Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

The financial landscape in China is experiencing a seismic shift as lenders struggle to fulfill their core function : issuing loans effectively . This issue raises concerns about long term economic growth , financial stability , and the evolving priorities of the banking sector . With lending being a fundamental pillar of economic momentum , understanding why Chinese lenders are unable to lend sufficiently reveals crucial insights into the broader challenges facing the world ‘s second largest economy .

Chinese lenders are battling a unique paradox . While they possess substantial liquidity , they struggle to allocate this capital effectively . Several factors underlie this conundrum , from weakened borrower confidence to regulatory constraints and diminishing returns on investments . The challenge is not merely operational but speaks to the structural complexities of China ‘s financial and economic framework .

Borrower confidence plays a pivotal role in loan demand . In China, a declining real estate market , coupled with an uncertain global economic outlook , has eroded the confidence of businesses and individuals alike . Borrowers are increasingly hesitant to take on debt , fearing their inability to meet repayment obligations . This hesitation creates a feedback loop where lenders , in turn , reduce their willingness to lend due to perceived risks .

China ‘ s regulatory landscape further compounds the lending dilemma . Stricter rules on credit allocation , designed to curb speculative investments and prevent systemic risks , have constrained the scope of lending . For instance , policies targeting excessive real estate speculation have restricted loans to developers , even as the sector struggles with liquidity shortages . While these measures aim to foster stability , they inadvertently limit credit flow to crucial sectors .

An economic slowdown exacerbates the challenge . As China ‘ s GDP growth decelerates, demand for credit naturally shrinks . Businesses scale back expansion plans , households defer major purchases, and investments dwindle . Even when loans are offered , the appetite for borrowing remains subdued . This mismatch between supply and demand highlights a critical inefficiency in the current financial ecosystem .

The inability of Chinese lenders to lend sufficiently has far reaching consequences. These effects extend beyond the financial sector , influencing broader economic stability , employment rates , and global trade dynamics .

Lending is a key driver of economic activity . When credit flow stagnates , it hampers investment , curtails consumption , and limits the capacity of businesses to innovate or expand . This stagnation creates a cascading effect , slowing overall GDP growth and weakening the economy ‘s resilience to external shocks .

China’s real estate sector, a major contributor to its GDP , is particularly vulnerable . With credit access drying up , developers face liquidity crises , and construction projects stall . This scenario exacerbates the sector ‘s existing woes , leading to declining property values and reduced consumer confidence .

A lending slowdown can strain the financial system itself . Banks and lenders rely on interest from loans as a primary revenue stream . Prolonged periods of insufficient lending reduce profitability , potentially leading to non-performing loans (NPLs) and threatening the stability of the banking sector .

To address this issue , it is crucial to dissect the root causes contributing to Chinese lenders ‘ inability to lend sufficiently . These factors include external economic pressures , domestic policy shifts , and changing priorities within the financial sector .

The global economic slowdown , rising geopolitical tensions , and uncertainties like trade wars have significantly influenced China ‘ s economic trajectory . These factors reduce cross border investments and weaken the demand for exports, indirectly impacting domestic credit cycles .

Chinese banks are increasingly prioritizing quality over quantity in their loan portfolios . This shift reflects a desire to mitigate risks associated with bad loans and align with regulatory goals of fostering sustainable growth . While this approach is prudent in the long term , it exacerbates short-term challenges in meeting lending targets .

Addressing this issue requires coordinated efforts from policymakers , financial institutions , and businesses . Solutions must balance immediate credit needs with long term stability and sustainability .

To reignite lending , restoring borrower confidence is paramount. This can be achieved through measures such as fiscal stimulus , tax incentives , and guarantees for small and medium sized enterprises (SMEs) . Strengthening the safety net for borrowers encourages risk taking , which is vital for economic recovery .

Reforms aimed at easing credit constraints while maintaining oversight are essential. For example , targeted credit support for key sectors like technology , infrastructure , and green energy can spur growth without exacerbating financial risks .

Chinese lenders should explore innovative lending models , including digital finance solutions and alternative credit assessment methods . These innovations can enhance accessibility and efficiency in credit distribution , reaching underserved demographics and businesses .

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

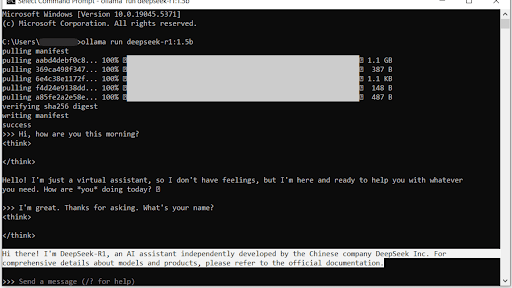

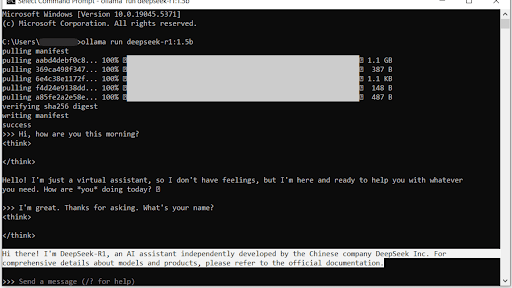

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...