Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Financial planning for the future, especially for your children’s well-being, involves making key decisions about where to invest. As a parent or guardian, you may be considering three major options: NPS Vatsalya, Long-term Equity Funds, and Children’s Mutual Funds (MFs). Each of these options offers unique benefits, but the ultimate question is: where will you get the maximum returns?

In this comparison, we’ll dive into each of these investment vehicles, their benefits, risks, and overall potential for growth. By the end of this blog, you should have a clearer understanding of which option could be the most profitable for your financial goals.

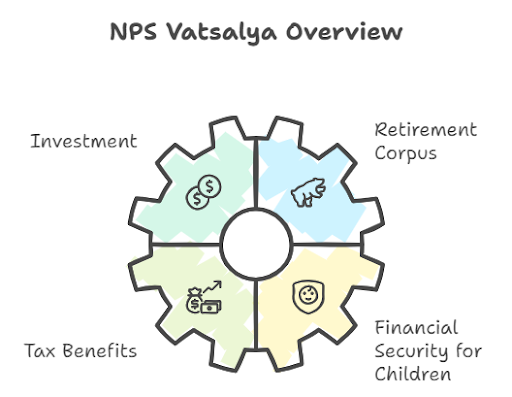

NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits.

This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation.

NPS (National Pension Scheme) Vatsalya is a pension scheme designed for parents looking to invest in their children’s future financial security. It is a relatively new segment in the Indian pension system, focusing on securing long-term savings for parents with added tax benefits.

This investment tool is primarily aimed at accumulating a retirement corpus, but it also provides a safety net for those who want to ensure their children are financially supported in their later years. With tax-saving advantages under Sections 80C and 80CCD, NPS Vatsalya offers more than just wealth generation.

Key Features of NPS Vatsalya:

However, NPS Vatsalya is not known for rapid growth. It’s an option more suited for conservative investors looking for steady income post-retirement, rather than parents aiming for high returns for their children’s future education or other financial needs.

Long-term equity funds, often referred to as ELSS (Equity-Linked Savings Schemes), focus on investing in equity markets for wealth creation over an extended period. These funds come with a higher degree of risk due to the inherent volatility of stock markets but offer the potential for much higher returns.

These funds are generally suitable for investors with a long-term horizon (5 years or more), allowing them to benefit from compounding returns and market growth.

Key Features of Long-term Equity Funds:

For parents or guardians with a higher risk appetite and longer investment horizon, long-term equity funds can offer substantial returns, especially for long-term goals like higher education or weddings. However, the volatility of equity markets means there’s no guaranteed return, and the capital can fluctuate over time.

Children’s Mutual Funds are specifically designed to help parents build a corpus for their child’s future, focusing on long-term goals like education, marriage, or other significant expenses. These funds are typically hybrid in nature, blending equity and debt instruments to balance both risk and growth potential.

While equity-driven children’s MFs have higher risk, the inclusion of debt components tempers this risk, making them a balanced choice for many investors.

Key Features of Children’s MFs:

Children’s MFs are an excellent option for parents seeking a middle ground between safety and return potential. They are more flexible than NPS Vatsalya but less risky than pure equity funds, providing a solid option for moderate risk-takers.

Choosing between NPS Vatsalya, Long-term Equity Funds, and Children’s MFs depends on your financial goals, risk tolerance, and investment horizon.

Ultimately, if your goal is maximum returns, long-term equity funds will likely outperform the other two options. However, if you prioritize safety and a guaranteed corpus, then NPS Vatsalya or Children’s MFs may be more suitable. Diversifying your investments across these segments could also offer a good balance between growth and security.

Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...