Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

European markets had a mixed trading session with stocks rising following U.S . inflation data coming in line with expectations and thus, boosting confidence among investors across the globe . But, the Zara owner , Inditex , was worst hit and plunged 6% into losses in market value . The trading day reflected a fine balance between macroeconomic stability-fueled optimism and investor caution, prompted by specific concerns about companies .

European markets reacted favorably to the inflation numbers out of the United States , which rose in line with expectations. This relief about the fears of strong rate hikes by the Federal Reserve did help bring a bit of stability to the global market . Major indices such as STOXX Europe 600, moved higher as the positive performance was mainly driven by technological, financial, and pharmaceutical stocks .

The U.S. inflation figures gave a sigh of relief to investors who had been worried about the persistence of high rates . With central banks remaining cautious , predictable inflation data is considered a cornerstone for steady economic recovery .

Interconnectedness of global financial systems means that U.S . inflation has a tremendous impact on European markets. Stable inflation figures reassure investors of the absence of uncertainty with regard to monetary policies. The Federal Reserve’s stance tends to be followed by the ECB .

For European firms exposed to exports, primarily exports to the U.S. market, stable inflation translates to healthier demand . This bodes well for the better overall response from European stocks and their dependence on transatlantic indicators .

The biggest news was probably Inditex, owner of the retail chain Zara. Even though optimism prevails about the broad market, this particular stock dived sharply , by 6%, although the group’s results over recent quarters had been remarkably positive . The concerns for slowdown of growth in the biggest markets as well as for difficulty to hold margins may have spurred the sell .

Inditex is a bellwether in the retail sector – nimble and efficient supply chains. But rising competition, and consumer behavior change due to the pandemic has set challenges that have perturbed investors .

European markets are going through a complex landscape, with economic recovery efforts , geopolitical tensions , and sector-specific dynamics . The good news on inflation in the United States was a temporary boost; challenges remain .

With a positive trading day, the technology sector outperformed amid fears of aggressive rate hikes reduced . The leading gainer was the semiconductor company and software firms that have resumed investor confidence in innovation driven sectors .

The energy sector still got comfort from reasonably stable oil prices, and the perfect blend of investments between green technologies and traditional energy production has made it attractive to a very wide range of investors .

For investors, the day’s trading underscored the value of diversification . While some macroeconomic indicators like U.S. inflation can set the tone , individual stock performance remains influenced by company-specific factors .

The key takeaway is that one should focus on a balanced portfolio that includes stable sectors alongside growth oriented companies . In today ‘s interconnected markets , staying informed about global economic trends and their ripple effects is essential .

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

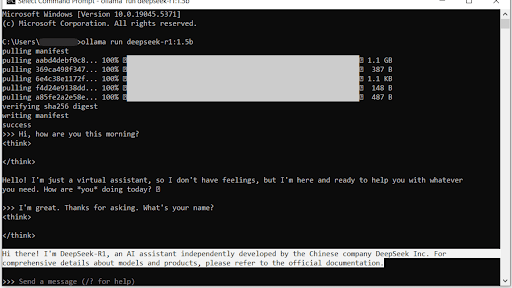

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...