Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum, he pointed out that Indian startups have become overly focused on food delivery, betting, and fantasy sports applications. In contrast, he highlighted how Chinese startups have prioritized advanced technological sectors such as electric vehicles (EVs), battery technology, semiconductors, and artificial intelligence (AI). Goyal urged Indian entrepreneurs to shift their focus towards more innovative and tech-driven industries, which would have a long-term impact on the country’s economic and technological growth. Current Focus of Indian Startups Over the last decade, India has seen a boom in its startup ecosystem. Several unicorns have emerged, particularly in the fields of fintech, e-commerce, and consumer services. However, a significant portion of venture capital funding has been directed towards businesses that focus on food delivery, ride-hailing, gaming, and online betting. While these sectors have seen rapid growth, they primarily cater to consumer convenience rather than fostering deep technological advancements. Apps like Zomato and Swiggy have revolutionized food delivery in India, and fantasy sports platforms such as Dream11 have gained immense popularity. However, Goyal believes that these businesses do not contribute to India’s long-term economic sustainability in the way that deep tech sectors would. Comparison with Chinese Startups Goyal contrasted India’s startup focus with that of China, where companies are investing heavily in AI, EVs, battery manufacturing, and semiconductor production. Chinese companies like BYD and CATL have become global leaders in electric mobility and battery technology, while tech giants like Alibaba and Tencent are making strides in AI-driven solutions. China’s emphasis on developing cutting-edge technology has helped it achieve global dominance in multiple sectors. The Chinese government and private investors have strategically invested in these areas, ensuring that their startups drive industrial and technological advancements rather than just consumer-based solutions. Need for a Shift Towards Deep-Tech Innovation To compete globally, India needs to foster an ecosystem that supports deep-tech startups. Sectors like artificial intelligence, biotechnology, space technology, renewable energy, and advanced manufacturing have the potential to make India a global technology hub. The government has already launched initiatives such as the Production Linked Incentive (PLI) scheme to boost manufacturing in high-tech industries. However, more efforts are needed from both policymakers and private investors to encourage innovation in these areas. Startups in AI and machine learning can help India develop homegrown solutions in areas like healthcare, automation, and cybersecurity. Similarly, investments in semiconductor manufacturing can reduce India’s dependence on imports and establish a robust domestic supply chain. Challenges and Roadblocks Despite India’s potential, several challenges hinder the growth of deep-tech startups: Limited Funding for Deep-Tech: Investors often prefer startups with quick returns, leading to an overemphasis on consumer-driven apps. Lack of Infrastructure: Advanced technology sectors require significant infrastructure and R&D investments, which India still lacks. Brain Drain: Many talented engineers and entrepreneurs leave India for better opportunities abroad. Regulatory Hurdles: The absence of clear policies in areas like AI, data protection, and semiconductor manufacturing creates uncertainty for entrepreneurs. The Way Forward To address these issues, India must take the following steps: Increase R&D Investments: The government and private sector should allocate more funds toward research in deep-tech fields. Develop Specialized Infrastructure: Establishing semiconductor fabrication units, battery manufacturing plants, and AI research centers can provide a strong foundation for innovation. Offer Incentives for Deep-Tech Startups: Tax breaks, grants, and easier regulatory approvals can encourage startups to explore advanced technology sectors. Industry-Academia Collaboration: Strengthening ties between universities and industries can help bridge the gap between research and commercialization. Attract Global Investors: Encouraging foreign direct investment (FDI) in deep-tech sectors can provide much-needed capital and expertise.

World Economies Brace for Trump Tariffs Deadline

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets and trading partners are preparing for potential economic disruptions. Trump has long claimed that the United States has been exploited by other nations through unfair trade practices and is now promising what he calls “Liberation Day” for America. Uncertainty Surrounding New Tariffs Trump has left much uncertainty about the exact scope of the new tariffs but has assured that he will be “very kind” in addressing what he perceives as trade imbalances. Speaking to reporters, he hinted at an imminent announcement, stating that details would be revealed “in two days, which is maybe tomorrow night or probably Wednesday.” Despite this ambiguity, markets and international leaders are scrambling to anticipate the potential fallout. Critics argue that Trump’s aggressive tariff strategy could trigger a global trade war, leading to retaliatory measures from major trading partners, including China, Canada, and the European Union. Global Response and Concerns Over the weekend, China, South Korea, and Japan took proactive steps by agreeing to strengthen free trade among themselves. Many analysts believe that such alliances may counterbalance the impact of U.S. tariffs. Trump, however, dismissed concerns that his policies would push allies closer to Beijing. He even suggested that a deal on TikTok could be linked to China-specific tariffs. White House Press Secretary Karoline Leavitt indicated that the administration aims to announce “country-based tariffs,” though Trump has also expressed interest in sector-specific charges. Reports from The Wall Street Journal suggest that his advisers proposed a 20% global tariff affecting nearly all U.S. trading partners. However, Trump insisted that his tariffs would be “far more generous” than existing levies placed on American goods by other countries. Market Reactions and Economic Fears The uncertainty surrounding Trump’s tariff plans has significantly impacted financial markets. Following his announcement that tariffs could target “all countries,” Asian stock markets experienced sharp declines on Monday. Some recovery was seen on Tuesday after Trump assured that he would be “nice” in implementing the new measures. Nonetheless, concerns about economic instability remain high. Goldman Sachs recently increased its probability of a U.S. recession within the next 12 months from 20% to 35%. Analysts cited falling consumer and business confidence, slower growth projections, and the White House’s willingness to “tolerate economic pain.” Moreover, Goldman Sachs adjusted its expectations for inflation, predicting higher underlying inflation rates through the end of 2025. This reflects growing uncertainty about supply chain disruptions and increased costs due to potential tariff hikes. IMF and Global Economic Outlook Despite widespread concerns, International Monetary Fund (IMF) Chief Kristalina Georgieva stated that while Trump’s tariffs have caused market anxiety, their overall impact on the global economy might not be as severe as feared. However, she acknowledged that heightened uncertainty and potential retaliation from key trading partners could slow down global growth.

Stock Market LIVE Updates: Markets Pare Early Losses; Nifty at 23,500, Sensex Down 150 Points

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex opening in the red. Nifty 50 slipped below 23,400, while Sensex fell by over 500 points to touch 76,870. Despite this decline, broader markets exhibited resilience and outperformed the benchmark indices. Investors closely monitored key global and domestic factors influencing the stock market movements. Key Factors Influencing the Market Several critical factors are shaping the direction of the stock market: 1. US Tariffs and Global Trade Concerns A major global development impacting the markets is the announcement by former US President Donald Trump regarding new tariffs. Trump declared that the United States would impose a uniform global tariff on all countries starting Wednesday, April 2, referring to the day as “Liberation Day.” Trump’s move towards protectionist trade policies has sparked uncertainties across global markets. While the precise impact on India’s exports remains to be seen, sectors such as information technology, pharmaceuticals, and automobiles may experience headwinds if the US raises import duties on Indian goods. Investors are cautiously evaluating the repercussions of this policy. 2. Global Market Trends Global stock markets displayed positive momentum despite the concerns over US tariffs. On Monday and early Tuesday, major equity indices across the world traded higher, with the US stock market closing on a positive note. Asian-Pacific markets also followed suit, opening Tuesday’s session on an optimistic note. The performance of global indices is expected to have a spillover effect on the Indian markets in the coming days. Investors are keenly awaiting further details on Trump’s reciprocal tariffs to assess their broader impact. 3. RBI Monetary Policy Announcement Domestically, market participants are eagerly awaiting the Reserve Bank of India’s (RBI) upcoming monetary policy decision. The RBI’s Monetary Policy Committee (MPC) is set to convene between April 7-9. There is widespread consensus that the central bank may announce a 25 basis points (bps) rate cut to support economic growth. Additionally, the RBI is likely to maintain an accommodative stance by ensuring sufficient liquidity in the financial system. Market analysts will also closely watch the RBI’s projections for GDP growth and inflation for the fiscal year 2025-26. Any downward revision in GDP estimates or upward revision in inflation forecasts could influence market sentiment. Sectoral Impact 1. Banking and Financial Services The banking sector remains a focal point as any changes in RBI’s monetary policy will directly impact banks’ lending rates and profitability. A rate cut could lead to a boost in lending activity, benefiting stocks of major banks and non-banking financial companies (NBFCs). However, concerns over rising non-performing assets (NPAs) continue to weigh on investor confidence. Private sector banks such as HDFC Bank, ICICI Bank, and Axis Bank are likely to witness heightened trading activity ahead of the policy announcement. 2. IT and Export-Oriented Sectors The IT sector is under scrutiny due to global trade developments. Indian IT giants such as Infosys, TCS, and Wipro derive a significant portion of their revenue from the US market. If Trump’s tariff policies adversely affect outsourcing, IT stocks could witness volatility in the coming sessions. Similarly, pharmaceutical exports to the US may also come under pressure, impacting companies like Sun Pharma, Dr. Reddy’s, and Cipla. 3. Auto Sector The auto sector, which is already grappling with high input costs and changing emission norms, is closely monitoring the RBI’s stance on interest rates. A rate cut could help stimulate demand for vehicles by making auto loans more affordable. Stocks of Maruti Suzuki, Tata Motors, and Mahindra & Mahindra remain in focus. Market Technical Analysis From a technical perspective, analysts note that Nifty 50 is finding support at the 23,400 level, with resistance near 23,600. If the index manages to sustain above this range, further upside momentum can be expected. Sensex, on the other hand, is witnessing resistance near the 77,000 mark. Market breadth continues to be positive, suggesting that mid-cap and small-cap stocks are outperforming large-cap stocks. Investor Strategy and Outlook Given the current market scenario, investors are advised to adopt a balanced approach: Long-term investors should focus on quality stocks in sectors like banking, IT, and FMCG, which tend to perform well in volatile markets. Short-term traders may look for opportunities in sectoral rotation, particularly in banking and auto stocks, ahead of the RBI policy announcement. Defensive sectors, such as pharmaceuticals and FMCG, may provide stability amid uncertainties related to US tariffs and global trade tensions.

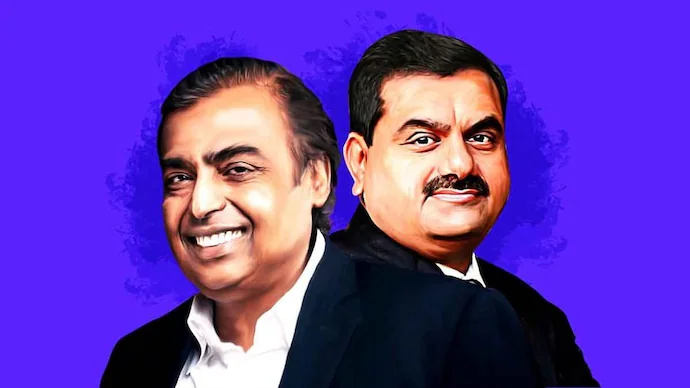

India’s Billionaires Amass Wealth Surpassing Saudi Arabia’s GDP

India’s wealthiest individuals now hold a combined fortune that surpasses the entire Gross Domestic Product (GDP) of Saudi Arabia. This remarkable milestone underscores India’s rapid economic expansion and the growing influence of its billionaires on the global financial stage. With this development, India firmly establishes itself as the third-largest hub for billionaires, trailing only behind the United States and China. India’s Rising Billionaire Class India’s economic growth in recent decades has fueled the rise of a formidable class of billionaires. As per the latest reports, the combined wealth of India’s richest individuals has exceeded Saudi Arabia’s GDP, which stands at approximately $1.1 trillion. This extraordinary accumulation of wealth highlights the country’s booming industries, from information technology and pharmaceuticals to manufacturing and energy. Mukesh Ambani, Gautam Adani, Shiv Nadar, Cyrus Poonawalla, and other business tycoons have significantly contributed to this growing wealth concentration. Their success is rooted in their ability to leverage India’s expanding markets and the increasing integration of Indian businesses into the global economy. Key Factors Behind the Wealth Surge Several factors have contributed to the dramatic increase in wealth among India’s billionaires: Booming Stock Markets: The Indian stock market has witnessed significant growth over the years, with the Sensex and Nifty indices repeatedly reaching record highs. This has propelled the net worth of business magnates who hold substantial stakes in publicly listed companies. Expanding Digital Economy: The rise of technology-driven businesses, fintech startups, and e-commerce giants has played a critical role in wealth creation. Companies such as Infosys, TCS, Paytm, and Reliance Jio have seen exponential growth, benefiting investors and entrepreneurs alike. Infrastructure and Energy Investments: Industrialists such as Gautam Adani have leveraged India’s increasing focus on infrastructure development and renewable energy. Massive investments in roads, ports, solar power, and green hydrogen projects have fueled wealth accumulation. Global Business Integration: Many Indian billionaires have expanded their businesses internationally, securing lucrative deals and mergers across diverse industries, further enhancing their net worth. India’s Global Billionaire Ranking According to Forbes and other wealth tracking organizations, India ranks third in the number of billionaires globally, trailing only behind the United States and China. As of the most recent data, India is home to over 160 billionaires, a number that continues to rise annually. United States: Over 750 billionaires China: More than 500 billionaires India: Around 160 billionaires Germany & UK: Approximately 120 billionaires each This statistic demonstrates India’s growing prominence in the global wealth hierarchy. The rapid increase in billionaires is a testament to the country’s evolving economic landscape and entrepreneurial spirit. Wealth Disparity and Economic Concerns While India celebrates the success of its billionaires, concerns regarding wealth disparity remain. A significant portion of India’s population continues to struggle with poverty, limited access to quality education, and inadequate healthcare. The wealth gap between the ultra-rich and the economically weaker sections has widened, raising debates about economic inequality. The government has introduced various initiatives, including progressive taxation and social welfare schemes, to address this gap. However, experts argue that more robust policies are needed to ensure inclusive growth, where economic benefits trickle down to all segments of society. The Future of India’s Billionaires As India continues its journey toward becoming a $5 trillion economy, the number of billionaires is expected to rise further. Technological advancements, startup culture, and increased foreign investments will likely create new opportunities for wealth generation. Additionally, India’s focus on manufacturing under the ‘Make in India’ initiative and the transition towards green energy will present lucrative prospects for business magnates. With the right balance between economic growth and equitable distribution, India can harness its billionaire boom to drive overall prosperity.

Modi Banks on Households to Manage a Staggering ₹29.7 Lakh Crore Debt

Prime Minister Narendra Modi faces a significant financial challenge: a mounting debt pile of $346 billion (₹29.7 trillion) that the government is actively seeking to manage. This substantial sovereign debt, accrued due to extensive pandemic-related borrowing and large-scale infrastructure investments, is due over the next five years. To mitigate the burden, the Reserve Bank of India (RBI) and the central government are adopting a strategy of refinancing debt by issuing longer-term bonds. The success of this refinancing effort has been increasingly reliant on an unlikely yet powerful player: Indian households. Households have been funneling their savings into insurance companies, which in turn are emerging as dominant buyers of long-dated sovereign bonds. This trend has led to a profound transformation in India’s government securities market. A Shift in Investment Patterns The growing role of households in financing government debt reflects a shift in investment preferences. Traditionally, Indian savers have favored fixed deposits, gold, and real estate as their primary investment avenues. However, with lower returns on traditional banking instruments and increasing financial literacy, many investors are now seeking instruments that offer long-term stability and better yields. This shift has significantly boosted investments in insurance products, which provide policyholders with both security and market-linked returns. According to Soumyajit Niyogi, Director at India Ratings (a unit of Fitch Ratings), households are increasingly channeling their savings into financial instruments that offer a longer investment horizon. This trend has created a robust demand for long-dated government bonds, ensuring the success of the refinancing strategy. Government’s Debt Refinancing Strategy To ease the burden of upcoming maturities, the Indian government has adopted a strategic approach: swapping maturing debt with longer-dated bonds. The Ministry of Finance has set an ambitious target of swapping ₹2.5 trillion worth of debt for the fiscal year beginning April 1. The government’s ability to meet this goal is bolstered by the rapid expansion of the insurance sector, which is growing at an annual rate of 12%-13%. Vidya Iyer, Head of Fixed Income at ICICI Prudential Life Insurance, has emphasized that this growth in the insurance sector is instrumental in supporting the government’s debt management plans. ICICI Prudential alone managed assets worth ₹3.1 trillion as of December, showcasing the significant role insurance companies play in the sovereign bond market. The Role of Life Insurance Corporation (LIC) A key player in this shift is the Life Insurance Corporation of India (LIC), the country’s largest insurer. With its substantial assets under management, LIC has been instrumental in absorbing a large share of the government’s long-term bonds. The increasing demand from insurance companies has even led to discussions about the feasibility of issuing ultra-long-term securities, including 100-year bonds. LIC’s growing interest in such long-dated instruments stems from its need to match long-term liabilities with appropriate assets. Given its massive policyholder base and steady premium inflows, LIC is well-positioned to invest in extended-duration bonds, providing the government with a stable and predictable source of financing. Why Households Are Opting for Insurance Investments Several factors are driving the surge in household investments in insurance-linked securities: Attractive Returns – Traditional savings instruments such as fixed deposits have witnessed declining interest rates, prompting investors to seek better-yielding options. Tax Benefits – Investments in insurance policies offer tax advantages under sections like 80C of the Income Tax Act, making them more appealing. Security and Stability – Insurance products provide a combination of risk protection and investment growth, ensuring financial security over the long term. Rising Financial Awareness – The push towards digital financial literacy has encouraged more households to explore structured investment avenues like insurance-linked bonds. Regulatory Support – The Insurance Regulatory and Development Authority of India (IRDAI) has been instrumental in promoting transparent and consumer-friendly insurance products, boosting trust in the sector. Implications for the Indian Economy The increased participation of households in government bond markets has several macroeconomic implications: Lower Borrowing Costs: A steady domestic demand for long-term bonds allows the government to refinance debt at relatively lower interest rates. Stable Debt Management: With a significant portion of the debt held domestically, India is less vulnerable to external shocks and currency fluctuations. Stronger Financial Markets: As more savings are channeled into formal financial instruments, India’s capital markets stand to benefit from greater depth and liquidity. Boost to Infrastructure Growth: By securing long-term financing at stable rates, the government can continue its infrastructure expansion plans without excessive fiscal strain. Potential Challenges While the strategy appears promising, it is not without risks: Market Volatility: A sudden shift in investor sentiment could lead to reduced demand for long-dated securities, making refinancing efforts more challenging. Inflationary Pressures: High inflation can erode the real returns on bonds, potentially discouraging household participation. Policy Uncertainty: Changes in tax regulations or investment policies could impact the attractiveness of insurance-linked investments. External Risks: Global economic downturns or financial crises could impact the government’s ability to secure funding at favorable terms.

Ola Electric Shares Surge 9%: Should Investors Consider This EV Stock for Short-Term Gains?

Ola Electric Mobility witnessed a strong rebound in its share price on Friday, surging 9.46% to reach a day high of Rs 56.55. This sharp recovery follows a brief dip in the stock, triggered by concerns over a temporary sales backlog in February. However, the company has since clarified that the delay was a result of ongoing negotiations with vendors responsible for vehicle registrations. With this clarification, market sentiment appears to have improved, leading to renewed investor interest in the stock. The significant jump in Ola Electric’s stock price raises an important question for investors: Is this EV stock a good short-term buy? Let’s take a closer look at the factors driving the recent price movement, the company’s financial outlook, and the broader market trends influencing the electric vehicle sector. Understanding Ola Electric’s Recent Surge Ola Electric’s stock price rally comes after a single-day halt in trading, during which investors were concerned about the reported backlog in sales. However, the company’s statement addressing these concerns has seemingly reassured investors, resulting in the stock’s sharp uptrend. The main reason for the temporary backlog in February was related to vendor negotiations. Ola Electric clarified that these discussions were necessary to streamline the vehicle registration process, ensuring a smoother experience for customers. This explanation helped ease investor concerns, as it suggested that the issue was not a fundamental flaw in the company’s operations but rather a temporary procedural hurdle. Market Sentiment and Investor Confidence Market sentiment plays a crucial role in stock price movements, especially for emerging companies like Ola Electric. The company operates in the fast-growing electric vehicle (EV) market, which is attracting significant attention from investors due to its long-term growth potential. As governments worldwide push for cleaner transportation alternatives, companies like Ola Electric are well-positioned to benefit from favorable policies and increasing consumer demand. Investor confidence in Ola Electric remains strong due to its aggressive expansion plans and innovative business model. The company has positioned itself as a leader in India’s electric two-wheeler market and is actively working on expanding its product lineup. With the government’s continued support for EV adoption through subsidies and policy incentives, Ola Electric’s growth trajectory appears promising. Short-Term vs. Long-Term Investment Perspective For short-term investors, the recent price surge presents an opportunity to capitalize on momentum trading. Given the stock’s volatility, traders may see further price swings in the coming sessions, which could provide opportunities for profit. However, it is essential to consider potential risks, such as market corrections or broader economic factors that could influence stock performance. On the other hand, long-term investors should evaluate Ola Electric based on its fundamental strengths and growth prospects. The company’s commitment to expanding its EV ecosystem, building charging infrastructure, and enhancing manufacturing capabilities positions it for sustained success in the evolving automobile industry. Key Factors to Consider Before Investing If you are considering Ola Electric as a short-term buy, here are some crucial factors to keep in mind: Market Volatility: The stock has exhibited significant price fluctuations in recent trading sessions. While this volatility presents trading opportunities, it also comes with risks. Industry Trends: The EV industry is undergoing rapid transformation. Government policies, fuel price trends, and advancements in battery technology could influence Ola Electric’s stock performance. Financial Performance: Investors should closely monitor the company’s financial health, revenue growth, and profitability. While Ola Electric is a relatively new player, its ability to generate consistent revenue and manage costs will be critical for long-term stability. Competition: The EV sector in India is becoming increasingly competitive, with players like Ather Energy, Bajaj, and TVS Motors entering the space. Ola Electric must continue innovating to maintain its market leadership. Regulatory Environment: Government regulations on electric vehicle subsidies, tax incentives, and environmental policies can impact the company’s growth prospects. Expert Opinions and Market Outlook Market analysts remain divided on Ola Electric’s short-term potential. Some experts believe that the recent price surge is a sign of investor confidence returning, which could push the stock higher in the coming weeks. Others caution that the stock remains highly volatile, making it a risky bet for short-term traders. The long-term outlook for Ola Electric appears positive, given the increasing adoption of electric vehicles and the company’s focus on expanding its product offerings. As battery technology improves and charging infrastructure expands, the demand for EVs in India is expected to rise, benefiting companies like Ola Electric.

Air India Eyes Major Widebody Jet Order from Boeing and Airbus

Air India, the country’s leading airline, is reportedly in talks to secure a multi-billion-dollar deal for dozens of new widebody jets from aerospace giants Boeing and Airbus. According to industry sources, the airline’s latest expansion strategy is aimed at strengthening its international presence and modernizing its fleet as part of its transformation under the Tata Group’s ownership. Ambitious Growth Plans Under Tata Group Since being acquired by the Tata Group in 2022, Air India has embarked on an aggressive expansion plan to reassert itself as a dominant global airline. In 2023, the airline placed an unprecedented order for 470 aircraft from both Airbus and Boeing. This included a mix of narrow-body and widebody aircraft. Last year, Air India added another 100 Airbus jets to its order book, primarily consisting of single-aisle aircraft. Now, the airline is setting its sights on expanding its widebody fleet, which is essential for long-haul international routes. Widebody jets, such as the Boeing 787 Dreamliner, Boeing 777X, and Airbus A350, are key to competing with global carriers that dominate lucrative long-haul markets. The latest deal could serve as a game-changer for Air India, allowing it to capture a larger share of the global aviation market and compete with rivals such as Emirates, Qatar Airways, and Singapore Airlines. Air India’s Strategic Fleet Expansion Air India’s move to acquire more widebody jets aligns with its strategic vision of revamping its long-haul operations. The airline currently operates Boeing 777s, 787s, and Airbus A350s for international routes. However, with growing passenger demand and increasing competition from foreign carriers, the airline needs a modern and efficient fleet to maintain and expand its market share. According to industry experts, Air India is likely to split the new order between Boeing and Airbus, continuing its strategy of diversifying suppliers. The Boeing 787 Dreamliner and 777X, along with Airbus A350 variants, are strong contenders for the airline’s requirements. These aircraft offer improved fuel efficiency, increased passenger comfort, and enhanced operational flexibility, making them ideal for long-haul and ultra-long-haul routes. Competitive Advantage in the International Market Air India has faced significant challenges in recent years, including financial struggles, declining service standards, and strong competition from global and domestic carriers. However, the Tata Group’s acquisition and subsequent investments have sparked a turnaround. A modern widebody fleet will allow Air India to provide a better passenger experience, improve operational efficiency, and expand its network to new international destinations. The airline is focusing on increasing non-stop flights to North America, Europe, and key Asian markets. By acquiring the latest generation of widebody jets, Air India can optimize its network planning and offer competitive fares while ensuring better connectivity between India and global hubs. This expansion is also expected to improve cargo operations, contributing to increased revenue streams. Industry Reaction and Market Implications The aviation industry is closely monitoring Air India’s potential widebody order. If finalized, it will mark another significant milestone in the airline’s transformation. The order will also benefit Boeing and Airbus, both of which are witnessing strong demand for their aircraft amid a post-pandemic travel boom. A large order from Air India could also influence market dynamics, prompting competitors such as IndiGo, Vistara, and international carriers to reassess their fleet expansion strategies. With the Indian aviation market growing rapidly, airlines are investing heavily in capacity expansion and service enhancement to capture a larger share of passenger traffic. Awaiting Official Confirmation Despite widespread industry speculation, Air India has not officially commented on the reports regarding its widebody jet negotiations. Similarly, both Boeing and Airbus have declined to comment on the matter. However, given Air India’s recent growth trajectory and its need for more widebody aircraft, experts believe that an official announcement could be imminent. If the deal is confirmed, Air India’s expansion strategy will gain further momentum, positioning the airline as a major player in global aviation. The acquisition of modern, fuel-efficient widebody jets will not only enhance its operational capabilities but also reaffirm the Tata Group’s commitment to making Air India a world-class airline.

Locks and Architectural Solutions Sets Sights on Rs 2,500 Crore Revenue by 2028

Locks and Architectural Solutions, a business unit of the Godrej Enterprises Group, has set an ambitious target of achieving Rs 2,500 crore in revenue by 2028. A senior company official revealed this goal, emphasizing the company’s commitment to maintaining its market leadership through innovation and digital expansion. Currently holding approximately 30% of the market share in India, Locks and Architectural Solutions continues to reinforce its position as the country’s most trusted and preferred locks brand. Shyam Motwani, Business Head of Locks and Architectural Solutions, shared this insight during a recent press conference, highlighting the company’s strategic direction and growth initiatives. Digital Transformation and Market Expansion The company has witnessed a significant transformation, driven by the rise of e-commerce and quick commerce. These channels have played a crucial role in expanding its reach, effectively doubling the business in the online segment. The adoption of digital locks has surged, particularly among younger consumers who prioritize smart, connected, and aesthetically appealing security solutions. Motwani noted that the digital lock segment has experienced an impressive 45% year-on-year growth. This trend underscores the increasing demand for modern security solutions that integrate convenience and advanced technology. The surge in e-commerce sales, which have doubled in recent years, further cements the company’s growing dominance in online and quick commerce channels. Innovation and Customer-Centric Approach To achieve its ambitious revenue target, Locks and Architectural Solutions is focusing on continuous innovation and expanding its digital product portfolio. By leveraging cutting-edge technology, the company aims to cater to evolving consumer preferences, particularly those seeking seamless, smart, and design-led security solutions. “Consumers today prioritize accessibility and convenience. E-commerce and quick commerce are integral to our growth strategy, and our business in these segments has doubled year-on-year. This reflects the growing demand for seamless and innovative security solutions,” Motwani stated. Strengthening Market Leadership As the company moves towards its 2028 revenue goal, it remains committed to reinforcing its leadership position. The growth in digital adoption, coupled with a strong focus on customer preferences, positions Locks and Architectural Solutions as a key player in the evolving security solutions market. With a combination of technological advancements, strategic online expansion, and an unwavering commitment to quality, the company is well on its way to achieving its Rs 2,500 crore revenue target. As consumer preferences continue to shift towards smart and connected solutions, Locks and Architectural Solutions is poised to meet and exceed market expectations.

Tesla Shares Decline for Seven Consecutive Weeks Amid Musk’s Washington Ties

For the past seven weeks, Tesla’s stock has been on a continuous decline since CEO Elon Musk took on a role in the Trump administration. The electric vehicle (EV) giant closed last Friday at $270.48, marking the longest losing streak in its 15 years as a public company. Tesla shares plummeted over 10% for the week, reaching their lowest level since Election Day on November 5, when the stock closed at $251.44. Since its peak of nearly $480 on December 17, Tesla has shed more than $800 billion in market capitalization. Wall Street Analysts Lower Price Targets Several major Wall Street firms, including Bank of America, Baird, and Goldman Sachs, have revised their price targets for Tesla. Bank of America slashed its target from $490 to $380, citing falling new vehicle sales and the absence of an update on a low-cost Tesla model. Similarly, Goldman Sachs reduced its target from $345 to $320, pointing to weak EV sales in early 2025 across key markets in Europe, China, and the U.S. Tesla’s competitive landscape in China appears particularly challenging. Goldman analysts noted that Tesla’s Full Self-Driving (FSD) software faces stiff competition, as many Chinese automakers offer smart driving features without requiring a separate purchase. This pricing strategy puts Tesla at a disadvantage in one of the world’s largest EV markets. Baird further added Tesla to its list of “bearish fresh picks” this week. Analysts at the firm highlighted concerns over production downtime as Tesla transitions to manufacturing its updated Model Y SUV. This shift could complicate Tesla’s supply-side equation, potentially exacerbating financial pressures. Musk’s Political Role Adds to Investor Uncertainty Beyond Tesla’s financial metrics, investors are grappling with how Musk’s political involvement may impact the company’s performance. As an advisor to President Donald Trump and the head of the newly established Department of Government Efficiency (DOGE), Musk has become a central figure in the administration’s push to shrink federal agencies, cut spending, and reduce government influence. Musk’s political actions and controversial statements on social media platform X have drawn criticism, including his attacks on judges and his promotion of misleading narratives about Ukraine. This has fueled anti-Musk and anti-Tesla sentiment in the U.S. and Europe, leading to protests, vandalism, and even suspected arson at Tesla facilities. Tesla Bulls Face a “Gut Check” Moment Even the most bullish Tesla analysts are acknowledging the potential risks associated with Musk’s political entanglements. Cleantechnica, a long-time Tesla advocate, recently published an opinion piece questioning whether Tesla owners should sell their vehicles and whether the company’s board should consider replacing Musk as CEO. Dan Ives of Wedbush Securities, a known Tesla supporter, described the situation as a “gut check moment for Tesla bulls, including ourselves.” Despite the negative sentiment, Wedbush added Tesla to its “Best Ideas” list, setting a 12-month price target at $550. “The best thing that ever happened to Musk and Tesla was Trump in the White House,” Wedbush wrote, arguing that a deregulated environment could benefit Tesla’s long-term vision. The firm believes that federal support for autonomous vehicle technology could be pivotal for Tesla’s future growth. Optimism for a 2025-2026 Product Cycle Despite the current downturn, some analysts see potential for a Tesla resurgence. TD Cowen analysts believe that Tesla is at the start of a major product cycle that could drive volume growth and shift market sentiment in the coming years. Tesla’s long-term growth strategy includes launching an affordable EV model, expanding its robotaxi and ride-hailing services, and advancing humanoid robotics for factory work. If successful, these innovations could help Tesla regain its competitive edge and restore investor confidence. Musk’s ability to refocus on Tesla and steer the company through these turbulent times will be crucial. Some analysts anticipate that by the second half of 2025, Musk will prioritize Tesla over his other ventures, potentially stabilizing the company’s outlook. The Road Ahead Tesla’s seven-week losing streak reflects a mix of financial, political, and competitive pressures. While short-term concerns over sales, production, and Musk’s political activities weigh on investor sentiment, long-term believers remain optimistic about Tesla’s ability to innovate and lead the EV market. Whether Tesla can rebound depends on several factors, including Musk’s leadership choices, global EV demand, and regulatory developments. As the company navigates these challenges, all eyes remain on how it adapts and evolves in the ever-changing automotive landscape.

International Women’s Day: Exploring Tax Benefits and Financial Provisions for Women in India

In India, financial independence and security for women have gained significant momentum over the years. With increasing awareness, government initiatives, and tailored tax benefits, women are empowered to take control of their financial futures. They are making autonomous decisions regarding investments, tax planning, property ownership, and entrepreneurship. On International Women’s Day, it is essential to highlight various tax benefits and incentives available to women. These measures are designed to support their financial well-being, encourage savings, promote home ownership, foster business growth, and ensure adequate healthcare planning. Understanding these benefits can help women optimize their financial planning and maximize tax savings. 1. Higher Tax Exemption Limits on Income While there was a time when women enjoyed a higher basic exemption limit compared to men, currently, the income tax slabs are uniform. However, women can still take advantage of various tax-saving instruments such as: Section 80C Deductions: Women can claim up to ₹1.5 lakh under Section 80C for investments in Provident Fund (PF), Public Provident Fund (PPF), National Savings Certificate (NSC), Life Insurance Premiums, and Equity-Linked Savings Schemes (ELSS). Section 80D Deductions: Women can avail tax deductions for medical insurance premiums paid for themselves, their spouse, children, or dependent parents. The limit is ₹25,000 for self, spouse, and children and ₹50,000 for senior citizen parents. Section 80E Deductions: Interest paid on education loans for higher studies is fully deductible under Section 80E. This benefit applies to loans taken for oneself, spouse, or children. 2. Benefits for Women Entrepreneurs Women entrepreneurs play a crucial role in India’s economic development, and several financial incentives are available to encourage their participation: MUDRA Loan Scheme: Under the Pradhan Mantri Mudra Yojana (PMMY), women can avail loans of up to ₹10 lakh for small businesses without collateral. These loans are categorized under Shishu (up to ₹50,000), Kishore (₹50,000 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh). Women-Specific Business Loans: Many financial institutions offer lower interest rates and special loan schemes for women-led businesses. Schemes like Annapurna Scheme and Stree Shakti Package support women in setting up their businesses. Tax Deductions on Business Expenses: Women running businesses can claim tax deductions on expenses such as rent, utilities, and salaries under Section 37(1) of the Income Tax Act. 3. Tax Benefits on Home Ownership Owning property is an important financial asset, and women in India enjoy several tax benefits when purchasing homes: Lower Stamp Duty Rates: Many states, including Delhi, Haryana, and Rajasthan, offer a 1-2% reduction in stamp duty for women home buyers, reducing the overall property acquisition cost. Home Loan Interest Deduction (Section 80EEA): Women first-time homebuyers can claim an additional ₹1.5 lakh deduction under Section 80EEA on home loan interest payments, apart from the existing ₹2 lakh deduction under Section 24(b). Joint Home Loans with Spouses: Women co-borrowers in a home loan can claim tax deductions separately, maximizing tax benefits for the household. 4. Savings and Investment Benefits Women can take advantage of various government-backed savings schemes for long-term financial security: Sukanya Samriddhi Yojana (SSY): This scheme is designed for the girl child and offers an attractive interest rate and tax-free maturity benefits. Contributions up to ₹1.5 lakh per year qualify for deductions under Section 80C. Public Provident Fund (PPF): Women can invest in PPF, which offers a tax-free return and serves as an excellent long-term savings instrument. Employee Provident Fund (EPF): Women employees can contribute to EPF, where both contributions and interest earned are tax-free. 5. Maternity and Healthcare Benefits Women can claim tax benefits and incentives related to maternity expenses and healthcare: Maternity Leave Tax-Free Income: Women employees are entitled to 26 weeks of paid maternity leave, which is tax-free. Medical Allowance and Reimbursement: Employers providing medical allowances can offer up to ₹15,000 per year tax-free for reimbursement of medical bills. Health Insurance Deductions: Women can claim deductions under Section 80D for health insurance premiums covering themselves and their families. 6. Special Provisions for Senior Women Senior citizen women (aged 60 and above) enjoy additional financial benefits, including: Higher Exemption Limit: Senior women have an increased income tax exemption limit of ₹3 lakh compared to ₹2.5 lakh for younger taxpayers. Senior Citizens Savings Scheme (SCSS): This scheme offers higher interest rates and tax benefits under Section 80C. Tax-Free Fixed Deposits: Many banks offer higher interest rates to senior women, ensuring financial stability in retirement. 7. Additional Tax-Saving Strategies for Women Women can maximize tax savings by leveraging additional strategies: Income Splitting with Spouse: Women can invest in tax-free bonds or gift money to their spouses for tax-efficient financial planning. Investing in Tax-Free Instruments: Instruments like RBI Bonds, Sovereign Gold Bonds (SGBs), and ULIPs provide tax-free earnings under Section 10(10D). Capital Gains Exemptions: Women selling properties can reinvest in specified bonds or residential properties to avoid capital gains tax under Section 54 and 54EC.