Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

The interest rate policies of the Federal Reserve have always been under attention by investors, economists, and policymakers around the world . Its latest position on interest rates has shaken the markets and raised questions on the greater implications of such actions . Central banks in various parts of the world would mean much when the Federal Reserve acts as the central bank of the United States .

The Federal Reserve interest rate decisions are important determinants of the tone set by the global economy . Whether it is a policy of tightening or loosening , these moves determine the borrowing costs, investment activities , and currency valuation. Of late , communications from the Fed have hinted at an extended period of high rates, which has caused market volatility as investors adjust to a possibility of reduced liquidity and slower growth .

Uncertainty, especially for financial markets, is particularly unsettling. This is because the Fed would be signaling that rates are likely to stay high, thus forcing asset valuations and profit expectations to be adjusted. Stocks, bonds , and commodities are all equally at risk , as are the emerging markets that rely on foreign capital .

When the Fed shifts its stance , other central banks are often at a crossroads . In a highly interconnected global economy, currency values and capital flows are influenced heavily by U.S . monetary policy . If the Fed continues to maintain higher interest rates , other countries may experience increased outflows of capital , especially from emerging markets .

For central banks in advanced economies, that choice often comes down to raising their own interest rates to keep currency stable, or allowing potential depreciation, which makes their efforts of balancing inflation control and growth more complex.

The emerging markets face further issues. Whenever the Fed hikes rates, the dollar appreciates, and hence servicing obligations becomes costlier for countries that have dollar-denominated debt. Such a situation leads to fiscal pressure and decreased economic activity .

History gives much insight into how the Fed’s monetary policy impacts global economics . Sharp rate hikes in the 1980s by then-Fed Chair Paul Volcker led to a global debt crisis , especially in developing nations . Though today’s financial systems are much more resilient, similar risks persist, especially in countries with weaker economic fundamentals .

Another example was the global financial crisis of 2008 , where the Fed’s monetary policies had far reaching effects . The slashing of interest rates and introduction of quantitative easing stabilized the domestic economy but flooded international markets with liquidity . Central banks around the world were forced to adapt to this new reality , often with mixed results .

Not all central banks are following in the Fed’s footsteps . For instance , the ECB has been more conservative than others and reflects the peculiarity of the challenges in the eurozone. In contrast , the Bank of Japan still persists in ultra-loose monetary policies even when the rest of the world is tightening .

These divergent approaches make modern monetary policy so complex. Some economies are trying to contain inflation , while others are more concerned with growth . The Fed’s decisions still cast a shadow over these approaches .

Investors and businesses are getting used to the idea that high rates might stay longer than one expected . This has all implications for borrowing costs , investment strategies , and corporate earnings. Companies that rely a lot on debt may have their financial strain increased ; conversely, savers will enjoy higher returns from fixed-income assets .

The real estate sector , often a bellwether for economic sentiment, is particularly sensitive to interest rate changes . Prolonged high rates could dampen housing demand , leading to price corrections in some markets .

As the world gets accustomed to the Fed’s view , cooperation among the central banks becomes more critical . The G20 and the International Monetary Fund are some of the forums where policymakers can coordinate their strategies , reduce risks , and enhance stability .

Finally, the Fed’s decisions reflect the interdependence of the world economy . Though its policies are meant to respond to internal issues, their impacts often go far beyond U.S. borders and shape the world financial landscape .

Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Google AI Model Release : The Next Stage in Google’s Virtual Agent Push Google has taken a bold step in...

Ferrari earnings growth 2025 Shares Pop 8% as Luxury Carmaker Sees Further Earnings Growth Ferrari earnings growth 2025 , the...

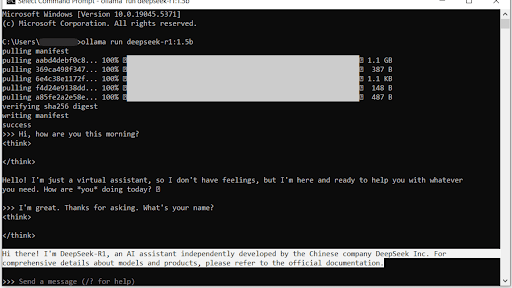

How China’s DeepSeek Benefits for India: A New Era of Technological Synergy China’s advanced technological solutions, like DeepSeek, have been...