Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

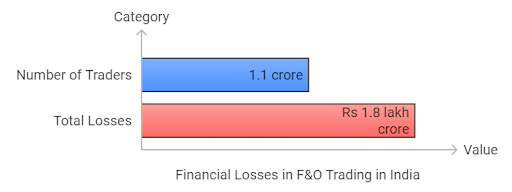

Futures and Options (F&O) trading has become synonymous with high risks, fast profits, and unfortunately, devastating losses. A recent study by the Securities and Exchange Board of India (SEBI) has brought to light a staggering statistic—1.1 crore traders have lost a collective Rs 1.8 lakh crore over the last three years. This revelation has sparked concern across the financial community, as F&O addiction continues to lure retail investors into a high-stakes game they often cannot win. The findings highlight the darker side of trading, where dreams of quick money can lead to crushing financial losses.

Futures and Options (F&O) trading allows investors to trade contracts on the future value of assets like stocks, indices, or commodities. The allure lies in the potential for massive gains with relatively small investments, thanks to the leverage involved. Many retail investors, lured by the promise of quick returns, dive headfirst into this market, often without a solid understanding of the risks. However, F&O trading is not for the faint of heart—it requires precision, market knowledge, and the ability to withstand financial shocks.

Despite these requirements, SEBI’s study shows that a significant portion of F&O traders are retail investors who may not fully grasp the risks. With platforms making trading more accessible, the ease of entry has created a perfect storm for addiction, and this trend is rapidly growing.

SEBI’s extensive study covered three years of F&O trading data and revealed some shocking facts. It is not just the high volume of losses, but the sheer number of traders affected that stands out. Over 1.1 crore participants entered F&O trading during the period under review, and collectively, they lost Rs 1.8 lakh crore. While F&O might be marketed as an advanced financial instrument for seasoned traders, the reality is that a large portion of these losses came from retail investors, often with limited knowledge of the market dynamics.

The study exposed a troubling pattern—retail investors were drawn to F&O because of aggressive marketing and an optimistic view of the stock market, which frequently downplayed the significant risks involved. These traders, hoping for outsized gains, often found themselves on the wrong side of the market, losing significant capital in a short time.

Trading addiction is a growing concern, and F&O addiction is particularly perilous due to the high stakes involved. The psychological element of trading is often under-discussed. Traders experience a euphoric rush when they win, which leads to a dopamine hit similar to what one might feel with gambling. The high volatility of F&O trading, with its massive swings, adds to this sense of exhilaration.

On the other side, the emotional pain of a loss pushes many to chase their losses, hoping for a lucky break. This cycle of highs and lows keeps traders coming back for more, often with detrimental financial consequences. SEBI’s study suggests that many retail investors in India are caught in this vicious cycle, where small wins are overshadowed by much larger losses, leading to devastating outcomes over time.

One of the most significant factors contributing to F&O addiction is the ease of access. Modern trading platforms offer user-friendly interfaces, making it incredibly simple for individuals to start trading F&O contracts. The convenience of apps and websites means that people can execute trades from their smartphones at any time, further feeding the addiction.

While these platforms provide useful tools, they also remove the friction that might give someone pause before placing risky trades. In some cases, traders don’t even need substantial capital to get started, as F&O trading allows leverage—essentially borrowing money to increase the size of the trade. This means that traders can bet big without putting down an equivalent amount of money upfront, which, while enticing, also magnifies potential losses.

The figure Rs 1.8 lakh crore is enormous—equivalent to the GDP of some small countries. The financial impact of these losses has ripple effects, not just on the individual traders but on the economy at large. Many of these losses are borne by retail investors, who often have smaller portfolios and fewer safety nets than institutional players.

For those affected, these losses can mean more than just financial setbacks—they can derail life plans, drain savings, and lead to significant psychological stress. SEBI’s study highlights that a large majority of these losses were concentrated among retail investors, indicating a widespread problem that needs urgent attention.

While F&O trading inherently carries risk, there are strategies traders can adopt to mitigate their exposure. First and foremost, education is key. Traders need to fully understand the instruments they are dealing with, including the complex factors that influence price movements. Additionally, risk management strategies like stop-loss orders can help prevent significant losses.

Diversification is another essential strategy. Rather than putting all their capital into F&O contracts, traders should consider spreading their investments across different asset classes to reduce risk. Finally, traders should only invest money they can afford to lose. Treating F&O trading as a speculative endeavor rather than a surefire way to make money is crucial to maintaining financial stability.

In light of the findings from the study, SEBI has proposed several measures to curb F&O addiction and protect retail investors. These include stricter regulations on leverage, more robust disclosures regarding the risks involved, and enhanced educational initiatives to improve financial literacy among retail traders.

Additionally, SEBI is considering limiting access to F&O trading for inexperienced investors. Such measures could include higher margin requirements or restrictions on the types of F&O contracts that retail investors can trade. These recommendations aim to reduce the number of retail investors who fall into the trap of excessive risk-taking in the F&O market.

As SEBI’s study brings much-needed attention to the risks of F&O addiction, the future of this market will depend on how effectively regulators, platforms, and traders themselves respond to the problem. While F&O trading will undoubtedly continue to be a part of the financial landscape, there is hope that with better education and more stringent safeguards, retail investors can avoid the kind of catastrophic losses seen in the last three years.

Going forward, a balanced approach that protects retail investors while still allowing for the growth and evolution of the market is crucial. By learning from the lessons of the past, it is possible to create a more sustainable trading environment where investors are better informed, and financial risk is more manageable.

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...