Walmart’s DEI Strategy | BizBlog News Analysis of Walmart’s Recent DEI Shift and LGBTQ+ Merchandise Policies In the dynamic corporate environment, the approach of Walmart towards its DEI initiatives and policies related to LGBTQ+ merchandise appears rather thoughtless on public radar. It serves as a balancing act not to become embroiled in politics and social controversy, thereby ensuring the continued sustenance of their enormous customer base. Here’s an in-depth look at the case, the decisions made, and the broader implications. Walmart’s DEI and LGBTQ+ Merchandise Stand Walmart has been criticized for perceived cuts in its DEI efforts and changes to the availability of its LGBTQ+ merchandise. Although Walmart rolled out its “Pride Always” collection, selling wares from LGBTQIA+ designers and gay-owned brands, the company seems to be choosy with the products it allows to show in the stores, instead making them available online. This makes Walmart join many other retailers in their cautious stance on the more contentious social debate. As the CEO Doug McMillon believes, Walmart is not interested in “waking up in the morning wanting to make social or political statements” but wants to ensure that its stores and facilities are inclusive to the customers and employees without offending particular groups. Comparison with Strategy of Competitors The latest woe to Target differs vastly from that of Walmart. Target pulled back some of its Pride merchandise following customer outcry and safety concerns. This move underlined the tightrope that major corporations must traverse between revealing their inclusivity and pleasing public opinion. Such a move by Target led to a drastic reduction in market valuation, in turn signalling potential dangers ahead. On the other hand, Walmart adopted the middle-of-the road approach; so far, it has kept away such harsh public condemnation and financial losses. For the above reasons, keeping its LGBT contents almost entirely online and not making any drastic change to the appearance of its stores helped Walmart reap no direct fallout-like what Target and Anheuser-Busch reeled from. Public and Political Backlash In reaction to public outcry by both consumer and advocacy groups, Walmart’s decisions had been polarized. Gay supporters argued that public visibility, in this case, an ordeal for everyone, will make the resistance stronger or give a new lease on life to those who oppose diversity efforts. Right-wing voices say this is long overdue: that is, away from what they seem to view as “corporate wokeness.” This polarized opinion resonates with the highly charged and complicated socio-political landscape within which corporate decision-making occurs. Implication of DEI and Corporate Responsibility Walmart’s strategic decisions raise important questions about what the future holds for DEI in corporate America: Consumer Expectations vs. Business Pragmatism: Companies are squeezed between the desire to support social causes and a broad, simple appeal to customers. Walmart’s cautious response seems to suggest stability at all costs and that anything revolutionary in terms of DEI that might have inherent financial or reputational risks is not likely to be realized anytime soon. Digital First for Problematic Products: This is the policy whereby troublesome products are placed online, so they can reach their niches without being controversial to the mass public. Long-term Brand Equity: Caution will prevent short-term public outcry but will continually dilute the trust of forward-thinking consumers and advocacy groups. What’s Next for Walmart? As it strives to perfect its DEI policies, Walmart will set a benchmark for the other companies in its effort to address the issue of inclusion without alienation. Builds on such reputation, based on the capabilities of keeping transparency over its intent and the discussion of issues with the diverse consumer markets, would strengthen its reputation further. The Walmart Approach: Balancing Inclusivity with Neutrality Walmart’s approach toward DEI and their very recent strategies regarding LGBTQ+-related products have seen how complex it is and what kind of challenges companies face. In this polarized time, Walmart has walked on that thin line by avoiding strong political positioning and having strategies on an average but that would suit both the left and the right-sided customers. Understanding Walmart’s Stance Walmart launched its “Pride Always” product line full of products from LGBTQIA+-owned businesses, both online and in the bricks-and-mortar locations. However, by not somehow mounting the visibility dramatically, Walmart treats almost all Pride efforts from behind the scenes compared to the graphic campaign set forth by Target. What sets this move by Walmart apart is that it tells an overall story of reducing controversy but embracing inclusiveness still. How Walmart Is Different from Target The differences in what Walmart and Target have done-or, rather, not done-show a lot of what, exactly, each is most focused on: Consumer Demographics: Target’s much bolder Pride merchandise strategy stirred such vociferous outrage, especially in America’s reddest areas. Walmart, with an exponentially larger and much more racially disparate customer demographic, has thus far successfully been able to avoid direct confrontation by keeping its own LGBTQ+ merchandise much more subtle. Marketing Strategy: While Target is boycotted and wrapped in controversy over certain Pride products advertised for children, Walmart has instead decided to leave its selections broad rather than pointed as not to raise any heated debate over social messaging. Implications of DEI Adjustments Walmart’s decisions reflect a new way of engagement on the side of corporations regarding inclusion: Risk Aversion Walmart doesn’t want to forfeit its traditional customers by having little existence of LGBTQ+ products within their physical in-store presence although it supports these causes through more subtle means. Online sells even the more incendiary merchandise, avoiding public view that may offend some consumers. As a result, it’s become a popular way to balance all three: inclusivity, operational security, and customer delight. Public Reactions and Critiques Public reactions to Walmart’s actions vary: LGBTQ+ Advocacy Groups: Express disgust at what they view as stepping back from public demonstrations of support; instead, Walmart is proceeding as if appeasement is more important than allyship. Conservative Voices: A thinking-critical-theory approach to DEI corporate efforts has praised Walmart’s choice not to participate in campus activism as the way to

Kenneth Leech Fraud WAMCO Investigation | BizBlog News

Kenneth Leech Fraud WAMCO Investigation | BizBlog News Investigate if Kenneth Leech was commiting fraud against WAMCO Kenneth Leech, former ex-CIO at WAMCO, Western Asset Management Company recently emerged as a high-profiled individual implicated in one of the significant financial scandals. The U.S. Securities and Exchange Commission, SEC, together with the Department of Justice, DOJ, also established that he was required to surrender over $600 million siphoned out from the largest Ponzi scheme over nearly eight years. This piece goes into the details of the case that has sent shockwaves down the financial industry, the lessons to investors and what it would mean for them going forward. The Allegations: A Closer Look at the Fraud The SEC charged Lee that during 2021 and 2023 he ran a “cherry-picking” scheme. A “cherry-picking” scheme was delayed trade allocations, waiting for market movements, then cherry picking profitable trades into the favored accounts and losses into other accounts. The SEC said the scheme had primarily affected the management of WAMCO’s Macro Opportunities fund versus its Core strategies. It is alleged that this manipulation brought in $600 million in gains for the favored clients, weighed against equal losses to others. These are tantamount to gross violation of trust since investment advisers are supposed to act for their clients’ best interests. The DOJ has charged Leech with counts of securities fraud and investment adviser fraud among other related offenses. If found guilty, Leech will face such a grim punishment-a lifetime ban from the industry and time to serve in the penitentiary. Internal Probe and Other Aftermath Irregularities in WAMCO, a subsidiary of Franklin Templeton which manages over $380 billion of assets, called for an in-depth internal investigation. The inquiry scrutinized more than 17,000 trades that were made during the suspected period. While there is no direct evidence that has surfaced yet to indicate personal financial gains by Leech, the entire action taken by him has planted fertile ground for the loss of trust amongst the investors. This has already caused significant withdrawals by investors. Secondly, billions of dollars have been withdrawn from WAMCO’s funds, leading to an investigation into its compliance processes. Franklin Templeton and WAMCO have vowed to strengthen oversight processes to regain investor trust. Defense and Counter Arguments His lawyers have strongly defended his allegations by pointing out that Leece has nearly 50 years of spotless experience in the financial sector. His lawyers argued that since different fixed-income strategies have performed differently, the charges by the SEC against him prove baseless. The lawyers asserted that they will defend him against such charges in court. The Bigger Picture in the Financial Sector This case goes identical to the vulnerability of the asset management industry. Indeed, these investment houses have robust compliance systems in place; however there is a scale to the alleged fraud that opens up holes even for high-profile organizations to exploit. The regulatory bodies will react with strong oversight and enforcement to this case which shall raise the operational cost for the firms. This event is a rude awakening for investors, calling them to grill the methods and transparency of fund management. Observing performance inconsistencies and knowledge about the allocation procedure may reduce exposure to certain risks. Highlights for Stakeholders: More Scrutiny: Investors should make fund managers more accountable and transparent. Tighter Regulations: It may push the regulatory authorities to strengthen regulations concerning trade allocations and disclosure. Regaining Trust: Financial institutions will have to fill the compliance gaps that are damaging investor confidence proactively. This case is very important to WAMCO and the entire asset management industry, whether guilty or not, for it will be reflected in its judgment and evolution on the policy of the regulatory; hence, it will change their practices across the sector. The lessons from this incident are already in evidence: integrity and compliance are non-negotiable pillars of trust in financial markets. Sources: SEC and DOJ announcements about the case. WAMCO’s in-house investigation and industry analysis Investigating the Kenneth Leech Fraud Case The financial world is talking about the case of Kenneth Leech, a former co-CIO at WAMCO, who is accused of operating a multi-million fraud scam. Here is an investigation into the case and its implications for the actors. How Cherry-Picking Works At the heart of the charges lies “cherry-picking,” by which performance of certain trades that he has observed has been unfairly allocated to him. The allegations claim that, between 2021 and 2023, Leech allegedly withheld assignment of Treasury futures and options trades. This only served him well in making sure that some winning trades were approved for “preferred” clients like institutional investors while losses were absorbed by the other portfolios, which pension and savings funds were part of. And this is what is surfacing-This net gain to the “favored” customers: $600 million. Equivalent losses for less favored clients. This does not conform to fiduciary duties as clients expected the funds be managed equitably. It is also against policies as upheld by regulations looking to improve fairness in executions and allotments. Effect on WAMCO’s Image The worst casualty of that reputation loss has been WAMCO, one of the largest fixed income asset managers in this world and owned by Franklin Templeton. WAMCO managed over $380 billion before all these allegations surfaced. That money now threatens to be withdrawn in huge amounts, threatening the stability of its future. So, do internal controls work? How wasn’t this detected sooner? WAMCO had robust policies; more than 17,000 trades passed without a catch. What’s the future? WAMCO has launched an in-house review and promised to be more vigilant but restores investor confidence, it will take some time. Industrywide Takeaways Part I: Transparency Pays Investors and asset managers have to get transparent. Allocations practices need to be easily documented and auditable. Institutions should also enable their compliance teams to question and audit every decision made by the CIO-level. Regulatory Crackdown to Come: Following this scandal, regulatory bodies like the SEC might raise their standard bar for trade allocations. Companies would need

Starbucks’ Solution to Long Lines at Airport Cafes | BizBlog News

Starbucks’ Solution to Long Lines at Airport Cafes | BizBlog News Can Starbucks Solve the Problem of Long Lines at Its Airport Cafes? Any traveler knows, by now, that Starbucks is the go-to destination for comfort, caffeine, and familiarity in noisy airport terminals around the world. Yet, one problem persists at its airport stores: long lines. For many jet-setting customers, the excitement of grabbing a favorite latte can rapidly be offset by the tension of watching the clock tick away before a flight. However, can Starbucks solve this problem so that service will be offered uniformly without compromising the quality? Let’s dive into the challenge and then some solutions . The Challenge of High Traffic in Airports The atmosphere at airports is particularly stressful, because time is always of the essence in an airport. Uniquely compared to other Starbucks stores, this means that airport cafes are servicing an unusual amount of people within short windows of time. This high demand often occurs during morning rushes, flight delays, and tight layovers. As such, a brand like Starbucks, proud of its made-to-order drinks experience, tends to peak to frustrating levels . Besides volume, the complexity of the orders makes things even more difficult. Many passengers customize their drinks, and the time to create complex drinks can really choke up the entire line. Pair this with the limited space for larger cafes or additional staff at most locations, and things become even more daunting . Technology as a Game Changer Another potential solution lies in leveraging technology to streamline the ordering process . Mobile ordering, which has been a big success at traditional Starbucks stores , can be scaled up and optimized for the airports. It can enable customers to place their orders through the Starbucks app even before they arrive at the cafe , thus drastically cutting wait times . They will be labelled and placed on a designated pickup shelf, so customers will not have to wait in line for drinks they ordered beforehand . Another promising approach is the incorporation of self-service kiosks. Such digital terminals are already used by some quick-service restaurants, where customers place orders and customize them without really interacting with the baristas themselves. This reduces wait times and frees staff to focus on preparing drinks as efficiently as possible . Reimagining the Layout of Airport Cafes Another factor in customer experience relates to the physical design of Starbucks cafes in airports: there is often a lack of adequate space for the enormous foot traffic and quite heavy flow behind the counter in many of the current layouts. Redesigning these spaces to include separate zones for ordering , payment , and pickup would help to create a smoother process that reduces congestion. There might also be a secondary queue for customers who are interested in only quick grab-and-go items, such as prepackaged snacks or bottled drinks , to reduce pressure on the main line. This way , those with less complicated needs do not get entangled with the lengthy wait time for handcrafted beverages . Enhancing Staff Efficiency Behind each efficient Starbucks is a team of highly trained baristas, and airport locations are no exception. “Staf need to be thoughtfully prepared for the airport,” Abramowitz says. Cross-training employees to handle multiple roles—such as taking orders, making drinks, and managing inventory—can help improve efficiency during peak hours. Implementing dynamic staffing models would also be of importance. It could analyze historical data on patterns of airport traffic to offer Starbucks staff optimal scheduling to keep more baristas on at the busier times . Partnering with Airports for Seamless Service Collaborating with airport authorities might be the way to some innovative solutions. For example, Starbucks might collaborate with airports to introduce express lanes or featured pickup zones at terminals. Some airports nowadays already offer centralized apps for ordering food from all restaurants in the airport, allowing passengers to order from their favorite restaurants and collect at a convenient point in the airport. Starbucks might tap into these systems and expand its offerings. Starbuck may also use strategically located satellite kiosks or carts to reach different passengers in a terminal. Small outlets could cater to simple menu items to make the main cafe less crowded . Looking Ahead The challenge of long lines at Starbucks airport cafes is not a small one, but certainly it is far from insurmountable. This is where embracing technology, rethinking cafe design, and optimizing staff efficiency will enable Starbucks to transform its airport locations into fast, reliable, and satisfying service models . For the tourists, grabbing a Starbucks coffee during a busy trip is more than just a caffeine shot; it’s a moment of comfort and familiarity . Solving the problem of long lines would not only improve the customer experience but also reaffirm Starbucks ‘ position in leadership in the global coffee industry . With innovation, collaboration, and a commitment to excellence , undoubtedly Starbucks can rise to the challenge . UseFull Links Marketing Adani Group Fraud and Bribery Charges | Latest BizBlog News November 22, 2024/No Comments Adani Group Fraud and Bribery Charges | Latest BizBlog News Adani Group Slams ‘Baseless’ New York Fraud and Bribery Charges… Read More Alphabet VC Arm Backs Odoo | BizBlog News November 21, 2024/No Comments Alphabet VC Arm Backs Odoo | BizBlog News Alphabet’s VC Arm Backs Little-Known SAP Rival Odoo, Boosting Valuation to $5.3… Read More Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News November 20, 2024/No Comments Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News Doubts Mount Over Britain’s Ambitious Growth Plans —… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News November 23, 2024/No Comments Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News Battery Giant Northvolt Files for Bankruptcy: A Major Setback… Read More European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments

COP29 Climate Finance Agreement | Bizblog News

COP29 Climate Finance Agreement | Bizblog News COP29 Secures a Groundbreaking $300 Billion Climate Finance Agreement The attention of the world was once again directed toward COP29, where global leaders came together to address one of the most daunting challenges humanity faces today : climate change . This year marked history as the conference concluded its resolution with a $300 billion climate finance agreement . It marks not only the urgency of combating the climate crisis but also affirms collective responsibility of nations in funding sustainable solutions for a greener future . A Turning Point for Climate Action The $300 billion agreement is a testimonial to the rising awareness and commitment from nations to mitigate the effects of climate change. In fact, this was one real intense negotiation that stretched over several days of talking, debating, and compromising . Leaders of developed and developing nations came together to focus funding on green infrastructure, renewable energy, and climate-resilience projects . Unlike in previous years, COP29’s finance package is considered more inclusive and impactful, ensuring that vulnerable nations receive resources to adapt to climate challenges . This signalizes a shift in global priorities , where addressing climate equity is finally at the heart of center discourse . What Does the $300 Billion Fund Aim to Achieve? The money raised for the COP29 is to be used on a plethora of climate-focused initiatives, including most of the transition to renewable sources of energy, like wind, solar, and geothermal power. Moreover, this deal earmarks resources for reparation work in degraded ecosystems, speeding up plans for reforestation and biodiversity protection . For countries that are the worst victims of climate disasters-including sea rising, flooding, and droughts, among others-the deal supports most of the much-needed funding to adapt measures. This includes building resilient infrastructure, enhancing disaster response systems, and developing climate-smart agriculture . Moreover, the transaction highlights public funding in bringing about private investment. The governments and financial institutions would collaborate to multiply the impact of this public funding by leveraging it to attract other capital from the private sectors . The Role of Developing Nations One of the most impressive features of this deal is its focus on climate justice. Much funding will be allocated for the developing world as they have been particularly hit by climate impacts despite their least contribution to the global emissions . The Global South for decades has sought a more fair share of the climate finance. Their voice resounded louder than ever at COP29: $300 billion will ensure countries in Africa, Asia, and Latin America have the technology, infrastructure, and expertise to confront climate challenges effectively . This is very different from what happened at conferences in the past, promising financial assistance without being able to deliver. COP29’s agreement brings with it binding commitments and clearly set timelines, holding perpetrators accountable over something that has been quite lacking in past pacts . How COP29 Differed from Past Climate Summits COP 29 differs from all previous such gatherings in at least a couple of respects. It is unprecedented in scale: never before has so much money been pledged specifically for climate finance. The negotiations also assumed a far higher level of cooperation among nations, which seemed to indicate a sense of responsibility that is shared worldwide in the fight against climate change . Moreover, the participation of indigenous communities and grass-roots organizations in discussions imbued negotiations with a new dimension of perspective. Such groups are generally ignored in international conferences yet contribute much to sustainable practices and local resilience strategies . Challenges Ahead While the $300 billion agreement is undoubtedly a breakthrough, there is much work ahead. The real test lies in the implementation of funds. Transparency, prevention of corruption, and the monitoring of project effectiveness financed will be important factors. Some critics have even said that 300 billion dollars is still not even large enough to enable the handling of the very monumental scale of the climate crisis. According to the UN, by 2030, trillions of dollars will annually be needed to meet global climate goals. Nonetheless, the COP29 deal marks an important step forward and sets the stage for further commitments in the following years . A Collective Win for the Planet It is in this light that COP29 is a success-there was meaningful progress achieved through collaboration. The agreement is more than just financial ; it is a message of hope and determination . Pooled resources and prioritizing the health of the planet tell nations that fighting climate change is not a problem that is impossible to overcome . As the world sits watching the disbursement of this $300 billion fund, it is clear that unity is the bedrock of sustainable development in a global community. The message from COP29, then, is one of hope and vision to grow economically but not at the expense of environmental protection UseFull Links Knowledge Sharing Europe Stocks Rise Amid Weak PMI Data as Euro Slumps | BizBlog News November 23, 2024/No Comments Europe Stocks Rise Amid Weak PMI Data as Euro Slumps | BizBlog News Europe Stocks Higher as Investors Assess Weak… Read More Britain’s Mini-Budget Disaster | BizBlog News November 22, 2024/No Comments Britain’s Mini-Budget Disaster | BizBlog News Why Britain’s ‘Mini-Budget’ Disaster Should Alarm U.S. Economists Britain’s fateful “mini-budget” has sent shock… Read More European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News November 19, 2024/No Comments European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News European Markets Fall as Investors Look to Regional… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News November 23, 2024/No Comments Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News Battery Giant Northvolt Files for Bankruptcy: A Major Setback… Read More European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines

Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News

Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News Battery Giant Northvolt Files for Bankruptcy: A Major Setback for Europe’s EV Ambitions A recent announcement that Northvolt-the most dominant battery-maker in Europe-has filed for bankruptcy has sent shock waves across the continent. Meanwhile, the ongoing electric vehicle (EV) revolution is fastening its pace across the world, which raises pressing questions about whether Europe is adequately prepared to compete in that global EV market. This landmark move can be seen as a significant moment threatening not only the region’s ambitions in the EV market but also its energy independence and supply chain stability . Understanding Northvolt’s Role in Europe’s EV Push Northvolt has long been considered a cornerstone in the building of Europe’s sustainable battery ecosystem. It was founded in 2016, and subsequently began appearing more widely as Sweden’s first large-scale manufacturer of lithium-ion batteries on its way to becoming a vital player in reducing Europe’s reliance on Asian battery suppliers. It has a mission to deliver high-performance lithium-ion batteries by way of clean energy, attracting investments from major players like BMW and Volkswagen and getting government subsidy to have broader footing in pursuit of Europe’s green energy transition. Innovative Gigafactory projects promised to transform the region into a powerhouse for battery production . The bankruptcy of Northvolt casts significant doubts over such goals. It, in fact, unveils deeper challenges in the European EV landscape- rising production costs, supply chain vulnerability, and increasing competition from the established global players . Why Northvolt’s Bankruptcy Matters to Europe’s EV Ambitions Europe is staking so much of its future on winning the global transition to electric. Automakers and governments have pledged billions of euros toward the cause of electrification, with strict emission regulations forcing an abrupt shift away from fossil fuels. Batteries lie at the heart of this revolution, which makes Northvolt’s bankruptcy such a devastating blow to the continent’s hopes . The loss of a significant domestic battery manufacturer would mean even more reliance on imports from China, South Korea, and Japan. Such a dependence could weaken the ability of the continent to become its own independent producer, with decarbonization, therefore, potentially being pushed into more distant timelines. In addition, Northvolt’s collapse may lessen the investment and funding for other clean energy startups . The Financial Pressures That Drove Northvolt to Bankruptcy The bankruptcy comes amidst a complex scenario of combined financial and operational challenges. Faced with skyrocketing raw material prices, supply chain disruptions, and its own ambitions and demonstrated track record of building high volumes of output, Northvolt struggled to scale its production to meet the enormous global demand for batteries in times when essential components such as lithium, cobalt, and nickel have become much more expensive . In addition, the Gigafactory projects in Northvolt required substantial up-front investments. As with all such facilities designed to produce batteries at scale, they are capital-intensive and may take years to pay off. Adding to the problems was a slowdown in European EV sales growth, partly reflecting both economic uncertainty and inflation with a commensurate diminution in consumer buying power. This environment made it increasingly difficult for Northvolt to continue to attract the additional funding needed to sustain operations . The Broader Implications for Europe’s Battery Sector Northvolt’s crash could have far-reaching effects on the European battery industry. Many of the new battery entrants used the success of Northvolt to attract investments and prove the region’s capability in competing globally. Its failure may cause investors to freeze over newfound risks of underwriting European battery ventures, a scenario that might stall innovation and capacity-building work . This, however, raises further concerns about broader industrial policies under the EU. The Green Deal of Europe was meant to make this region the global champion of clean energy solutions and clean technologies. Northvolt’s financial woes appear to reveal a lack of ambition in support measures, as these seem insufficient to protect companies against market fluctuations and international competition . Can Europe Recover from Northvolt’s Collapse? While Northvolt’s bankruptcy is undoubtedly a set-back, it is not the end of Europe’s EV aspirations. The region retains enormous manufacturing experience in the automotive sector as well as an integrated commitment towards renewable energy. Policymakers and industry leaders alike have to take action quite rapidly by sorting out those challenges exposed by the failure of Northvolt. That includes enhancing financial support for startups in battery sectors, making resiliency possible in supply chains, and bringing the private and public sectors closer together . Furthermore, Europe may have to reposition itself concerning global competition. While striving for self-sufficiency remains a laudable goal, greater cooperation with international partners can help better improve the risks involved with supply chain disruption and resource shortagesv. Lessons from Northvolt’s Journey Northvolt’s rise and fall teach a great deal of lessons to Europe’s clean energy transition. The company proved that the most advanced battery technologies are achievable in Europe, fueled by renewable energy sources, along with innovative designs. But bankruptcy is a stark reminder that ambition needs to find a balance with financial prudence. Companies in emerging industries now face complex dynamics-the race to high growth often means equally strong risks . For policymakers, the story of Northvolt shines a light on the need for holistic strategies that cover every segment of the battery value chain-from raw materials sourcing to recycling. Ensuring access to critical minerals, incentivizing their domestic production, and researching alternative chemistries of batteries are crucial steps to building a resilient and competitive battery industry . Rebuilding Confidence in Europe’s EV Future Despite the Northvolt bankruptcy, the ambitions of European EV ambitions are well on the agenda. Automakers, governments, and consumers alike recognize the grave urgency that extends the date to transition to sustainable transportation. By learning from Northvolt’s experience, doubling down on battery sector support, and insisting that anything can be done within the set arena, Europe will make its move toward climate goals . The future will demand synergies, bold investments, and a mindset

Europe Stocks Rise Amid Weak PMI Data as Euro Slumps | BizBlog News

Europe Stocks Rise Amid Weak PMI Data as Euro Slumps | BizBlog News Europe Stocks Higher as Investors Assess Weak PMI Data; Euro Slumps to Two-Year Low European stock market surprisingly increased today, despite the expectations and the digestion of weakness in PMI numbers reported a day ago. Amid mixed economic signals, the euro fell sharply and reached its low level in two years against the U.S. dollar. Amid all these, it has put a lot of emphasis to the concern over the region’s economic robustness while fueling speculations on further policy actions at the ECB . European Stocks Gain Despite Economic Headwinds Major STOXX 600 indices across Europe experienced broad gains as the close ended higher. These rises were brought about by strengthening in the financial and industrial sectors. This was despite flash PMI (Purchasing Managers’ Index) data showing manufacturing and services activity contraction to be deeper than expected . Factory output in countries like Germany and France, considered to be the region’s economic powerhouses, dropped significantly, signaling woes to post pandemic recovery momentum . Investors seemed to view the soft data as a potential impetus for the ECB to take a more accommodative approach . With inflation pressures easing, and given the likelihood of rate cuts or further stimulus measures to ease the struggling economy, European equities benefited from a “bad news is good news” dynamic, with market participants looking toward easier monetary policies to sustain growth . The Euro Hits a Two-Year Low The euro had a bashing, falling to a two-year low versus the U.S. dollar, as European stocks remained firm. The interest rate differential between the Federal Reserve and the ECB has widened even further recently, one reason behind this decline. As the Fed gives no indication of hesitation in further interest rate hikes, having been that U.S. data has been so robust, the greenback again outpaced its European counterpart . Weak PMI figures aggravated the worries over the eurozone’s prospects of growth further dented the confidence in the single currency. A weak euro, however good news for exporting nations, paints a rather bleak picture of the region’s capability of attracting foreign investment while stabilizing the economy with increasing global hurdles . Key Sectors Supporting Market Gains Leading the rally for European equities was cyclical-less sensitive sectors. Utilities, health care, and technology stocks all rose strongly, reflecting investors’ love for defensive plays amid uncertainty in the economy. Bank stocks too edged higher, supported by hopes that the ECB may maintain liquidity support to financial institutions as it battles against the slowdown. Energy stocks rose as oil prices steadied from recent declines, while retail-focused shares also gained ground as improving consumer sentiment in certain markets provided a counterbalance to the negative impacts that broader economic concerns indicated by the PMI data had at the sectoral level . Global Markets Respond to European Developments Europe’s mixed signals gave reverberations across global markets. Wall Street opened up cautiously into the plus column, even as investors were mindful of Europe’s direction on its economy. Asian markets, similarly, closed with modest gains, influenced by a European stock rally, but cautions with the weakening euro and its spillover impact on trade balances . Attention is now centered on central banks, with investors looking forward to upcoming ECB meetings to get rid of any ambiguity in future policy direction. Weak PMI data only adds to the delicate balance between fighting inflation and pushing the economy: a tightrope that may not be unique to Europe, but poses a particularly grievous test for the eurozone . Outlook for Europe’s Economic Recovery The latest PMI data has lent further ammunition to skepticism over the sustainability of the eurozone’s recovery, as it grapples with structural challenges and cyclical headwinds . Indeed, high energy costs, geopolitical uncertainties, and sluggish domestic demand continue to weigh so heavily on sentiment, while the resilience of the stock market does signal cautious optimism reflecting investor confidence that policymakers will intercede to stabilize the situation . The European Central Bank is at a crossroads. A mishap in monetary policy may exacerbate the loss of ground by the euro or undermine the feeble equity recovery in Europe. Alternatively, well-timed maneuvers such as cutting interest rates or expanding bond-buying programs could stabilize the economy and reboot growth . UseFull Links Knowledge Sharing Britain’s Mini-Budget Disaster | BizBlog News November 22, 2024/No Comments Britain’s Mini-Budget Disaster | BizBlog News Why Britain’s ‘Mini-Budget’ Disaster Should Alarm U.S. Economists Britain’s fateful “mini-budget” has sent shock… Read More European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News November 19, 2024/No Comments European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News European Markets Fall as Investors Look to Regional… Read More Postelection Stock Market Trends and Analysis | BizBlog News November 18, 2024/No Comments Postelection Stock Market Trends and Analysis | BizBlog News Postelection Stock Market Thrust Unable to Be Sustained as Rate and… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines for Third Consecutive Year — But the… Read More European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News November 19, 2024/No Comments European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News European Tech CEOs Urge a ‘Europe-First’ Mentality to Counter U.S. Dominance… Read More Homebuilder Deal Activity Insights | BizBlog News November 15, 2024/No Comments Homebuilder Deal Activity Insights | BizBlog News Homebuilder Deal Activity Is Surging, Fueled by Major Japanese Buyers The American real… Read More Load More End of Content.

Britain’s Mini-Budget Disaster | BizBlog News

Britain’s Mini-Budget Disaster | BizBlog News Why Britain’s ‘Mini-Budget’ Disaster Should Alarm U.S. Economists Britain’s fateful “mini-budget” has sent shock waves through global financial markets and bond strategists caution that it is simply one example of pitfalls that could destabilize America’s economy. With governments fighting inflation, spending pressures, and public opinion, the cautionary tale of Britain provides a real reminder of fiscal responsibility and economic foresight Britain’s Mini-Budget: A Quick Recap In the fall of 2022, the United Kingdom’s government, headed by then-Prime Minister Liz Truss and Chancellor Kwasi Kwarteng, unveiled a mini-budget that was very ambitious. The fiscal plan consisted of major tax cuts with equally significant government spending. The goal was to spur growth and welcome more investment . The plan, though, backfired spectacularly. There wasn’t a clear funding strategy, and the warnings from financial institutions went ignored; this had a severe erosion of investor confidence. In days, bonds yields skyrocketed, and the pound plummeted to catastrophic levels such that the Bank of England intervened in order to calm markets. The crisis led to Truss’s resignation in just 44 tumultuous days in office . What Triggered the Economic Fallout? At the heart of the mini-budget lay the flaws in the unfunded tax cuts. Proposing a scrapping of the top tax bracket and a drastic cut in corporate taxes without any compensatory measures bred the fears of unsustainable borrowing. Fears of rising deficits spooked investors into a sell-off in bonds and currency markets. The crisis is further compounded by poor communication. Telling, without previous consultation of key stakeholders such as the Office for Budget Responsibility (OBR), the sweeping comprehensive economic reforms eroded confidence. Markets thrive on predictability, and the sudden introduction of a mini-budget introduced dangerous uncertainty . Unfunded Promises and Rising Debt American lawmakers have increasingly resorted to ambitious fiscal promises, often financed by borrowing. Whether stimulus checks, infrastructure packages, or tax reforms, the rising national debt–over $33 trillion–mirrors concerns raised during the U.K.’s mini-budget saga . The risk? A sudden loss of confidence in U.S. Treasuries could drive up yields, weakening the dollar and increasing borrowing costs for businesses and consumers alike . Lessons the U.S. Can Learn from Britain’s Misstep One of the most critical criticisms given to Britain’s mini-budget was that there was no consultation and oversight . The U.S. can avoid such pitfalls by being transparent in its fiscal policies , which will include careful reviews of agencies like the Congressional Budget Office and constant communication with stakeholders . Bond Markets as Sentinels of Stability Fiscal policy is an early alert to economic instability, and the British bond market reflects just that. The British bond market reaction was huge, as investors clearly distrust the mini-budget. Similarly, the U.S. needs to pay heed to such signals since its bond market plays an even more central role in the world economy. When bond prices fall and yields rise, borrowing costs increase-not just for governments but also for corporations and households. And for a country with trillions in outstanding debt, the stakes could hardly be any higher . Why Global Financial Stability Hinges on Responsible Governance Modern economies are so intertwined that turmoil in one area can quickly spread across the globe. The mini-budget disaster set Britain’s economy reeling for a brief moment and underscored the fragility of investor confidence. For the U.S., as issuer of the world’s reserve currency, fallout from poor fiscal management would be even more profound. Take heed to Britain’s mistakes, U.S. policymakers have ample opportunity to protect home stability and healthy integrity of the worldwide financial system . UseFull Links Knowledge Sharing European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News November 19, 2024/No Comments European Markets Decline Amid Nvidia Earnings and Regional Data | BizBlog News European Markets Fall as Investors Look to Regional… Read More Postelection Stock Market Trends and Analysis | BizBlog News November 18, 2024/No Comments Postelection Stock Market Trends and Analysis | BizBlog News Postelection Stock Market Thrust Unable to Be Sustained as Rate and… Read More Top Family Offices Startup Investments: Key Trends & Insights | BizBlog News November 16, 2024/No Comments Top Family Offices Startup Investments: Key Trends & Insights | BizBlog News The Top 10 Family Offices for Startup Investments… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines for Third Consecutive Year — But the… Read More European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News November 19, 2024/No Comments European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News European Tech CEOs Urge a ‘Europe-First’ Mentality to Counter U.S. Dominance… Read More Homebuilder Deal Activity Insights | BizBlog News November 15, 2024/No Comments Homebuilder Deal Activity Insights | BizBlog News Homebuilder Deal Activity Is Surging, Fueled by Major Japanese Buyers The American real… Read More Load More End of Content.

Adani Group Fraud and Bribery Charges | Latest BizBlog News

Adani Group Fraud and Bribery Charges | Latest BizBlog News Adani Group Slams ‘Baseless’ New York Fraud and Bribery Charges India’s Adani Group has again made headlines, but this time for reasons quite different from their towering achievements or ambitious projects. Reports of fraud and bribery have again put this multinational firm in the spotlight, when it was dragged to a New York court. The company, however, wasted no time in issuing a strong rebuttal: the charges were categorically denied, and labeled “baseless.” Let’s dissect this controversy and see what the Adani Group had to say and what this may potentially mean for the company and its stakeholders . Understanding the New York Fraud and Bribery Allegations The case against the Adani Group thus emerges on account of a New York court lawsuit that alleges fraudulent practices and bribery by the company to secure contracts. Thus, the document embodies alleged operational discrepancies associated with its foreign entities and accuses the conglomerate of bypassing ethical standards in its business practices. These claims, however, have not been substantiated by any concrete evidence. It seems that these complaints have been lodged by entities having vested interests. With the Adani Group’s strong global presence, any such allegations can have highly detrimental effects if proven-not just to the company, but to the investor confidence in India’s booming corporate sector . Adani Group’s Swift and Strong Response In response to the allegations , the Adani Group reacted immediately and firmly . In a statement, the company labeled all charges against it “baseless and malicious . ” It highlighted that the allegations are devoid of any meaningful evidence and seem to be part of an orchestrated effort to undermine the conglomerate’s reputation . The statement hinted at the commitment of the group to transparency and ethical business practices . Representatives of Adani even intimated to pursue legal remedies against the allegations and seem to mean that company is serious about its reputation . Why the Adani Group Matters Globally The Adani Group is the largest group in India and a global powerhouse. Its diversified portfolio includes areas such as infrastructure , energy , ports , and renewable energy . Over the years , the group has developed into a critical contributor to India’s economic development . This global standing gives the accusations a better flair. Investors and governments around the world have partnered with the Adani Group on billion-dollar projects. Any scandal could destroy this partnership and undermine international stakeholders’ trust in the conglomerate . The Allegations in the Context of Geopolitical Rivalries Many experts believe that the timing of these allegations isn’t coincidental . As the Adani Group expands its influence in strategic sectors like renewable energy and critical infrastructure, its global competitors may have reasons to undermine its reputation . Historically, also, such moments have happened. Where in the world, geopolitical dynamics determined the corporate landscape. With India emerging as a major economic superpower, its leading corporations are always put into focus, especially by those quarters that perceive them as a threat to their market dominance . Legal and Ethical Standards in Adani’s Operations The Adani Group has long claimed that its operations comply with international legal and ethical norms. Its defense rests on the rigid compliance frameworks it follows , both within India and outside it . Over the years, the group has implemented several measures to enhance transparency, such as adopting global reporting standards and engaging with independent auditors for its financial disclosures . The current allegations, according to Adani’s statement, are a deviation from its established track record of integrity . Broader Implications for Indian Corporations This controversy also highlights how Indian corporations are increasingly becoming targets of international scrutiny. When India’s economy grows, its companies come onto the world’s stage, where they receive only admiration and criticism. Any moves made by the Adani Group concerning these allegations may serve as a precursor to future Indian firm efforts in similar scenarios. The group could look forward to making amends, paving the way for India’s corporate sector to become stronger and more professional . Standing Firm Amidst Challenges The Adani Group’s response to the allegations of fraud and bribery in New York speaks of its determination to protect its reputation . For a group like the Adani Group, it is very clear that it is unwilling to accept baseless accusations and is geared for legal recourse . While such allegations will cause a flurry of reactions across stakeholders, the group’s proactive approach and facilitative communication indicate confidence in addressing the issue. Under the light of the legal process, the focus shall be on maintaining operations and reputation for representing the company’s consistent practice over ages of excellence and integrity . UseFull Links Marketing Adani Group Fraud and Bribery Charges | Latest BizBlog News November 22, 2024/No Comments Adani Group Fraud and Bribery Charges | Latest BizBlog News Adani Group Slams ‘Baseless’ New York Fraud and Bribery Charges… Read More Alphabet VC Arm Backs Odoo | BizBlog News November 21, 2024/No Comments Alphabet VC Arm Backs Odoo | BizBlog News Alphabet’s VC Arm Backs Little-Known SAP Rival Odoo, Boosting Valuation to $5.3… Read More Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News November 20, 2024/No Comments Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News Doubts Mount Over Britain’s Ambitious Growth Plans —… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines for Third Consecutive Year — But the… Read More European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News November 19, 2024/No Comments European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News European Tech CEOs Urge a ‘Europe-First’ Mentality to Counter U.S. Dominance… Read More Homebuilder Deal Activity Insights | BizBlog News November 15, 2024/No Comments Homebuilder Deal Activity Insights | BizBlog News Homebuilder

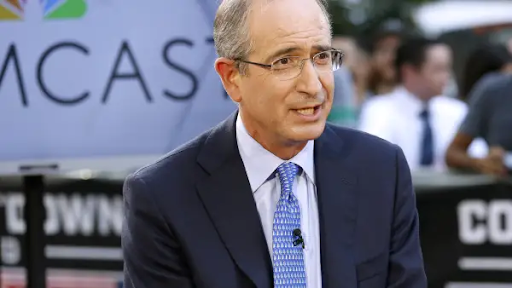

Comcast Cable Networks Spinoff | BizBlog news

Comcast Cable Networks Spinoff | BizBlog news Comcast to Spin Off Cable Networks as Subscribers Flee the Bundle The media industry is undergoing a tectonic shift, and Comcast is at the center of this shift. With more people ditching their TV bundles for streaming, once-the-industry-leader cable provider Comcast is trying to rethink its model. In a latest move, Comcast decided to spin off its cable networks – a deal that puts under the spotlight the rapid unraveling of the traditional cable ecosystem . This is more than a corporate restructuring—it is a signal of how deeply consumer behavior has been etched into the media landscape. It reflects a larger trend toward cord-cutting, by which viewers increasingly demand flexibility, affordability, and on-demand access over the rigid packages that cable companies have long offered to users . The Struggles of Traditional Cable in a Streaming World The decline of cable television is no longer a forecast-it’s the reality. For over six decades, cable bundles have been the norm in the entertainment marketplace, promising households dozens or hundreds of channels for one fee. However, what was once touted as convenient has ultimately become for many consumers a point of frustration: too expensive and filled with an assortment of irrelevance . Streaming services have dramatically changed the way people consume content. The current players- Netflix, Disney+, and Amazon Prime Video-have given choice to their viewers through libraries that include tailored content, thus avoiding waste by cutting out the bundles that were a wasteful aspect of traditional television. Indeed, increasingly savvy households have moved toward these flexible choices, making it harder for cable companies to retain customers. Comcast, one of the largest players in the market, is no different in this regard . Comcast’s Strategic Response to Subscriber Loss This move is based on Comcast’s necessity. The subscriber numbers have been gradually decreasing with a challenge of retaining the current number of subscribers while scouting for potential new ones. By spinning off its cable assets, Comcast frees itself to concentrate more on other resources, most likely its streaming service, Peacock . Peacock has evolved to become the central offering for Comcast during the streaming battles. With a huge catalog of content on demand, including original production and live programming, Peacock will be a direct competitor of industry leaders through this offering. By way of elimination, Comcast can free resources that can be put towards a renewed focus on streaming or for a digital-first audience . It also opens the way for a streamlined Comcast on its own: Separating cable lines-of-business creates operational independence, allowing the new firm it starts with greater freedom to pursue partnerships and strategies that could be called off as a result of the overall goals pursued by the parent company . What This Means for the Future of Cable The cable network spinoff decision itself serves as a microcosm for an even larger narrative: the future of cable television is unsure. With each year that passes, the juggernaut of streaming becomes stronger, and traditional cable companies must decide to adapt or face obsolescence. The spinoff is both a challenge and an opportunity for Comcast . On one hand, such a loss of cable subscribers means filling a large revenue gap. On the other hand, this move heralds a newfound willingness to change, which may position the company well for long-term success. With its focus on streaming, Comcast takes side with the consumer behavior that more and more favors control and personalization services . The Cord-Cutting Revolution and Its Impact It has been very transformative for the media industry, as it has grown with cord-cutting. What once was a niche movement among tech-savvy households became a phenomenon. Today, millions of consumers have canceled their cable subscriptions in favor of streaming services’ freedom and affordability. Undoubtedly, this revolution has not been convenient. Holding undeniable benefits, streaming already creates fragmentation within the entertainment marketplace. Consumers now have to navigate an dizzying number of platforms-all requiring subscription for access-convenience in a singular cable bundle has given way to confusion managing multiple accounts and logins . This evolution acts as a double-edged sword for companies like Comcast. The decline in cable forces them to revise business models they have in place. On the other hand, the boom in streaming proves quite an avenue for growth and expansion. Investment in Peacock by Comcast shines light on how slow the traditional media companies have been towards adaptation of the new normal . A Turning Point for the Media Landscape It is, however Comcast’s decision to spin off of the cable networks, this transition marks a turning point for Comcast and the larger media companies. The traditional cable bundle-one that has long been that gravy, the one thing set to anchor consumers in their armchairs-is rapidly being overtaken by the polished veneer of streaming. This isn’t just about technology; it’s about viewers valuing and consuming different content . The spinoff is a strategic maneuver by Comcast to shift its focus towards the future while not compromising its stand on present issues . By spinning off its cable networks, the company can now contextualize its operations based on the realities of the marketplace by placing its resources in areas promising growth and relevance . In contrast, the decision also speaks of the media industry’s resilience and flexibility. Decline of cable is loss, but it is also an opening for innovation, helping to redefine what entertainment in the age of digital or cybertime means . UseFull Links Education NPS Vatsalya vs Long-term Equity Funds vs Children MFs – Which Offers Maximum Returns? | Biz Blogs News September 21, 2024/No Comments NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? NPS Vatsalya vs… Read More Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News September 20, 2024/No Comments Truecaller Fraud Insurance Policy: What should you know about this new safety measure? In an age where online fraud and… Read More Education

Alphabet VC Arm Backs Odoo | BizBlog News

Alphabet VC Arm Backs Odoo | BizBlog News Alphabet’s VC Arm Backs Little-Known SAP Rival Odoo, Boosting Valuation to $5.3 Billion The latest news on Odoo, concerning Alphabet’s venture capital arm, CapitalG, has shifted the world of enterprise software by a notch or two. This places its valuation at an astonishing $5.3 billion, catapulting the relatively under-the-radar company to high valuation. Being positioned as a powerful rival to SAP, Odoo is making ripples in the industry dominated for long by established giants. The funding reflects both the firm footprint of Odoo and the changing landscape of business software solutions in the world market . Odoo’s Rise as a Game-Changer in Enterprise Software It has been a quite incredible journey that Odoo, an originally small Belgian company, took to get into the world map. The company was established in 2005 by Fabien Pinckaers and has positioned itself on a strong platform of giving SMEs an integrated suite of business management solutions . Applications range from accounting and inventory to CRM, human resource management, and even e-commerce, so to say, one-stop-shop for businesses eager to turn over their affairs more efficiently . What differentiates Odoo from the old-world software giants like SAP is its open-source foundation . The platform’s open-source model affords businesses the flexibility to adapt its software to uniquely evolve with a company’s requirements without being locked into exorbitant licensing fees. This customer-centric approach has drawn cost-conscious businesses to it especially . CapitalG’s Investment and Its Strategic Implications An endorsement by CapitalG also marks a big moment in the company’s journey. Alphabet’s investment arm is known for investing in transformational companies, and its stake is a vote of confidence in Odoo’s disruptive power for enterprise software . As such, with this funding, Odoo gets financial clout, as well as access to an ocean full of resources, expertise, and network connections within the industry . This strategic partnership will further speed up Odoo’s expansion into new markets, notably North America, which, more and more, is requested flexible, cloud-based software solutions. In addition, the funding will fuel innovation, allowing Odoo to innovate on its existing features and develop more tools for improving business needs . A $5.3 Billion Valuation That Speaks Volumes The $5.3 billion valuation marks growing recognition of Odoo’s strengths and competitive potential by disruptors in the market; SAP and Oracle are not exempt. Not only does it represent the financial performance of Odoo but also its influence in an industry ripe for disruption . Odoo has a competitive advantage in offering high-quality, scalable solutions at a fraction of the cost. Enterprise software democratization has now also exposed SMEs to tools previously not within their reaches due to costly competitors. This bodes well for Odoo: as more businesses look toward digital transformation, it stands to capture a big piece of the market . The Future of Business Software with Odoo at the Helm As digital transformation continues to reshape industries, the demand for flexible and affordable business software solutions is going to grow, and in this stream, Odoo stands out because of its commitment to accessibility and customization . Today, the investment from CapitalG marks a turning point for Odoo, marking its debut on the world stage as a serious challenger to the status quo of legacy software suppliers . With its open-source origins and a singular purpose to help all types and sizes of companies transform their businesses, Odoo is not only competing with these industry heavyweights but also propels rules ahead of them . The Broader Impact of Alphabet’s Investment Alphabet’s involvement in Odoo also reflects a larger trend within the tech industry . Venturing arms of tech giants are increasingly focusing on enterprise solutions with huge potential for growth in that space. Companies like Odoo and investment from such firms support portfolio diversification and innovation through organizations that are challenging the very foundations of business growth . But then it can inspire other investors to focus on opportunities in the enterprise software space, which might usher in a funding wave for innovative startups. Such investments may create ripple effects that accelerate the pace of digital transformation within industries to their benefit and that of businesses and consumers . Why Odoo’s Story Matters Odoo’s success story talks of innovative ideas as well as the potential of targeting under-serviced markets. Focusing on SMEs and making solutions available both at an affordable price with maximum functionality, Odoo has found its niche in this congested industry. Alphabet’s CapitalG validation of this strategy sets it up for the next chapter in its growth journey . As more terrain extends into Odoo’s footprint and offerings increase, it would be great to see how it shapes the future of enterprise software. One thing is for sure : with a valuation of $5.3 billion and the muscle behind one of the world’s most influential tech companies, Odoo is no longer just a competitor—it’s a contender . UseFull Links Marketing Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News November 20, 2024/No Comments Britain’s Ambitious Growth Plans and Potential UK Tax Rises | Bizblog News Doubts Mount Over Britain’s Ambitious Growth Plans —… Read More Jake Paul vs Mike Tyson Fight Viewership Breaks Records | BizBlog News November 18, 2024/No Comments Jake Paul vs Mike Tyson Fight Viewership Breaks Records | BizBlog News Netflix’s Record 60 Million Viewers for Jake Paul… Read More World’s Largest Olive Oil Produce | BizBlog News November 16, 2024/No Comments World’s Largest Olive Oil Producer News World’s Largest Olive Oil Producer Predicts Prices to Halve: Relief for Global Markets This… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines for Third Consecutive Year — But the… Read More European Tech CEOs Advocate ‘Europe-First’ Mentality | BizBlog News November 19, 2024/No Comments European Tech CEOs Advocate ‘Europe-First’