Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Managing credit card bills can sometimes feel overwhelming, but with the right approach, it becomes a smooth process. Whether you’re new to credit cards or simply looking for easier ways to manage your payments, knowing your options will help you stay on top of your finances. In this guide, we’ll walk you through the most effective ways to pay credit card bills, both online and offline. With these methods, you’ll be able to navigate the payment process like a seasoned pro.

Paying off your credit card bill on time is crucial to maintaining a healthy financial profile. Late payments can lead to penalties, higher interest rates, and a negative impact on your credit score. But don’t worry! Whether you prefer paying your bills digitally or in person, there’s a solution that fits your lifestyle.

In today’s fast-paced digital world, online payments offer convenience, speed, and security. Let’s dive into some of the most popular ways to pay your credit card bills online.

Internet Banking

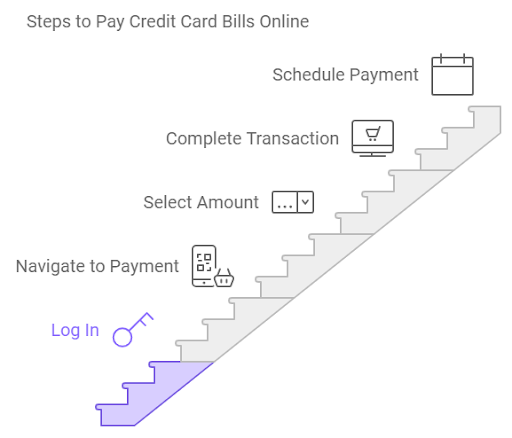

One of the most straightforward ways to pay credit card bills is through internet banking. This method allows you to transfer money directly from your bank account to your credit card. Most banks provide a user-friendly online interface, where you can select the credit card payment option and complete your transaction within minutes. All you need is your bank’s online banking credentials and the credit card details. It’s easy, fast, and safe.

Once logged in, simply navigate to the “Pay Bills” or “Credit Card Payment” section, and follow the prompts. You can either pay the minimum amount due, the total outstanding, or a custom amount. Some banks even allow you to schedule payments, ensuring you never miss a due date.

Mobile Banking Apps

With mobile banking apps, paying your credit card bills becomes even more convenient. Simply download your bank’s app from the App Store or Google Play, and follow the same steps as internet banking. Many mobile apps offer additional features like push notifications, payment reminders, and one-click payment options. Plus, mobile banking apps are designed with strong security features like fingerprint or face recognition, ensuring your transactions are safe.

If you’re someone who’s constantly on the go, this method is ideal. You can clear your credit card bill while waiting in line for coffee or during your daily commute.

Credit Card Issuer’s Website

Another easy option is to visit your credit card issuer’s website. Most card issuers provide a dedicated online portal where customers can manage their accounts. Here, you can check your balance, view your transaction history, and pay your bill directly.

Paying through the issuer’s website is a reliable option, and you can often choose to save your bank account details for future payments, speeding up the process for the next billing cycle.

Make sure to enable two-factor authentication on your account for extra security, and avoid using public Wi-Fi when making payments to protect your financial information.

Autopay Services

If you’re worried about missing payment due dates, autopay is a fantastic option. Most credit card companies offer an autopay feature, which automatically deducts the bill amount from your linked bank account on a specific date every month. You can choose to pay the minimum due, the total outstanding balance, or any other fixed amount.

This method ensures you never miss a payment and helps you avoid late fees and interest charges. However, always ensure that there are sufficient funds in your bank account to prevent failed transactions and overdraft fees.

Third-Party Payment Apps

In recent years, third-party payment apps like PayPal, Google Pay, and Apple Pay have become increasingly popular for paying credit card bills. Many credit card issuers now support payments via these apps, providing users with another layer of convenience.

These apps are particularly useful for those who prefer keeping their financial activities consolidated in one place. Additionally, they often come with built-in features that track your spending, which can help you manage your budget more effectively.

Offline Payment Methods

Not everyone is comfortable with online payments, and that’s completely fine! There are several reliable offline methods available for paying your credit card bills.

Bank Branch

One traditional way to pay your credit card bill is by visiting your bank’s branch. This method allows you to make a payment in person, either by filling out a payment slip or asking a bank representative for assistance. If you have the time and prefer a face-to-face transaction, this is a safe and secure option.

When visiting the branch, make sure to carry your credit card, account information, and an ID for verification. Once the payment is made, you’ll typically receive a receipt, which you can keep for your records.

ATM Payments

Did you know that you can also pay your credit card bill at an ATM? Many banks offer the option to make credit card payments through their ATM machines. All you need to do is insert your debit card, choose the “Credit Card Payment” option, and follow the instructions on the screen.

This is a great alternative for those who prefer not to visit a bank branch but still want to make payments offline. It’s quick and convenient, especially if you’re already at the ATM to withdraw cash.

Cheque or Demand Draft

If you’re not a fan of digital payments, paying by cheque is another method you can consider. Simply write a cheque payable to your credit card issuer, ensuring that you include your credit card number in the memo section. Then, either drop it off at the bank or send it via post to your card issuer’s mailing address.

This method does take a few days to process, so be sure to send your cheque well before the due date to avoid any late fees.

Phone Banking

For those who want the convenience of paying bills without using the internet, phone banking is a solid option. You can call your bank’s customer service number, and an automated system or a representative will guide you through the payment process. Usually, you’ll be asked to provide your bank account and credit card details, and your payment will be processed over the phone.

Phone banking is secure, and many people appreciate the personal interaction it offers, especially if they have questions or concerns about their account.

Cash Payments

While less common, some banks still allow you to pay your credit card bill in cash. You can do this by visiting the bank branch or using specialized cash deposit machines. However, it’s important to note that many banks charge a fee for cash payments due to the additional handling required. Plus, this method may not be as convenient as others.

With so many options available, you might be wondering how to choose the best way to pay your credit card bill. The right method largely depends on your lifestyle, comfort with technology, and financial habits.

If you prefer convenience and speed, online payments via mobile banking apps, internet banking, or autopay services are excellent choices. For those who value in-person transactions or don’t feel comfortable using online platforms, offline methods like visiting a bank branch, phone banking, or paying by cheque are solid alternatives.

Always consider factors like payment processing time, ease of access, and any potential fees when choosing your payment method. It’s also wise to diversify your options, so you can always switch to another method if one isn’t available.

Now that we’ve explored how to pay credit card bills, it’s important to remember why timely payments are so crucial. Here are a few key benefits:

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

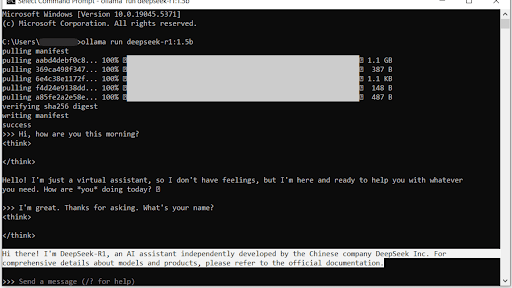

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...