Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

The European Central Bank has yet again taken bold steps in an effort to resolve the continuous economic issues within the eurozone . The ECB’s reduction of interest rates by a quarter point is an effort to promote economic growth and stabilize inflation . This is the fourth reduction in interest rates this year, which indicates vigilance amidst the uncertainty of the financial environment .

Interest rates are one of the pillars of monetary policy, affecting borrowing costs , consumer spending, and investment levels . When the ECB changes its interest rates , it creates ripples in the financial system , from corporate lending to household budgets. Reducing interest rates often aims to stimulate borrowing and spending, which counteracts weak economic performance .

The latest quarter point cut will push the ECB’s benchmark rate to record lows , creating an environment where economic activity can prosper while leastening the risks from stagnation .

Persistent inflation concerns and easing economic activity in the euro area are compelling the ECB towards accommodation . While inflation of a few member states appears to stabilize , it is still patchy within the region . Geopolitics continues to pose uncertainties and weaken the global demand , further baring the economic prospects .

Four rate cuts in one year suggest an aggressive ECB attempt at reviving the eurozone economy . This third rate cut heralds a policy response geared toward acting on persistent challenges . It also casts critical questions over the effectiveness and long-term implications of prolonged low interest rates .

This reduction directly affects the borrowing cost in the eurozone . Consumers can get cheaper credit, which might boost sectors such as housing and retail . Businesses also find it more attractive to finance projects or hire extra staff , which might alleviate pressures on unemployment .

While low-interest rates have brought lots of benefits , prolonged periods can bring along risks . Reducing the returns on deposits wipes off value savings from households , and weak interest rate results in asset price inflation , which might create high risks in terms of market bubbles . The ECB needs to strike a perfect balance between the interventions they make .

This action is a way the ECB mirrors measures other global central banks are making today . Indeed, against global winds , most of its fellows have copied it as others , including the Federal Reserve of the United States, have followed by readjustment of their interest rates in line to control inflationary pressure and generate growth .

The ECB’s approach is thus uniquely shaped by the complexity of the eurozone . It seeks to harmonize monetary policy with the economic realities of each divergent reality for 20 member countries using one common currency .

The ECB ‘s fourth rate cut is considered by most economists as necessary and strategic . However, opinions on its effectiveness vary . While some say that monetary policy alone cannot solve structural economic problems such as labor market inefficiencies and demographic challenges , others believe that the ECB ‘s actions are crucial in sustaining stability in a turbulent environment .

ECB ‘ s rate cuts are transforming the financial behavior of the eurozone . Businesses are taking advantage of lower borrowing costs to invest in innovation and expansion . Consumers are also benefiting from reduced loan repayments and more accessible credit , boosting confidence and spending .

Still, these benefits are not evenly distributed . Countries with strong financial systems might gain more than those dealing with deeper structural issues . Policymakers must address such disparities to ensure inclusive growth .

The accommodative stance of the ECB fuels speculation on what next . Will the central bank deliver further cuts , or does it approach the limits of its monetary tools ? Much may depend on the global and regional evolution of economic conditions .

The ECB may eventually have to balance rate cuts with other measures perhaps quantitative easing or fiscal policy coordination to achieve this . Coordination with governments will be essential in creating an environment where monetary policy and fiscal policy work together and reinforce each other .

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

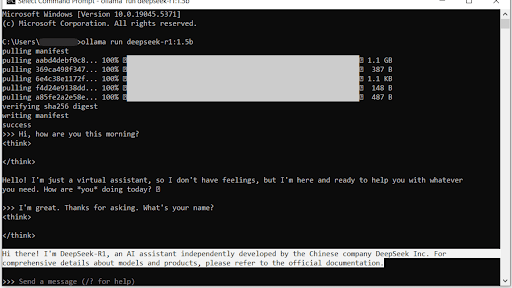

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...