Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

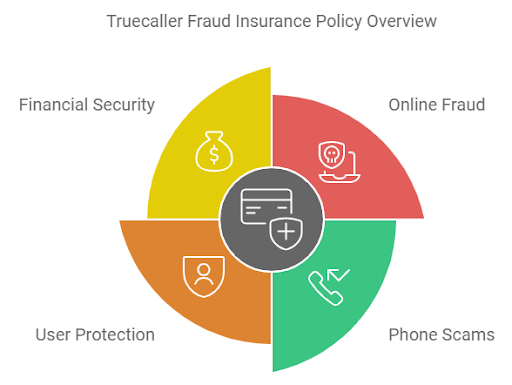

In an age where online fraud and phone scams are increasing exponentially, Truecaller has stepped up its efforts to protect users with an innovative safety net: the Truecaller Fraud Insurance Policy. As people rely more on mobile communication, fraudsters have become adept at deceiving individuals through fake calls and messages. But this new insurance policy promises to be a significant layer of defense, helping users reclaim their financial security if they fall victim to fraud.

Truecaller is widely known as an app that helps identify unknown numbers, block spam calls, and improve communication safety. However, its latest offering, Truecaller Fraud Insurance, adds an extra layer of security for users. Partnering with reputable insurance companies, Truecaller now provides a safeguard that covers financial losses resulting from fraudulent activities, such as phishing or scam calls.

This insurance is designed to help individuals recover from potential monetary losses that occur due to deception from fraudsters. By offering this service, Truecaller aims to provide users with peace of mind, knowing that they have a safety net in place if they ever become victims of such schemes.

The Truecaller Fraud Insurance Policy is straightforward. When a user falls prey to a scam that results in a financial loss, they can file a claim with Truecaller’s insurance partners. After submitting relevant evidence, including the nature of the fraud and the financial impact, the user may receive compensation as per the terms of the insurance plan.

To be eligible, users must first ensure they have opted into the insurance program through the Truecaller app. There may be different tiers or levels of coverage, depending on the user’s country of residence, as the policy is not yet available globally. Once a fraudulent event occurs, the victim can file a report with Truecaller’s support team, who will guide them through the process of claim submission.

The protection extends to a variety of scams, including:

Anyone who uses a smartphone and is concerned about the rise in online fraud should consider opting for this policy. Mobile scams have become more sophisticated, and even vigilant users can fall prey to well-executed schemes. This is especially true for individuals who frequently use online banking or make transactions via mobile platforms. The fraud insurance policy can be an effective back-up in case something goes wrong.

Additionally, businesses that handle sensitive customer information and communication via phone calls may also benefit from enrolling in Truecaller Fraud Insurance for added protection.

Truecaller’s fraud insurance offers several important features that make it a viable option for those looking to secure their digital interactions:

While no system is foolproof, Truecaller’s Fraud Insurance Policy certainly marks a significant step in the fight against phone-based fraud. The increasing sophistication of scams—often involving impersonations, fake government or banking alerts, and urgent payment requests—makes it difficult to rely on just caller identification apps or personal vigilance. Having an insurance policy that specifically covers financial fraud provides an added layer of security that could prove invaluable.

Given that mobile scams are projected to increase in the coming years, the availability of such a service could act as a critical deterrent. By offering users financial coverage, Truecaller is not only enhancing its brand as a protector of safe communication but also addressing a real and growing concern for digital users.

Activating the Truecaller Fraud Insurance Policy is a straightforward process. First, users need to ensure that they are using the latest version of the Truecaller app. Once logged in, they can navigate to the “Safety & Protection” section within the app’s settings. From there, users will find an option to activate the fraud insurance. This feature might initially be available in select countries, so users should check for its availability based on their region.

After signing up, users will be required to choose a plan that suits their needs and confirm their subscription. Depending on the chosen policy, Truecaller’s insurance partners will provide the necessary coverage.

We live in an era where digital communication is vital. Whether for work, social interaction, or financial transactions, the reliance on mobile phones has reached unprecedented levels. Unfortunately, this heavy dependence has also made individuals more vulnerable to fraudsters who exploit weaknesses in communication systems.

Scammers have grown bolder and more creative, using technologies like spoofing and social engineering tactics to mislead even the most careful users. Often, a single deceptive phone call or SMS can result in significant financial damage. Truecaller’s fraud insurance aims to mitigate this risk by ensuring that users are not left financially devastated after falling victim to such malicious acts.

Amazon-backed More Retail is gearing up for a major move as it sets its sights on an initial public offering...

Union Commerce Minister Piyush Goyal recently expressed concerns about the direction of India’s startup ecosystem. Speaking at a business forum,...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Introduction The global financial markets are facing renewed volatility as the Trump administration announced broader-than-expected reciprocal tariffs. This latest move...

Introduction As the world braces for a new wave of tariffs imposed by former U.S. President Donald Trump, global markets...

Market Overview The Indian equity markets faced a turbulent start in Tuesday’s trade, with both the Nifty 50 and Sensex...