to your credit card. Most banks provide a user-friendly online interface, where you can select the credit card payment option and complete your transaction within minutes. All you need is your bank’s online banking credentials and the credit card details. It’s easy, fast, and safe. Once logged in, simply navigate to the “Pay Bills” or “Credit Card Payment” section, and follow the prompts. You can either pay the minimum amount due, the total outstanding, or a custom amount. Some banks even allow you to schedule payments, ensuring you never miss a due date. Mobile Banking Apps With mobile banking apps, paying your credit card bills becomes even more convenient. Simply download your bank’s app from the App Store or Google Play, and follow the same steps as internet banking. Many mobile apps offer additional features like push notifications, payment reminders, and one-click payment options. Plus, mobile banking apps are designed with strong security features like fingerprint or face recognition, ensuring your transactions are safe. If you’re someone who’s constantly on the go, this method is ideal. You can clear your credit card bill while waiting in line for coffee or during your daily commute. Credit Card Issuer’s Website Another easy option is to visit your credit card issuer’s website. Most card issuers provide a dedicated online portal where customers can manage their accounts. Here, you can check your balance, view your transaction history, and pay your bill directly. Paying through the issuer’s website is a reliable option, and you can often choose to save your bank account details for future payments, speeding up the process for the next billing cycle. Make sure to enable two-factor authentication on your account for extra security, and avoid using public Wi-Fi when making payments to protect your financial information. Autopay Services If you’re worried about missing payment due dates, autopay is a fantastic option. Most credit card companies offer an autopay feature, which automatically deducts the bill amount from your linked bank account on a specific date every month. You can choose to pay the minimum due, the total outstanding balance, or any other fixed amount. This method ensures you never miss a payment and helps you avoid late fees and interest charges. However, always ensure that there are sufficient funds in your bank account to prevent failed transactions and overdraft fees. Third-Party Payment Apps In recent years, third-party payment apps like PayPal, Google Pay, and Apple Pay have become increasingly popular for paying credit card bills. Many credit card issuers now support payments via these apps, providing users with another layer of convenience. These apps are particularly useful for those who prefer keeping their financial activities consolidated in one place. Additionally, they often come with built-in features that track your spending, which can help you manage your budget more effectively. Offline Payment Methods Not everyone is comfortable with online payments, and that’s completely fine! There are several reliable offline methods available for paying your credit card bills. Bank Branch One traditional way to pay your credit card bill is by visiting your bank’s branch. This method allows you to make a payment in person, either by filling out a payment slip or asking a bank representative for assistance. If you have the time and prefer a face-to-face transaction, this is a safe and secure option. When visiting the branch, make sure to carry your credit card, account information, and an ID for verification. Once the payment is made, you’ll typically receive a receipt, which you can keep for your records. ATM Payments Did you know that you can also pay your credit card bill at an ATM? Many banks offer the option to make credit card payments through their ATM machines. All you need to do is insert your debit card, choose the “Credit Card Payment” option, and follow the instructions on the screen. This is a great alternative for those who prefer not to visit a bank branch but still want to make payments offline. It’s quick and convenient, especially if you’re already at the ATM to withdraw cash. Cheque or Demand Draft If you’re not a fan of digital payments, paying by cheque is another method you can consider. Simply write a cheque payable to your credit card issuer, ensuring that you include your credit card number in the memo section. Then, either drop it off at the bank or send it via post to your card issuer’s mailing address. This method does take a few days to process, so be sure to send your cheque well before the due date to avoid any late fees. Phone Banking For those who want the convenience of paying bills without using the internet, phone banking is a solid option. You can call your bank’s

HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News

HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made its place in almost every industry. Its use has become even more important in the marketing field, as it helps companies to better understand, analyze, and personally connect with customer behavior. What is HubSpot and its contribution to marketing HubSpot is a leading customer relationship management (CRM) platform that offers a variety of tools specifically for inbound marketing, sales, and customer service. It helps businesses to better connect with their customers and understand their needs. Features of HubSpot’s AI-Powered Tools HubSpot’s AI-powered tools not only automate the marketing process, but also help analyze data, create customized content, and create better marketing strategies. Let’s take a look at some of the key features of these tools. Smart Content Personalization : The biggest benefit of AI is that it helps in understanding customer behavior and their preferences. HubSpot’s AI-powered tools show customers the content that’s most relevant to them through smart content personalization. This not only improves the user experience Data Analytics and Forecasting Capabilities : HubSpot’s AI tools help you analyze data and make predictions. For example, what type of content is working best for your audience, which marketing strategy is generating more leads Workflow Automation : Marketing automation just got easier. AI-powered workflows not only save time, but also allow you to communicate with your customers more accurately and timely. These tools also make tasks like email marketing, social media management, and lead nurturing easier. HubSpot and the future of marketing with AI This move by HubSpot shows how AI is completely changing the direction of marketing. In the times to come, AI will become even more advanced and make marketing campaigns more effective and accurate than ever before. If you want to learn more about HubSpot’s AI-powered tools, you can check out the articles in Search Engine Journal . Marketing HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Fundamental of Digital Marketing | BizBlogs News September 12, 2024/No Comments Fundamentals of Digital Marketing : Your Complete Guide Digital marketing is now the foundation of business in the present day.… Read More Load More End of Content. UseFull Links Home About Stories Contact Marketing HubSpot’s AI-Powered Marketing Tools Revolutionize Marketing – BizBlogs News September 19, 2024/No Comments HubSpot’s AI-Powered Marketing Tools: The Direction of the Future of Marketing In today’s digital age, AI (Artificial Intelligence) has made… Read More SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Fundamental of Digital Marketing | BizBlogs News September 12, 2024/No Comments Fundamentals of Digital Marketing : Your Complete Guide Digital marketing is now the foundation of business in the present day.… Read More Load More End of Content.

SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News

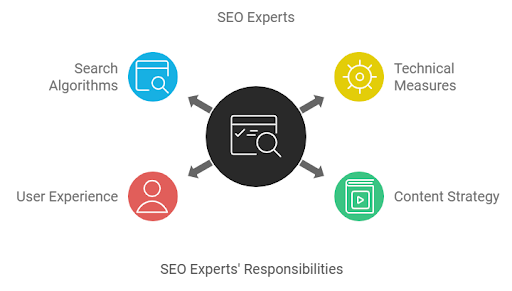

SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become a major part of the success of every business. The job of SEO experts is not only to increase the ranking of the website but also to improve the experience of the users and present the right information at the right time. In this context, recently many SEO experts gathered and openly discussed various aspects of search. This podcast highlighted several important points about the present and future of SEO. Let us know the main points of this honest discussion. Who are SEO experts? SEO experts are professionals who use technical, content, and strategic measures to get websites to the top of search engines . Their work is not limited to just keyword research or link building ; They understand the overall structure of the website, the user experience, and the algorithms of search engines like Google . Purpose of Podcast The main objective of this podcast was to provide a platform for SEO experts to share their personal strategies, challenges, and experiences . This discussion not only highlights current trends in the SEO industry, but also how experts keep pace with changing algorithms and user behavior . Changing landscape of search engine algorithms Google and other search engines constantly update their algorithms. This is a big challenge as it is becoming difficult to optimize the website and maintain rank according to these algorithms. Experts discussed how these updates give priority to content quality, mobile-friendly websites, and user experience. Outlook on the future of SEO Who will decide the future of SEO? Experts believe that Artificial Intelligence (AI) and Machine Learning will have a big impact on SEO in the coming times. He said that search engines are becoming smarter and no longer focus only on keywords . User intentions and experiences are also being given importance . SEO experts’ advice : the need for consistency and innovation Maintaining consistency in SEO can be difficult, but it is the key to success . Experts suggested that SEO requires using the latest techniques and tools, keeping track of regular updates, and understanding user needs . Mobile-First Indexing: The New Era of SEO Mobile-first indexing means that Google now gives priority to the mobile version of the website. Experts pointed out that this is a big change in the world of SEO, because optimizing only the desktop website is no longer enough . A large proportion of users now use mobile . Changing approach to keyword research Earlier, more attention was given to keywords, but now the quality of content and user intent have become more important. Experts believe that keywords are still important, but now we need to pay attention to what type of information users are looking for. User Experience (UX) and SEO User experience has now become an important part of SEO. Experts discussed that if your website is useful and easy for the user, Google will rank it higher. Website speed, navigation, and content presentation now play an important role in SEO. Importance of Backlinks Although a lot has changed in SEO, backlinks are still important. Experts point out that high quality backlinks can improve a website’s ranking. But it is important to pay attention to the quality and source of backlinks. Local SEO: A Boon for Local Businesses Local SEO is important for businesses that target the local market. Experts said that businesses can improve their local ranking by properly using tools like Google My Business. Marketing SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Fundamental of Digital Marketing | BizBlogs News September 12, 2024/No Comments Fundamentals of Digital Marketing : Your Complete Guide Digital marketing is now the foundation of business in the present day.… Read More AI in Digital Marketing: Transforming Strategies – BizBlog News September 10, 2024/No Comments AI Marketing : The Future of Digital Marketing In the rapidly changing digital world, AI Marketing is emerging as a… Read More Load More End of Content. UseFull Links Home About Stories Contact Marketing SEO Expert Meeting: Candid Search Conversations [Podcast] – Bizblogs News September 16, 2024/No Comments SEO Expert Meeting: Honest Conversations on Search [Podcast] Introduction In today’s digital age, SEO i.e. Search Engine Optimization has become… Read More Fundamental of Digital Marketing | BizBlogs News September 12, 2024/No Comments Fundamentals of Digital Marketing : Your Complete Guide Digital marketing is now the foundation of business in the present day.… Read More AI in Digital Marketing: Transforming Strategies – BizBlog News September 10, 2024/No Comments AI Marketing : The Future of Digital Marketing In the rapidly changing digital world, AI Marketing is emerging as a… Read More Load More End of Content.