U.S. Payrolls Surge in November | Unemployment Rate at 4.2% – BizBlog News November Job Market Surges with 227,000 New Payrolls The U.S. job market saw an outstanding performance in November, with increases in payrolls amounting to 227,000, which surpassed analysts’ expectations . Such strong growth underscores the strength of the labor market even as uncertainties in the economic space persist. Combining these figures with a steady unemployment rate at 4.2% , the data support a gradual push toward economic stability . Why the November Jobs Report Matters The payroll gains in November tell the story of the state of the nation’s economy . The jobs report is a gauge for policy makers and businesses in measuring the economic vitality of the country. When economists had forecasted a more minor increase , the addition of 227,000 jobs is above expectations. This growth indicated that businesses are hiring, thereby giving confidence to the economy about its state despite global and domestic challenges . Unemployment Rate Holds at 4.2% While payroll growth captured much of the attention, the unemployment rate being steady at 4.2% is equally interesting . This stable figure suggests that the labor market is effectively absorbing new job seekers . It also reflects progress toward returning to pre pandemic employment levels though disparities remain in various sectors and demographics . Industries Driving Payroll Growth Several industries contributed to the payroll increase in November. Leisure and hospitality , a perennial driver of post pandemic recovery , continued to add jobs at a steady pace . Professional services, healthcare, and transportation also showed strong hiring activity , underscoring the broad based nature of the labor market ‘s recovery . However, some industries, such as manufacturing, faced headwinds due to supply chain constraints . Wage Growth and Worker Demand November’s job market again showed higher competition for workers , wages ticking upward as businesses were looking to attract talent . The demand for skilled labor remains at a high level, primarily in sectors such as technology , healthcare , and logistics . These are the trends that reflect shifts in the labor market since employers have to adapt to new workforce expectations and challenges . Challenges Facing the Labor Market Although the numbers are positive, the labor market still has some lingering challenges. Workforce participation remains below pre pandemic levels , driven by early retirements , childcare challenges , and health concerns . Worker shortages continue to plague sectors such as retail and hospitality , making it difficult to maintain growth . What This Means for the Broader Economy The November payroll and unemployment data constitute a critical pulse check for the U.S . economy. For the Federal Reserve , the stronger-than-expected growth could influence decisions on interest rates and monetary policy . But for businesses and consumers , the data reinforce optimism over recovery , even as inflation and geopolitics loom large in the horizon . Looking Ahead: The Road to Full Recovery The momentum will continue into 2024 . Policymakers, businesses , and workers will be at the center of the challenges for ensuring a balanced and inclusive recovery . The November uptick is positive, but the long-term stability required to achieve this is found in filling the gaps within the workforce, ensuring growth for all , and resilience to tackle uncertainties . UseFull Links Education Comcast Cable Networks Spinoff | BizBlog news November 21, 2024/No Comments Comcast Cable Networks Spinoff | BizBlog news Comcast to Spin Off Cable Networks as Subscribers Flee the Bundle The media… Read More NPS Vatsalya vs Long-term Equity Funds vs Children MFs – Which Offers Maximum Returns? | Biz Blogs News September 21, 2024/No Comments NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? NPS Vatsalya vs… Read More Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News September 20, 2024/No Comments Truecaller Fraud Insurance Policy: What should you know about this new safety measure? In an age where online fraud and… Read More Load More End of Content. Home About Stories Contact UseFull Links Technology Microsoft Faces £1 Billion Cloud Overcharging Lawsuit | BizBlog News December 4, 2024/No Comments Microsoft Faces £1 Billion Cloud Overcharging Lawsuit | BizBlog News Microsoft Hit with £1 Billion Lawsuit for Alleged Overcharging of… Read More Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News November 23, 2024/No Comments Northvolt Bankruptcy: Major Setback for Europe’s EV Goals | BizBlog News Battery Giant Northvolt Files for Bankruptcy: A Major Setback… Read More European Tech Funding Declines but Stabilizes | BizBlog News November 20, 2024/No Comments European Tech Funding Declines but Stabilizes | BizBlog News European Tech Funding Declines for Third Consecutive Year — But the… Read More Load More End of Content.

Comcast Cable Networks Spinoff | BizBlog news

Comcast Cable Networks Spinoff | BizBlog news Comcast to Spin Off Cable Networks as Subscribers Flee the Bundle The media industry is undergoing a tectonic shift, and Comcast is at the center of this shift. With more people ditching their TV bundles for streaming, once-the-industry-leader cable provider Comcast is trying to rethink its model. In a latest move, Comcast decided to spin off its cable networks – a deal that puts under the spotlight the rapid unraveling of the traditional cable ecosystem . This is more than a corporate restructuring—it is a signal of how deeply consumer behavior has been etched into the media landscape. It reflects a larger trend toward cord-cutting, by which viewers increasingly demand flexibility, affordability, and on-demand access over the rigid packages that cable companies have long offered to users . The Struggles of Traditional Cable in a Streaming World The decline of cable television is no longer a forecast-it’s the reality. For over six decades, cable bundles have been the norm in the entertainment marketplace, promising households dozens or hundreds of channels for one fee. However, what was once touted as convenient has ultimately become for many consumers a point of frustration: too expensive and filled with an assortment of irrelevance . Streaming services have dramatically changed the way people consume content. The current players- Netflix, Disney+, and Amazon Prime Video-have given choice to their viewers through libraries that include tailored content, thus avoiding waste by cutting out the bundles that were a wasteful aspect of traditional television. Indeed, increasingly savvy households have moved toward these flexible choices, making it harder for cable companies to retain customers. Comcast, one of the largest players in the market, is no different in this regard . Comcast’s Strategic Response to Subscriber Loss This move is based on Comcast’s necessity. The subscriber numbers have been gradually decreasing with a challenge of retaining the current number of subscribers while scouting for potential new ones. By spinning off its cable assets, Comcast frees itself to concentrate more on other resources, most likely its streaming service, Peacock . Peacock has evolved to become the central offering for Comcast during the streaming battles. With a huge catalog of content on demand, including original production and live programming, Peacock will be a direct competitor of industry leaders through this offering. By way of elimination, Comcast can free resources that can be put towards a renewed focus on streaming or for a digital-first audience . It also opens the way for a streamlined Comcast on its own: Separating cable lines-of-business creates operational independence, allowing the new firm it starts with greater freedom to pursue partnerships and strategies that could be called off as a result of the overall goals pursued by the parent company . What This Means for the Future of Cable The cable network spinoff decision itself serves as a microcosm for an even larger narrative: the future of cable television is unsure. With each year that passes, the juggernaut of streaming becomes stronger, and traditional cable companies must decide to adapt or face obsolescence. The spinoff is both a challenge and an opportunity for Comcast . On one hand, such a loss of cable subscribers means filling a large revenue gap. On the other hand, this move heralds a newfound willingness to change, which may position the company well for long-term success. With its focus on streaming, Comcast takes side with the consumer behavior that more and more favors control and personalization services . The Cord-Cutting Revolution and Its Impact It has been very transformative for the media industry, as it has grown with cord-cutting. What once was a niche movement among tech-savvy households became a phenomenon. Today, millions of consumers have canceled their cable subscriptions in favor of streaming services’ freedom and affordability. Undoubtedly, this revolution has not been convenient. Holding undeniable benefits, streaming already creates fragmentation within the entertainment marketplace. Consumers now have to navigate an dizzying number of platforms-all requiring subscription for access-convenience in a singular cable bundle has given way to confusion managing multiple accounts and logins . This evolution acts as a double-edged sword for companies like Comcast. The decline in cable forces them to revise business models they have in place. On the other hand, the boom in streaming proves quite an avenue for growth and expansion. Investment in Peacock by Comcast shines light on how slow the traditional media companies have been towards adaptation of the new normal . A Turning Point for the Media Landscape It is, however Comcast’s decision to spin off of the cable networks, this transition marks a turning point for Comcast and the larger media companies. The traditional cable bundle-one that has long been that gravy, the one thing set to anchor consumers in their armchairs-is rapidly being overtaken by the polished veneer of streaming. This isn’t just about technology; it’s about viewers valuing and consuming different content . The spinoff is a strategic maneuver by Comcast to shift its focus towards the future while not compromising its stand on present issues . By spinning off its cable networks, the company can now contextualize its operations based on the realities of the marketplace by placing its resources in areas promising growth and relevance . In contrast, the decision also speaks of the media industry’s resilience and flexibility. Decline of cable is loss, but it is also an opening for innovation, helping to redefine what entertainment in the age of digital or cybertime means . UseFull Links Education NPS Vatsalya vs Long-term Equity Funds vs Children MFs – Which Offers Maximum Returns? | Biz Blogs News September 21, 2024/No Comments NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? NPS Vatsalya vs… Read More Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News September 20, 2024/No Comments Truecaller Fraud Insurance Policy: What should you know about this new safety measure? In an age where online fraud and… Read More Education

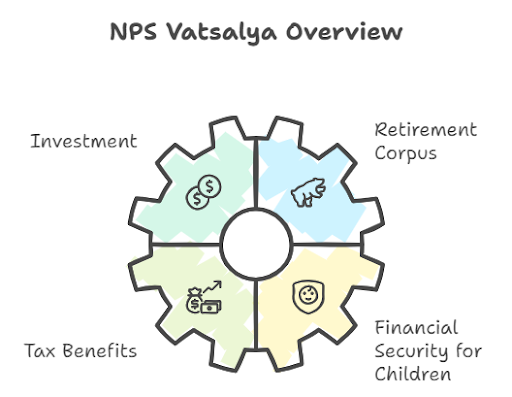

NPS Vatsalya vs Long-term Equity Funds vs Children MFs – Which Offers Maximum Returns? | Biz Blogs News

NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? NPS Vatsalya vs Long-term Equity Funds vs Children MFs: In Which Segment Will You Get Maximum Returns? Financial planning for the future, especially for your children’s well-being, involves making key decisions about where to invest. As a parent or guardian, you may be considering three major options: NPS Vatsalya, Long-term Equity Funds, and Children’s Mutual Funds (MFs). Each of these options offers unique benefits, but the ultimate question is: where will you get the maximum returns? In this comparison, we’ll dive into each of these investment vehicles, their benefits, risks, and overall potential for growth. By the end of this blog, you should have a clearer understanding of which option could be the most profitable for your financial goals. What is NPS Vatsalya? NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits. This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation. What is NPS Vatsalya? NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits. This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation. Key Features of NPS Vatsalya: Low Risk: Compared to equity-based investments, NPS Vatsalya is a low-risk option, since it largely focuses on debt instruments like government bonds. Tax Benefits: You can claim deductions of up to ₹1.5 lakh under Section 80C, along with an additional ₹50,000 under Section 80CCD(1B). Steady Returns: While the returns are stable, they tend to be lower compared to equity-based investments due to their conservative nature. However, NPS Vatsalya is not known for rapid growth. It’s an option more suited for conservative investors looking for steady income post-retirement, rather than parents aiming for high returns for their children’s future education or other financial needs. What Are Long-term Equity Funds? Long-term equity funds, often referred to as ELSS (Equity-Linked Savings Schemes), focus on investing in equity markets for wealth creation over an extended period. These funds come with a higher degree of risk due to the inherent volatility of stock markets but offer the potential for much higher returns. These funds are generally suitable for investors with a long-term horizon (5 years or more), allowing them to benefit from compounding returns and market growth. Key Features of Long-term Equity Funds: High Returns: Equity markets have historically provided returns in the range of 10%-15% over the long term, depending on market performance. Tax Benefits: Like NPS Vatsalya, investments in ELSS are eligible for tax deductions of up to ₹1.5 lakh under Section 80C. Liquidity: ELSS has a lock-in period of three years, which is the shortest among tax-saving investment options. After this period, you can withdraw or continue holding the investment, depending on market conditions. For parents or guardians with a higher risk appetite and longer investment horizon, long-term equity funds can offer substantial returns, especially for long-term goals like higher education or weddings. However, the volatility of equity markets means there’s no guaranteed return, and the capital can fluctuate over time. Understanding Children’s Mutual Funds (MFs) Children’s Mutual Funds are specifically designed to help parents build a corpus for their child’s future, focusing on long-term goals like education, marriage, or other significant expenses. These funds are typically hybrid in nature, blending equity and debt instruments to balance both risk and growth potential. While equity-driven children’s MFs have higher risk, the inclusion of debt components tempers this risk, making them a balanced choice for many investors. Key Features of Children’s MFs: Balanced Risk: These funds usually have a mix of equity and debt, providing a blend of high-return potential with some stability. Lock-in Period: Similar to ELSS, children’s MFs often come with a lock-in period, ensuring that funds are preserved for the intended purpose. Goal-based Investment: These funds are structured around specific future goals for your child, such as education, helping you stay focused on long-term planning. Children’s MFs are an excellent option for parents seeking a middle ground between safety and return potential. They are more flexible than NPS Vatsalya but less risky than pure equity funds, providing a solid option for moderate risk-takers. Conclusion: Where Will You Get Maximum Returns? Choosing between NPS Vatsalya, Long-term Equity Funds, and Children’s MFs depends on your financial goals, risk tolerance, and investment horizon. NPS Vatsalya is ideal for conservative investors focused on long-term stability and retirement planning. Its returns are steady but not suited for those looking to grow wealth rapidly for their children’s future. Long-term Equity Funds are best for those with a high-risk tolerance and a long investment horizon. They offer the highest potential returns but come with market risks. Children’s MFs provide a balanced approach, offering both safety and growth potential, making them a good option for parents who want moderate returns without extreme volatility. Ultimately, if your goal is maximum returns, long-term equity funds will likely outperform the other two options. However, if you prioritize safety and a guaranteed corpus, then NPS Vatsalya or Children’s MFs may be more suitable. Diversifying your investments across these segments could also offer a good balance between growth and security. Education NPS Vatsalya vs Long-term Equity

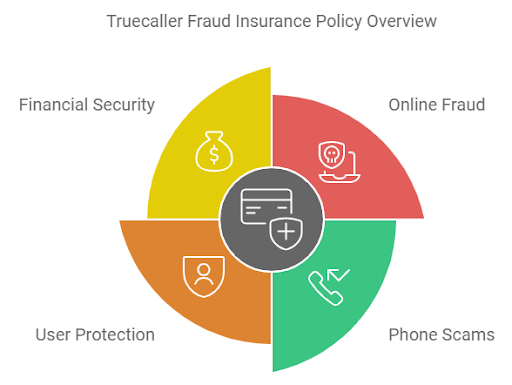

Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News

Truecaller Fraud Insurance Policy: What should you know about this new safety measure? In an age where online fraud and phone scams are increasing exponentially, Truecaller has stepped up its efforts to protect users with an innovative safety net: the Truecaller Fraud Insurance Policy. As people rely more on mobile communication, fraudsters have become adept at deceiving individuals through fake calls and messages. But this new insurance policy promises to be a significant layer of defense, helping users reclaim their financial security if they fall victim to fraud. What is Truecaller Fraud Insurance? Truecaller is widely known as an app that helps identify unknown numbers, block spam calls, and improve communication safety. However, its latest offering, Truecaller Fraud Insurance, adds an extra layer of security for users. Partnering with reputable insurance companies, Truecaller now provides a safeguard that covers financial losses resulting from fraudulent activities, such as phishing or scam calls. This insurance is designed to help individuals recover from potential monetary losses that occur due to deception from fraudsters. By offering this service, Truecaller aims to provide users with peace of mind, knowing that they have a safety net in place if they ever become victims of such schemes. How Does the Fraud Insurance Policy Work? The Truecaller Fraud Insurance Policy is straightforward. When a user falls prey to a scam that results in a financial loss, they can file a claim with Truecaller’s insurance partners. After submitting relevant evidence, including the nature of the fraud and the financial impact, the user may receive compensation as per the terms of the insurance plan. To be eligible, users must first ensure they have opted into the insurance program through the Truecaller app. There may be different tiers or levels of coverage, depending on the user’s country of residence, as the policy is not yet available globally. Once a fraudulent event occurs, the victim can file a report with Truecaller’s support team, who will guide them through the process of claim submission. The protection extends to a variety of scams, including: Phishing scams: where fraudsters pose as legitimate companies or banks to steal sensitive information. Vishing (Voice phishing): where criminals use phone calls to trick users into revealing financial or personal details. SMiShing (SMS phishing): a deceptive practice using text messages to lure users into providing confidential data or making fraudulent payments. Who Should Consider Opting for Truecaller Fraud Insurance? Anyone who uses a smartphone and is concerned about the rise in online fraud should consider opting for this policy. Mobile scams have become more sophisticated, and even vigilant users can fall prey to well-executed schemes. This is especially true for individuals who frequently use online banking or make transactions via mobile platforms. The fraud insurance policy can be an effective back-up in case something goes wrong. Additionally, businesses that handle sensitive customer information and communication via phone calls may also benefit from enrolling in Truecaller Fraud Insurance for added protection. Key Features of the Truecaller Fraud Insurance Policy Truecaller’s fraud insurance offers several important features that make it a viable option for those looking to secure their digital interactions: Wide coverage: The policy covers a range of fraud types, from vishing and phishing to deceptive SMS frauds. Efficient claims process: Truecaller promises a smooth and timely process for claim submissions. Users can track their claim progress through the app, ensuring transparency. Affordable premiums: Early indications suggest that the premiums will be reasonably priced, making it accessible to the average user. Trusted partners: Truecaller has collaborated with leading insurance firms to ensure that users get reliable and swift support when dealing with fraud. Multi-tiered plans: Users may have the option to select from different coverage levels, tailoring the policy to their needs and usage habits. Is Truecaller Fraud Insurance the Answer to the Rising Threat of Phone Scams? While no system is foolproof, Truecaller’s Fraud Insurance Policy certainly marks a significant step in the fight against phone-based fraud. The increasing sophistication of scams—often involving impersonations, fake government or banking alerts, and urgent payment requests—makes it difficult to rely on just caller identification apps or personal vigilance. Having an insurance policy that specifically covers financial fraud provides an added layer of security that could prove invaluable. Given that mobile scams are projected to increase in the coming years, the availability of such a service could act as a critical deterrent. By offering users financial coverage, Truecaller is not only enhancing its brand as a protector of safe communication but also addressing a real and growing concern for digital users. How to Activate Truecaller Fraud Insurance? Activating the Truecaller Fraud Insurance Policy is a straightforward process. First, users need to ensure that they are using the latest version of the Truecaller app. Once logged in, they can navigate to the “Safety & Protection” section within the app’s settings. From there, users will find an option to activate the fraud insurance. This feature might initially be available in select countries, so users should check for its availability based on their region. After signing up, users will be required to choose a plan that suits their needs and confirm their subscription. Depending on the chosen policy, Truecaller’s insurance partners will provide the necessary coverage. The Growing Need for Fraud Protection in the Digital Age We live in an era where digital communication is vital. Whether for work, social interaction, or financial transactions, the reliance on mobile phones has reached unprecedented levels. Unfortunately, this heavy dependence has also made individuals more vulnerable to fraudsters who exploit weaknesses in communication systems. Scammers have grown bolder and more creative, using technologies like spoofing and social engineering tactics to mislead even the most careful users. Often, a single deceptive phone call or SMS can result in significant financial damage. Truecaller’s fraud insurance aims to mitigate this risk by ensuring that users are not left financially devastated after falling victim to such malicious acts. Education Truecaller Fraud Insurance Policy | Latest Updates from Biz Blogs News September 20, 2024/No

Education Loan Interest – Key Insights & Updates | BizBlog News

Education Loan Interest: Right Guidance for Education Education plays the most important role in any person’s life, but the expense of higher education can sometimes become a hindrance in the path of our dreams. In such a situation, an education loan plays an important role. However, understanding education loan interest is as important as choosing the loan. With the right interest rate and terms you can reduce your financial burden significantly. What is education loan interest ? Education loan interest is the amount you have to pay on top of the principal amount of the loan. Whenever you take a loan for education from a bank or any financial institution, you have to pay an additional amount as per a fixed interest rate on that loan. This interest rate may change over time or remain constant, depending on the bank’s policy and market conditions . How are education loan interest rates determined ? The interest rate on education loan depends on many factors. Banks or financial institutions decide your interest rate based on these factors : Loan amount : Higher loan amounts for higher education may have higher interest rates . Tenure : The longer the tenure for which you take the loan, the higher the interest rate can be. Credit Score : Banks may offer lower interest rates if you have a good credit score. Bank Policies : Every bank has its own policy which affects the interest rates offered by them. Education Education Loan Interest – Key Insights & Updates | BizBlog News August 29, 2024/No Comments Education Loan Interest: Right Guidance for Education Education plays the most important role in any person’s life, but the expense… Read More UseFull Links Home About Stories Contact Marketing Effective Marketing Strategy in India | BizBlog News August 28, 2024/No Comments Effective Marketing Strategy in India: Understanding the Indian Market India is a huge and diverse nation that has each region… Read More Matka Gambling, Satta Matka Online Strategies – Bizblog News August 24, 2024/No Comments Matka Gambling: What is it and how to play it? Matka gambling, commonly known as ‘Satta Matka’, is an extremely… Read More IPO Grey Market: A Comprehensive Overview by BizBlog August 16, 2024/No Comments IPO Grey Market: Golden opportunity or risk for investors? The IPO Grey Market is becoming increasingly popular among investors in… Read More Load More End of Content.