Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

European markets witnessed a significant increase before the Christmas holiday due to the optimism wave after a massive acquisition announcement . Aviva , the UK based insurance behemoth, announced the $4.6 billion acquisition of Direct Line , reviving confidence in the financial sector and the general market mood . The investors welcomed this development as a sign of resilience and strategic growth in a challenging economic climate .

This will mark one of the biggest consolidations moves by Aviva in the UK insurance market as a result of acquiring Direct Line . The acquisition sets up Aviva to grow and strengthen its competitive edge over competitors in the general insurance market . Direct Line , one of the household names in the UK, is set to bring Aviva the strongest portfolio of customers offering great synergies for its long term growth .

This announcement further reinforces Aviva ‘s commitment to market leadership and reflects confidence in its ability to deliver value to shareholders . The deal is expected to create operational efficiencies and strengthen Aviva’s foothold in a fiercely competitive industry .

The announcement had a ripple effect across European stock markets , particularly benefiting financial and insurance stocks . Benchmark indices in major European markets , including the FTSE 100 and DAX, closed higher , reflecting investor optimism . Market analysts attribute this rally to the timing of the acquisition, which comes as businesses and investors seek stability amidst ongoing global uncertainties .

However, it also aligns with trading at the holiday season, during which volumes are lighter , but sensitivity to news can be heightened . Aviva’s bold move, added to some resilience in the broader economy, helped overall market morale .

The purchase of Direct Line by Aviva underlines the trend towards consolidation within the insurance industry . The ever-rising costs of running operations, technological upsets , and changing expectations among customers force companies to revisit their strategies and make drastic decisions . Buying Direct Line helps Aviva gain entry into sophisticated digital resources and expand its customer profile , helping the company compete in the volatile marketplace .

It would be set to encourage other industry players to think about merger and acquisition as a channel through which sustainable growth can be achieved . Analysts view such trends to redefine the competitive landscape of European insurance markets .

The timing of this acquisition is very important . It comes at a time when European markets are cautiously optimistic about the new year , boosted by easing inflationary pressures and hints of easing policies from central banks . The announcement from Aviva gave investors a welcome distraction from concerns about energy prices and geopolitical tensions, reminding them of growth and innovation in uncertain times .

For investors , Aviva ‘s move will be seen as a calculated risk that may eventually reap handsome profits in terms of profitability and market share . The confidence is reflected in the appreciation of Aviva’s stock price that has further boosted the European markets .

As Europe heads into the holiday season , stocks have rallied , and so have the continent ‘s financial markets toward a positive close for the year. Aviva’s acquisition of Direct Line could be a catalyst for other major deals , injecting liquidity and confidence into the markets . And at a broader level , this could shape investor strategies for 2024 across the insurance and financial services sectors .

Aviva acquisition consolidates its position in the market and creates a sense of optimism in Europe about its businesses being more resilient and adaptable . When global markets are geared for the challenges and opportunities the new year would bring, actions such as this underscore strategic foresight and decisive action .

Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

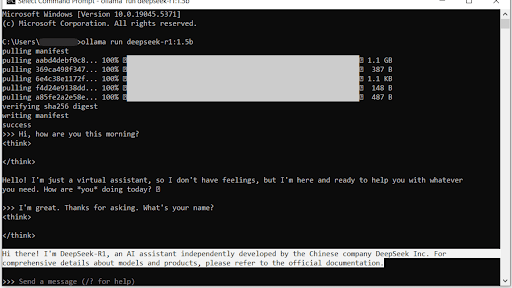

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...